The S&P 500 sold off on Thursday and Friday after briefly making a new record high above the 5,500 level on Thursday morning. The primary reason for the pullback was a 6.7% decline in AI darling Nvidia (NVDA) after it made a new all-time high at $140.76 on Thursday morning.

Earlier in the week, the chip company temporarily surpassed Microsoft (MSFT) and Apple (AAPL) to become the most valuable publicly traded company.

Some have raised concerns that the market is overly reliant on NVDA. And that’s understandable. So far in June, the chip company has accounted for one-third of this month’s 3.6% gain in the S&P 500.

But the chart below shows the stock’s dramatic ascent, with shares up more than 1,000% since October 2022.

We’ve traded the stock over the years in the Income Masters and Income Madness programs, capitalizing on its above-average volatility. Due to Nvidia’s high share price prior to the company’s 10-for-1 stock split on June 7, we utilized a bull put spread strategy to greatly reduce our capital requirements while earning solid returns. We got burned a time or two, but the vast majority of our trades were profitable.

Most recently, though, we’ve been trading the stock in the 5K Challenge program, which launched earlier this month.

In 5K Challenge, our goal is to leverage options tactics — using both short- and long-duration expirations — to average $5,000 in income per week on a $100,000 trading portfolio.

This approach is for active and more experienced options traders. We make about two to six trades per week, seeking to maximize returns through scale, frequency and time using a range of tactics.

For the past six months, the CBOE Volatility Index (VIX) has largely traded in a range between 12 and 14 with the exception of the short-lived spike to the 18-20 level during the April sell-off.

The low VIX has made it a challenge to find credit when selling options. As volatility declines, we often find that we need to go closer to the money, thereby increasing our risk, or go further out, potentially tying up our capital for longer, to find decent premiums.

So, we’ve been looking at tactics that perform well in low-volatility environments like the diagonal call debit spread.

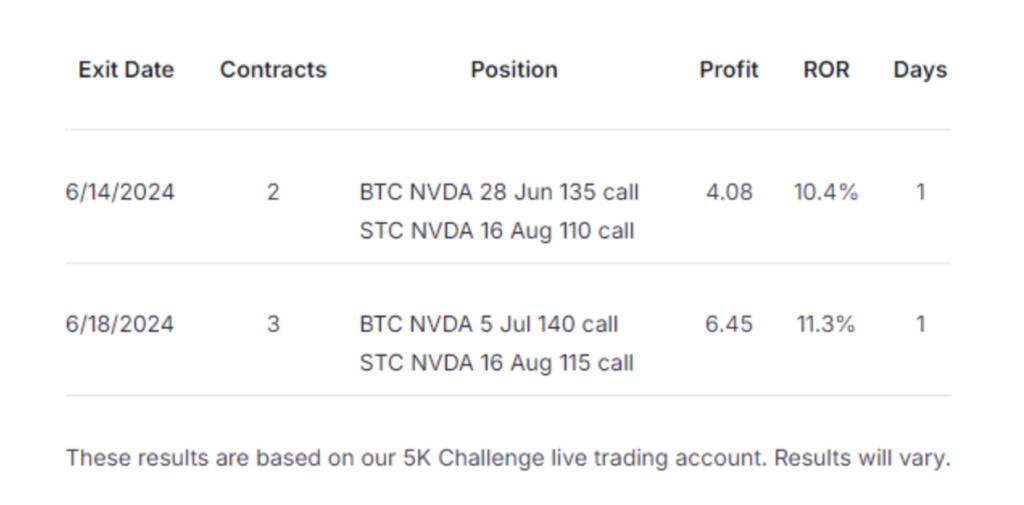

Using this strategy, we booked back-to-back one-day winners on Nvidia, pocketing around $1,050 in cash in less than five days. We touched on these trades in Filthy Rich, Dirt Poor last week, but let’s take a look at the specifics.

During the 5K Challenge Live Trading Session on June 13, NVDA was trading at $127.82, after rising on the heels of its 10-for-1 stock split a few days earlier.

With a diagonal call debit spread, you buy a long call option with a lower strike price and a later expiration date and sell a short call option with a higher strike price but an earlier expiration date.

We bought the NVDA 16 Aug 110 call and sold a NVDA 28 Jun 135 call for a net debit of $19.66, trading two contracts in the live account.

By the following morning, the stock had advanced 3.5% to $132.29, causing our long 110 call to gain in value. The overall position was up more than 10% in less than 24 hours.

With such a solid short-term profit sitting on the table, we decided to exit the trade. We sold the long call for a credit and bought back the short call for a debit. The end result was a net credit of $21.70 for a profit of $204 per contract, or $408 on two contracts.

That closeout was on a Friday. The following Monday, Nvidia was trading flat, at $132.12, giving us a chance to reenter a debit spread trade.

This time, we bought the NVDA 16 Aug call and sold the NVDA 5 Jul call for a net credit of $18.95, trading three contracts.

And once again it took less than 24 hours for our spread to be up over 10%. On Tuesday, with the stock at $135.72, we exited the trade for a net credit of around $21.10, pocketing a profit of $215 per contract, or $645 for three contracts, and an 11.3% return.

Between those two trades, we generated around $1,050 in profits, or roughly one-fifth of our 5K Challenge weekly goal.

Now, we certainly don’t expect to hit that goal every week. It’s a goal, after all, and nothing in trading is absolute. Nor do we expect all of our diagonal spreads to close as quickly as our Nvidia trades did. Generally, we’re targeting closeouts in 7-14 days.

But when you have a stock run up like NVDA did, it’s wise to book profits rather than get greedy. There’s always the option to go back to a stock, and we may look to trade NVDA again once we see the stock flatten out after its recent pullback.