As most of you know, we’re gearing up for our 2024 Millionaire’s Trading Club Live Trading Event in Las Vegas, which will run from Oct. 16-18. With just a few weeks left, we’re finalizing our travel plans and putting the finishing touches on our presentations. We’re excited to be connecting with many of you in person and with those who will be attending virtually as well.

As part of our ramp up to the live event, we hosted three preview sessions, beginning this summer. The idea was to get attendees prepped for what to expect in Las Vegas and to let other members get a sense of what the event was all about so they could decide whether to join us.

Our three sessions covered a range of topics that were about as timely as you could get.

Our July MTC Preview Session was on “Trading for Income in a Low-Volatility Environment.” With the CBOE Volatility Index (VIX) languishing near historical lows, we discussed how income traders could adapt by adding strategies such as diagonal and calendar spreads.

Our August MTC Preview Session, “Trading in and Around Earnings,” took place in the middle of the second-quarter earnings season. As the title implies, we explored trades to take advantage of the added volatility around earnings events.

Our third and final MTC Preview Session took place last week, and it was a smashing success. Anyone who traded alongside us in the live account could have covered the cost of their MTC ticket (and probably their hotel and airfare too) in less than 48 hours.

The topic of this session: “Trading Short-Duration Options.”

During Wednesday’s session, Dave Durham and Jeff Wood, who will both be presenting in Vegas next month, offered an impactful and actionable discussion.

Specifically, they looked at trading 0 DTE (contract that expires the same day), 1 DTE (contract expires within one day) and 2 DTE (contract expires within two days) options.

They reviewed the benefits of short-duration trades, which include the ability to capitalize on short-term momentum, limited time in trade and their use as hedges. They also covered the potential caveats of these vehicles, including the need for active management.

While only a few securities offer options that expire every trading day, namely the major indexes and the ETFs that track them, any stock with weekly options can be traded as zero, one or two days-to-expiration (DTE) options.

However, this type of trading lends itself more to certain options strategies than others, especially in a low-VIX environment, such as vertical spreads, iron condors, debit spreads (diagonals and calendars), and long straddles and strangles.

Dave and Jeff went over each of these strategies in detail. Equally as important, they discussed how to find underlyings that are suitable for these strategies, going on to place five trades during the live session.

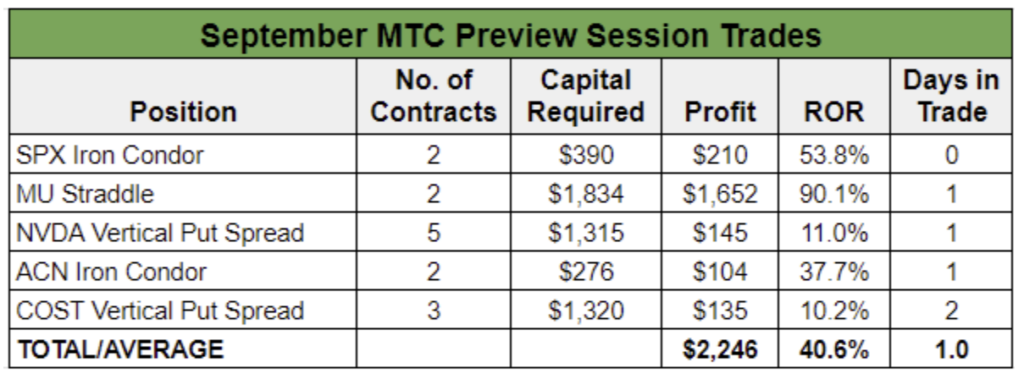

The first closeout came mere hours after we ended the live session, with Jeff’s S&P 500 (SPX) iron condor yielding a more than 50% return on risk.

The next morning, Dave’s Micron Technology (MU) straddle filled way above our target exit price after the company beat earnings estimates and gave strong guidance based on AI demand. The stock jumped more than 15% in overnight trading and computers looking to fill at our lower good ‘til canceled (GTC) price ended up filling much higher at the open.

We exited the trade with $1,652 in cash on two contracts for a return of more than 90% in less than 24 hours.

That was the best-performing trade of the bunch from both a cash and rate-of-return standpoint. But as you can see in the table above, we booked five successful trades in a row, pocketing $2,246 in cash in just two days’ time.

If trading short-duration options is something that interests you, there will be plenty more of it when we get to Las Vegas in October. Plus, if you sign up now to attend live or virtually, you will gain access to the “Trading Short-Duration Options” preview session.

While it’s too late to make any of the trades, you can learn about the tactics we’ll be using and why they are well suited to today’s trading environment.

Viva Las Vegas!