The market sold off last week and experienced a “worst day since…” headline. Then the market turned around and experienced a, “best day since…” headline on Friday. Investors’ turmoil in the last week made many want to throw their hands up and sit on the sidelines. And that was just the precursor to one of the most important trading weeks of the year. Let’s dive into everything you need to know for the week ahead!

For context, let’s start by looking at the S&P 500 chart to set the scene.

Since May the market has been in a solid up trend, pushed higher by the AI-craze that has largely impacted the Magnificent-7 (also 7 of the most popular companies in the world). A series of hiccups with Crowdstrike shut Microsoft services down globally and that combined with bad economic data that showed steep slowdowns in manufacturing caused the index to fall hard, wiping out nearly 5% in seven trading days. But if you look to the far right of the chart, you can see Friday’s recovery, gapping higher and closing up over 1% on the day.

As positive as the day was on Friday, beware of the large upper wick on the candle.

As high as the market tried to get on Friday, the bears came in and pushed the market lower. The S&P 500 closed just about at the halfway point between the high and low of the day.

Why did the market go through two days of significant selling only to be followed up with a day of significant buying? What changed?

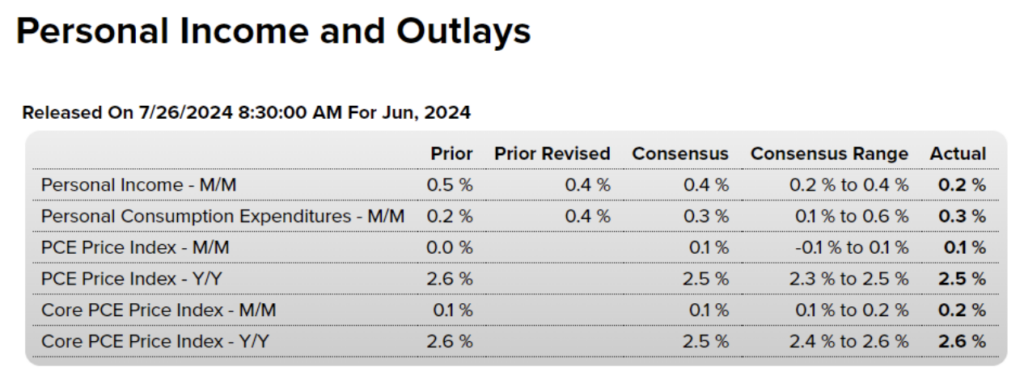

Friday’s Personal Income and Outlays had something to do with it. The report showed the Fed’s favorite inflation indicator, Core PCE, staying at 2.6% year-over-year. Even though it didn’t go down from the prior print, it didn’t tick higher and maintained a downward trend toward the 2% inflation goal.

This gives the Fed room to lower rates by a quarter point in September. Investors are speculators, so the market moved higher with the optimism of a September rate cut.

The market is now speculating a 100% chance of a September rate cut if the Fed leaves rates unchanged during the July meeting.

That makes September one of the most pivotal times you will need to be prepared for. As such, options prices and volatility are likely to expand rapidly if any source of information comes in that suggests a rate cut is no longer a slam dunk. There is an incredible risk anytime speculators say there’s a 100% chance of something happening in the future, especially in the financial markets.

While we wait for September, we have yet another pivotal moment coming up this week. Second quarter earnings continue this week with several of the Magnificent 7 on deck.

One third of the S&P 500 companies have already reported and the general consensus is a +9% year-over-year earnings growth, but only 43% have beaten revenue expectations, which is the lowest in about five years.

As inflation subsides, revenues will decrease. For example, if McDonald’s cuts their prices from $10 to $6 for a value meal because inflation is decreasing, their revenue will decrease. But if they are decreasing prices because the cost of goods sold is decreasing, then the overall profit margin should be ok.

If the other Mag-7 stocks are anything like Tesla and Alphabet, the market could be in for a rocky road this week. Tesla lost 12% after their latest earnings announcement, but remains higher than it was in June.

Alphabet lost 5% and continued to drop afterwards. It is now trading below its June levels.

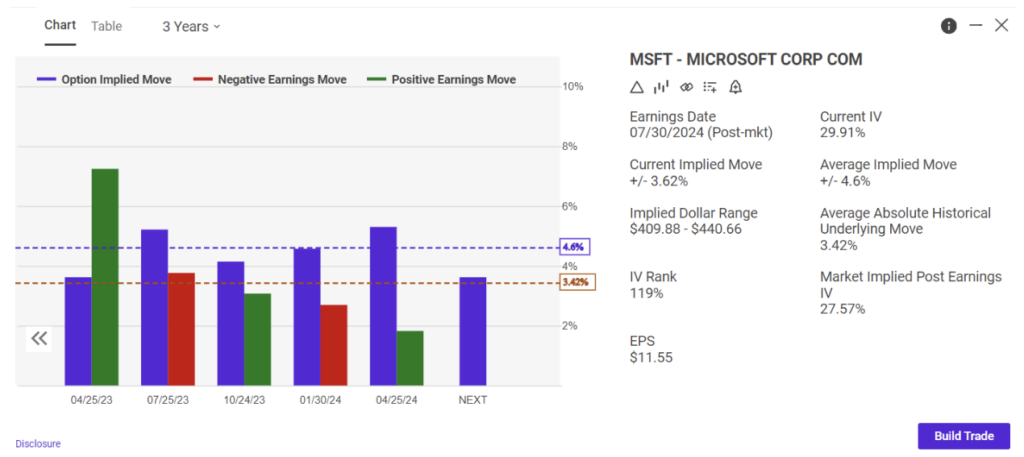

Let’s look at Microsoft for a moment, since they report earnings this week. Over the last three years the average absolute historical underlying move after an earnings announcement is 3.42%.

As of July 2, 2024, Microsoft is responsible for 7.25% of the S&P 500. So, all other things remaining equal, if MSFT falls by its average historical move of 3.42%, that would represent about a -13 point move in the S&P 500 index this week. And that’s just one of the 5 mega-caps reporting this week. Of course we also know nothing happens in a vacuum so the rest of the market will likely follow the lead, in whatever direction the Mag-7 goes.

We’ll have to wait and see if the other Mag-7 stocks can deliver better news than ramblings over a robotaxi at some undetermined time (TSLA) and weak guidance from a company that has consistently been behind in cloud computing and AI (GOOG).

Even if Microsoft mentions lower future revenue, they can still be a market winner this week if they report positive signs of AI integration as an additional revenue source.

Adjust your position sizing to account for your risk tolerance as we could continue to see some big swings this week.

Happy trading!