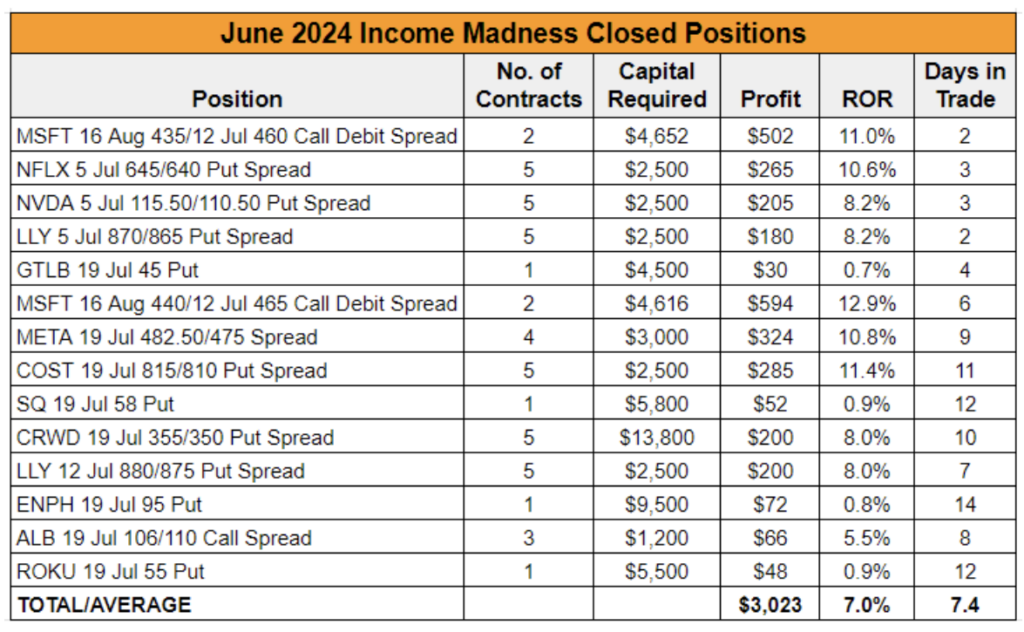

We recently wrapped up the latest round of Income Madness, which kicked off in late June. We are in the process of closing out our remaining trades, but here’s how our results look so far:

We’ve generated more than $3,000 in cash with 14 trades closed. We remain in five positions, which we will look to exit over the coming days.

The goal of Income Madness is to genrate a large amount of cash in a short amount of time using a variety of option strategies. We predominately sell cash-secured puts and bull put spreads, although we also trade the occasional buy-write, bear call spread, call debit spread and iron condor.

While our focus is on short-term trades, we do not close positions prematurely just to get them off the books. And while the vast majority of our trades are profitable, we occasionally find ourselves in a recovery trade that stretches out over a few months or more.

