Four times a year, once each quarter, we are met with what is called a quadruple witching day, and no it has nothing to do with ghouls or goblins. Yet some investors stay away from the market even though there are plenty of opportunities if you know what to look for. Let’s discuss what the day is, what typically happens before and after the day occurs, and how you can profit from it.

First, let’s break down quadruple witching so you have a better idea of what happens during the trading day on this special day.

One day every quarter we have four key expirations:

- Stock index futures (e.g., S&P 500 futures)

- Stock index options (e.g., NASDAQ 100 index options)

- Stock options (e.g., options on Apple)

- Single stock futures (e.g., futures on Tesla)

The day invokes fear in some investors because the volume of trades increases, as does volatility, because investors review positions, and make plans/adjustments as needed. That can be closing out of losing trades, rolling trades, etc.

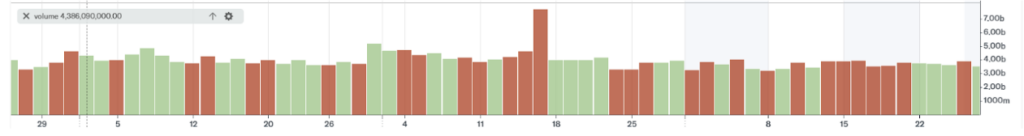

Here’s a chart of the average volume of the S&P 500 traded daily. Knowing what you know now, I’ll let you pick which day you think was quadruple witching (it’s the tallest red bar).

This means there may be larger price swings as orders flood the market. Many investors will try to adjust their portfolios earlier in the day, so you can expect an uptick in volatility in the morning. If you’re an options trader, this means you may see option prices move more erratically as orders are placed and filled.

The last hour of the day is known as “the witching hour” and that usually sees a greater spike in volatility and investors rush to close or adjust open positions before they expire at the end of the trading day.

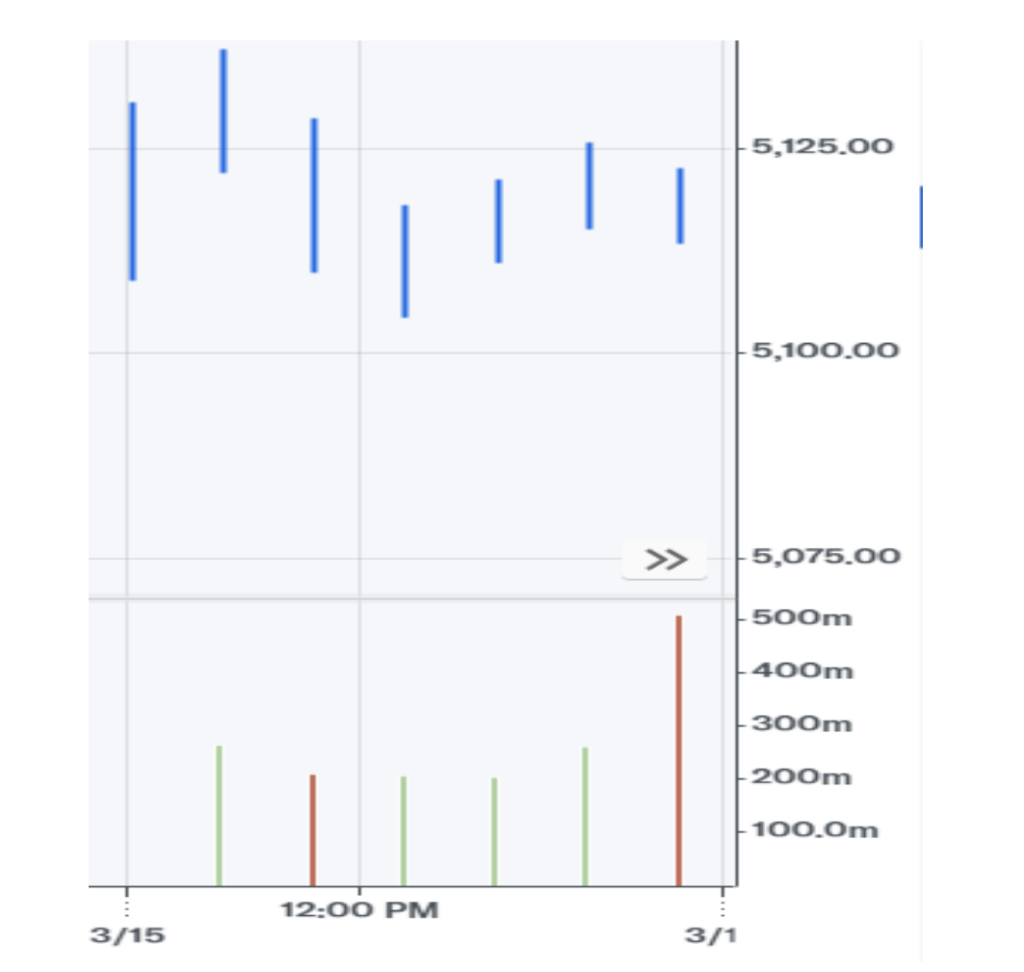

And here’s an hourly volume chart to show just how much volume can increase during the last hour (again, look at the tallest red bar on the volume chart below the stock chart).

