After a relatively slow start to August, we kicked into high gear last week in terms of Income Masters closeouts.

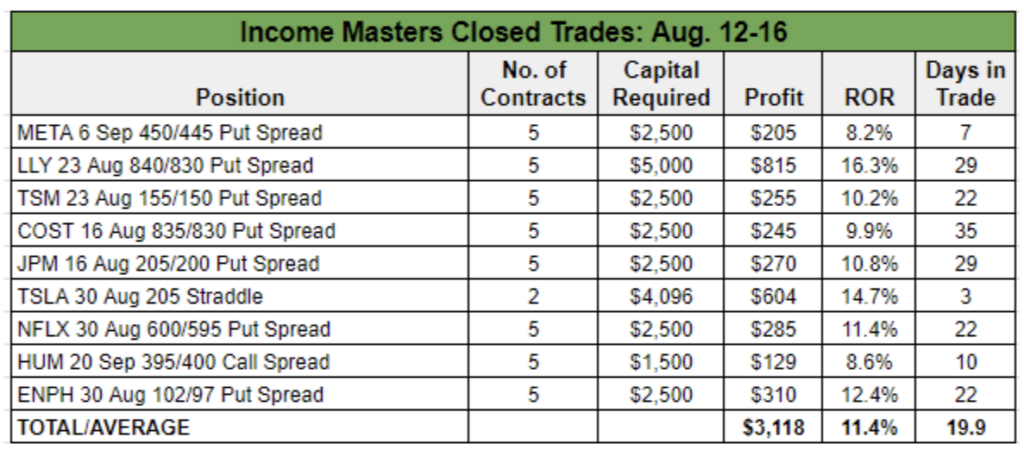

We closed nine profitable positions last week, pocketing more than $3,100 in cash, bringing our monthly total to $3,593 with two full weeks to go in the month. Here’s a look at all of last week’s closed trades:

Seven of our closed trades were neutral-to-bullish bull put spreads and we had one neutral-to-bearish call spread in the mix, as well as our first straddle trade. (We’ll cover this trade in more detail later this week.)

Thanks to the relatively low capital requirements of credit spreads, we averaged an 11.4% return per trade. From both a cash and rate-of-return perspective, our highest-yielding trade was our recovery trade on Eli Lilly (LLY).