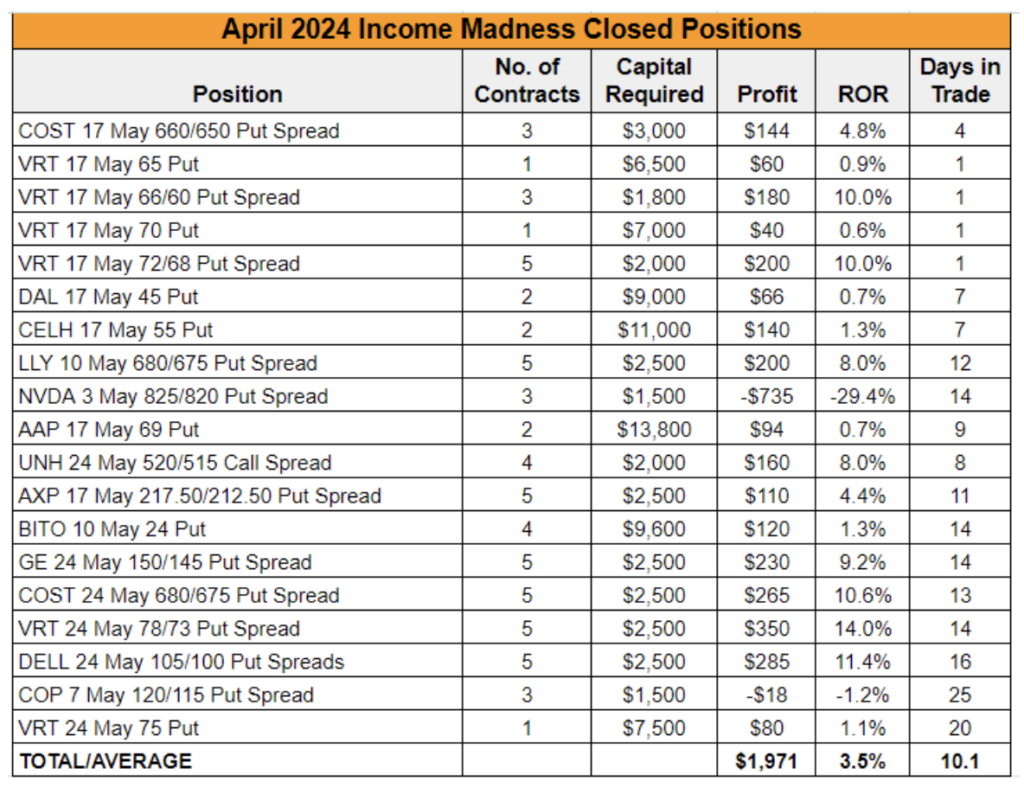

That is the case with our final trade from the April round of Income Madness. Between April 19 and May 15, we closed all but one of our trades, generating nearly $2,000 in cash in the live account and averaging a holding time of just over 10 days.

The trade that remains open is on Tesla (TSLA), which has taken us on a wild ride.

This trade was a bit different right from the start. For one thing, we traded a bear call spread. While not unheard of, we tend to trade bear put spreads, especially in rising markets.

For those who are not familiar with the strategy, a bear call spread involves simultaneously selling a call option and buying a call option with the same expiration date but a higher strike price. It is a neutral-to-bearish strategy that is generally used when you expect the price of the underlying asset to remain flat or decline by expiration.

The maximum profit is the net credit received upfront, while the risk is limited to the difference between the strike prices minus the net credit received. In other words, the risk profile of a bear call spread is similar to that of a bull put spread. And like a bull put spread, the use of this strategy greatly reduces the capital required, offering the potential for high rates of return.

The one caveat is that while stocks can and do sell off, this strategy can be tricky when the broader market is moving higher, as a rising tide has the potential to lift all boats.

But TSLA itself had been struggling for about nine months prior to us entering the trade, with the stock falling more than 40%. After a big run-up in early 2023, investors began unloading shares in the summer months amid mounting concerns about competition in the electric vehicle (EV) market and lower profit margins as Tesla cut prices in an effort to maintain sales growth.

The other thing that was different about this trade was that we put it on just a few hours before the company was set to report its first-quarter results after the close on April 23.

We noted that those who were uncomfortable with the higher risk profile of this trade (or with trading call spreads in general) should take a pass on it. However, for those who were comfortable with the pre-earnings trade, we took steps to mitigate our risk.

At the time we entered the position, TSLA was trading around $145 a share. The expected one-day move on earnings was 15 points in either direction – so up to about $160 or down to about $130.

We selected a short strike that was another 15 points above that expected move, selling to open the TSLA 24 May 175 Call and buying to open the TSLA 24 May 180 Call for a net credit of around $0.56, or $56 per spread. We sold three contracts of this bear call spread in the live account, bringing in $168.

As far as our risk profile went, we stood to make money on the trade as long as TSLA was below $175.56 at expiration on May 24.

The 31 days to expiration (DTE) also gave us some flexibility to manage the position should TSLA rally following its earnings announcement.

After the close that day, Tesla reported Q1 revenue of $21.3 billion, a 9% drop and the sharpest year-over-year decline since 2012. Revenue fell short of analysts’ estimates, as did profits. Adjusted earnings per share (EPS) of $0.45 missed by $0.06. And net income was down 55% from a year ago.

