Don’t look now, but the S&P 500 is up over a staggering 50% since October 2022 and is currently up over 15% in the first half of 2024. At this point, it’s no surprise that the bears are peaking out from their slumber, and news articles are using fear-mongering to warn of impending doom. And yet other analysts are touting this is just the beginning of a five-year bull run. Who is right? What should you expect in the second half of the year? I have what you need to know and what you need to watch out for.

First, as an options trader, I don’t really care who is right – if we’re headed into a bear market or a continuation of a bull market. I’ll change tactics accordingly, so I don’t normally get too deep into the investment bank predictions and mostly ignore those stories that hit my feed.

But after visiting family and friends this weekend, I came across a near-perfect bell curve of data when I asked where the market was going in the second half of the year. I came across the perma-bulls, and the perma-bears, and the majority didn’t know what to think, but said they read the financial headlines and trust that someone else knows more than they do.

Let’s look at why the bears feel like the end is near. Look no further than a chart of the S&P 500 in 2024. There was a single pullback in April, but otherwise, the AI bubble and rate-cut optimismhas pushed stocks to incredible highs.

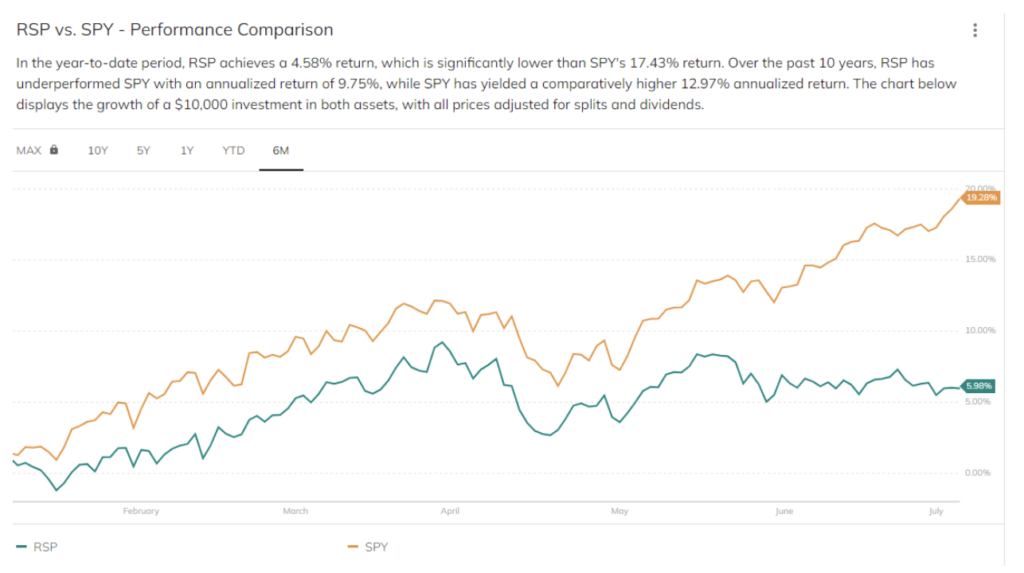

Next, the bears will say this market doesn’t have broad-based participation – the Mag (5, 6, or 7) stocks are responsible for most of the gains. As seen by the comparison of the equal-weighted S&P 500 ETF (RSP) returns vs the weighted S&P 500 ETF (SPY).

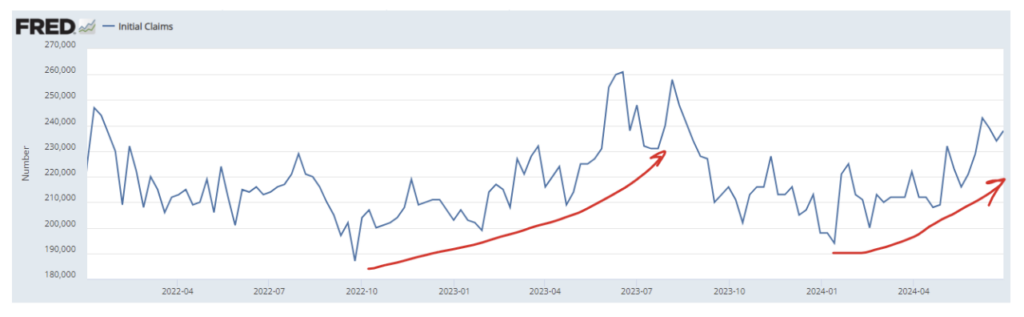

The bears also point to worsening jobless claims, as the economy softens. Jobless claims have been on a steady rise ever since 2024 started. Maybe AI is disrupting jobs more than we thought. Unless you’ve tried Adobe’s generative AI – that still needs work before it’s going to take over a traditional designer’s job. I digress…

Lastly, as we embark on yet another earnings season, the bears will say this market is grossly overbought and in need of a correction based on the historic earnings multiple of the S&P 500. The fundamentalists put the market value at 5412 – quite a bit lower than 5570.

What’s the other end of the argument? Why do the bulls say we’re just getting started?

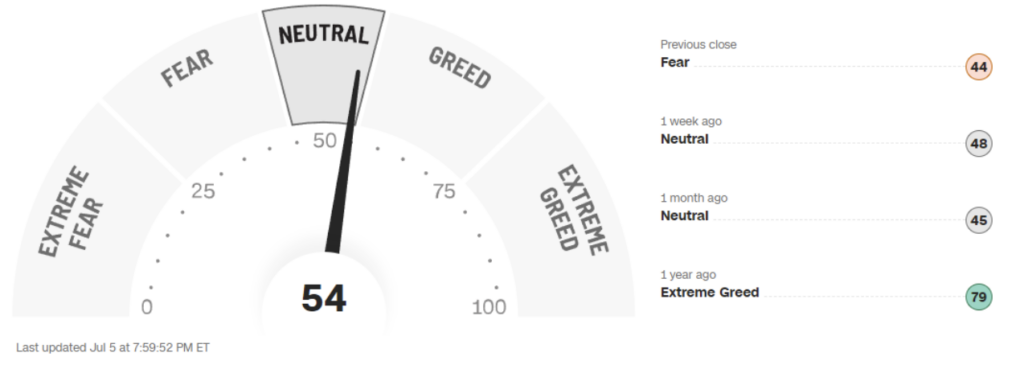

The trend is your friend (until it isn’t). And right now it’s bullish. We will need to see some negativity from earnings to overcome AI optimism and the hope that multiple rate cuts from the Fed are right around the corner. This may not be the first time traders are caught being complacent, but the CNN Fear and Greed Index is showing that traders are neutral right now, not overly greedy.

The Volatility Index (VIX) is showing no real signs of fear in the market either. It’s been relatively flat this entire year except for April. They seem confident in the soft-landing approach from the Fed.

Finally, since October 2023, we’ve had one significant pullback, but otherwise, we’ve been marching higher. Without a trend break of a moving average, I would expect the next area of resistance to be around $5650 (SPX) or $565 on the SPY.

The reality is both bulls and bears could be right. Maybe the market will drop. Maybe this is the start of a bull run over the next 5 or 10 years. But as an options trader, I don’t care. I’m going to trade what the market gives me, and right now the overwhelming trend is bullish.

I still think we could come into uncertainty as the U.S. presidential election nears, but unless we see really bad corporate earnings, I’m staying with the existing trend for the next month.