What typically happens leading up to and after a quadruple witching event?

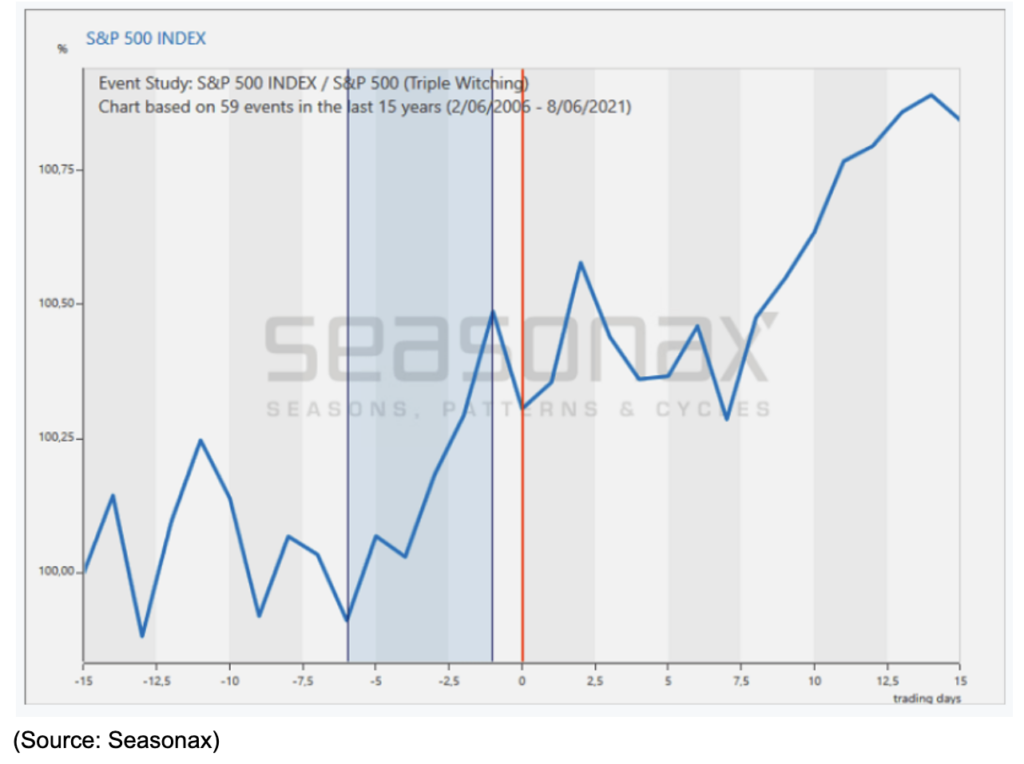

We typically see a bit of a rally six trading days before the event, with an average increase of about 0.58%. In the last 15 years, this increase happened in 42 of the 59 quadruple witching events.

The day of the event has shown a slight drawdown, but you can see from the chart that after the event occurs, the market picks back up again for the next two to three trading days. Look at what has typically happened 7 trading days afterward! I’ll certainly be looking on the bullish side of things.

If we go back to what happened on March 15th of this year, the last quadruple witching day, we can see that the market was moving higher into the event, gapped lower on March 15th, essentially traded flat, and then resumed its uptrend for the next few days.

That particular day didn’t experience wild swings either. The range between high and low on that day was only 32 points, which isn’t much for the S&P 500.

And if we go back to 2023 and look at what happened on December 15th, we can see another instance of positive momentum, leading into a flat to bearish trading day, and then resuming the uptrend for the next two days.

Knowing that we may see a morning gap down and then neutral trading the rest of the day, followed by a couple of up days means we can look at different trading strategies to take advantage of this knowledge.

For example, you can try to take advantage of volatile price action throughout the day by using scalping trading techniques when you see a price veer off from its underlying true value.

Also watch for mean reversions, meaning when the price moves too far in one direction or another, keep an eye on it turning around, and returning to a more normal average move.

While quadruple witching sounds bad, investors can take advantage of extra liquidity and volatility on that day. For others, it may be frustrating to watch the market act uncharacteristically but watch for the long trend to continue, and for us right now, that means I’m expecting to see a bullish start to next week.

Have a great weekend!