Given this, you’d think TSLA would have continued its sell-off. But shares rallied 12% on the day, after CEO Elon Musk told investors that production of new affordable EV models would begin by early 2025, which was sooner than expected.

It just goes to show you that even if you can correctly predict whether a company will miss or beat expectations, there’s no telling how the market will react.

Over the next few days, the stock quickly ran over our short call strike. We hung on, hoping for a pullback in shares, but it did not come.

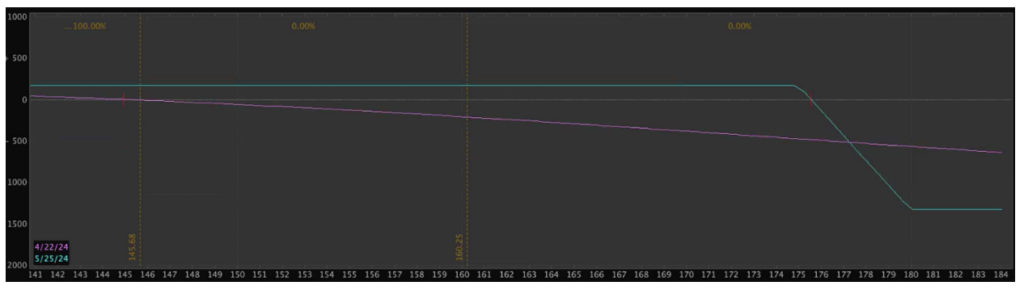

For reference, here is a look at TSLA’s chart since we entered the initial bearish trade:

On May 21, with just three days to expiration, the stock was trading above the $180 level, requiring us to manage the position. We rolled the call spread out to the June 14 expiration and up to the 180/185 strikes for a net debit of $1.15 each.

Given the stock’s bullish momentum in spite of negative news, we decided to enter a bull put spread to partially offset the net debit from rolling the call spread. We sold the TSLA 14 Jun 165 Put and bought the TSLA 14 Jun 160 Put for a net credit of $0.79 each. This created an iron condor and left us with a small credit of $0.20 on the position when factoring in the initial premium collected.

TSLA traded relatively flat after we converted the position to an iron condor, yet with the stock trading around $184, our call spread remained in the money (ITM) as we headed into the June 14 expiration.

So, we decided to adjust our strategy once again. On June 13, we closed down the iron condor, which cost us $2.90 each, leaving us with a net debit of $2.70 on the overall position. We opted to enter a new put spread to generate credit while forgoing the call side given the recent strength in shares. Specifically, we sold the TSLA 5 Jul 160/155 Put Spread for $0.54 each, lowering our overall net debit to $2.16.

Less than two weeks later, Tesla had run up to the $193 level, and we netted $0.85 by rolling our put spread out to the July 19 expiration and moving our short strike up to 175 and our long strike up to 170 to maintain our 5-wide spread. This left us with a net debit of $1.31 per spread.

As we headed into the July 4th holiday, Tesla continued to rally. On July 3, with the stock trading at $244.50, the premium on our spread had fallen to a nickel. Rather than risk holding the position for another two weeks until the July monthly expiration, we closed it out.

Then, on July 5, we entered a new trade, selling the TSLA 19 Jul 227.50 Put and buying the TSLA 19 Jul 222.50 Put for a net credit of $0.90 each.

By actively managing this recovery trade, we’ve managed to whittle our net debit down to just $0.45 per spread (or $1.35 for three contracts).

Keep in mind that the most capital we’ve allocated to this position was $3,000 for three contracts when we were trading the iron condor. The rest of the time, it’s only required $1,500 in capital, so it’s not tying up too much options buying power as we manage the position back toward breakeven.

Tesla is currently trading comfortably above our short put strike. With the company scheduled to report second-quarter earnings on July 23, the question now becomes whether we roll through the announcement to capitalize on elevated premiums or wait until after the earnings dust settles to reenter a position to work off the remaining net debit.

We don’t have an answer yet, but we’ll be watching the stock closely this week. And we’ll update you here once we finally close out the trade.