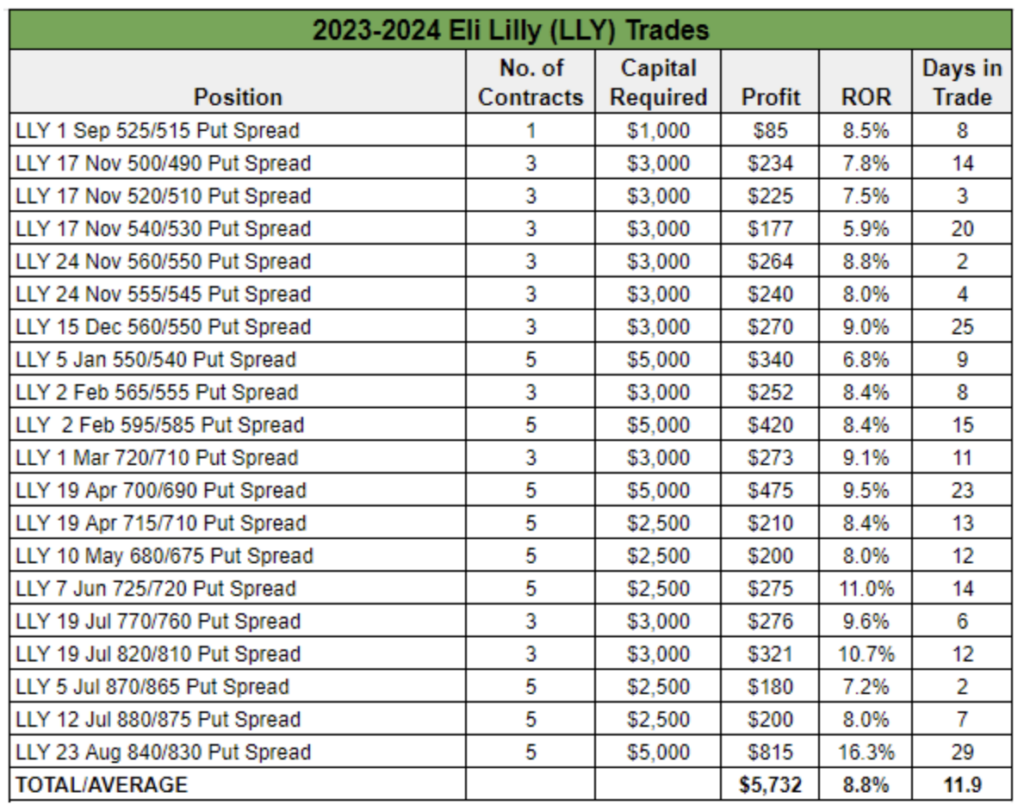

We’ve been trading the drugmaker for a year now to cash in on the weight-loss drug craze with exceptional results. During that time, we’ve closed 20 winners in a row, generating more than $5,700 in cash and averaging an 8.8% return per trade with an average holding time of just under 12 days.

The latest trade marks our longest time in an LLY position, at nearly one month. A look at the chart below explains why that is.

After a strong run up in 2024, shares faltered in mid-July, shortly after we entered the position on July 16. With the stock trading at $949.48, we sold the LLY 2 Aug 905/900 Put Spread for a net credit of $0.68, or $68 per contract. We traded five contracts in our live account, generating $340 in cash.

As you can see above, the stock quickly moved against us. With our spread 90 points in the money (ITM), we rolled out to the August monthly expiration and down to the 850/845 strikes for a net debit.

But the stock continued to fall, and as we headed into the company’s earnings date on Aug. 8, we decided to take action again. Competitor Novo Nordisk’s (NVO) earnings had just fallen short of expectations, but there was very little pre-earnings whisper news on Eli Lilly other than heavier-than-usual call option volume traded for a few days and an upgrade from one of the smaller Wall Street analysts.

We rolled our put spread out another week and down to the 840/830 strikes, widening our strikes by 5 points. This required an extra $500 of options buying power per spread, but it allowed us to collect a good deal of cash, flipping our position from a net debit back to a net credit.

As you can see in the chart below, LLY rallied after its earnings report.

The company reported better-than-expected Q2 results, easily beating analysts’ revenue and profit targets thanks to strong sales of diabetes drug Mounjaro and weight loss drug Zepbound.

Revenue surged 36% from a year ago to $11.3 billion, while adjusted earnings of $3.92 per share blew past the $2.60 estimate. Furthermore, management upped its full-year revenue outlook by $3 billion, as it expects to continue raking in cash after ramping up production of these blockbuster drugs.

LLY shot up 9.5% on the day its earnings were reported, closing at $844.14, moving our spread back out of the money (OTM).

Shares continued to advance over the next few days, and with $2.03 in cash built up per contract from our rolls, we set a target exit price at $0.50, placing a good ‘til canceled (GTC) order at that level during an Income Masters Live Trading Session.

We didn’t have to wait long for it to trigger. The following morning, we exited the position, booking a profit of $1.63, or $163 per spread, earning a 16.3% return on our 10-wide spread. Since we traded five contracts, our total profit was $815.

While LLY is down a bit since we exited the trade, the share price remains well above the 840 put strike we sold. It’s certainly possible that put would have remained OTM and we could have collected the remaining $0.50 per spread in credit.

However, we plan to go back to LLY with a new position next week during Income Madness, which is running from Aug. 19 through Aug. 22. The company’s sales show no sign of slowing anytime soon, and we plan to keep riding this train as far as it will take us.