Microsoft (MSFT) disappointed investors after showing the mass amount of money spent on infrastructure related to AI investments. Wall Street was impatient with the revenue coming in compared to spending. Microsoft controls a fair percentage of the weighted S&P 500 index, so the market started weak.

The equity market then gapped higher after better-than-expected earnings from AMD. Later the Fed said they were open to a rate cut in September as long as inflation data continued to show progress. However, Powell mentioned he’s concerned about the job market. One reason is that the initial jobless claims have steadily risen since 2024, nearing the peak experienced in July of 2023.

Remember, the Fed cuts interest rates when they need to spur economic growth, so while we all want cheaper mortgages and business loans, we need to remember that reduced interest rates usually mean weakness in the economy.

Optimism leading into the Fed meeting helped boost the S&P 500 by over 3% in four days.

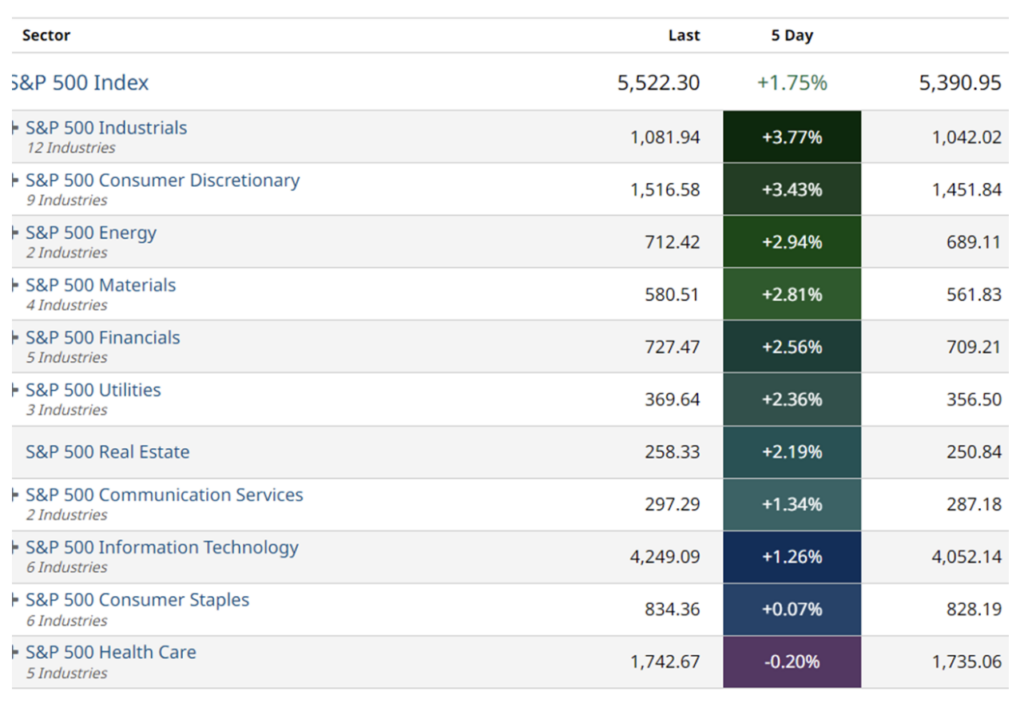

Almost all sectors participated in the run higher.

Even the equal-weighted S&P 500 index (RSP) showed strength, meaning the market was experiencing a broad-based recovery. The ETF reached new highs.

Then Thursday happened. While Thursday wiped away Wednesday’s gains and dipped below the 50-day moving average, the previous swing low remains intact for the time being. That’s around $537.52 on the S&P 500 ETF, SPY.

Stocks and ETFs can dip below the 50-day moving average and oscillate a little above and below before making the next move in either direction. So this dip below doesn’t necessarily mean we should be pulling the fire alarm just yet.

The index also dropped below the 50-day moving average in April before moving higher.

Where does this leave us?

The bullish catalysts for the market are earnings expansion and inflation/rate cuts. The Fed is leaning towards cuts because the economy is slowing and earnings, or at least earning projections, aren’t great. The bull market may be running out of gas. Will bargain hunters come in and save it from here?

If we look at how the market typically performs in August, we can see that over the last 10 years, the S&P 500 has only finished positive 40% of the time with an average gain of -0.3%. We’re headed into two of the slowest months of the year.

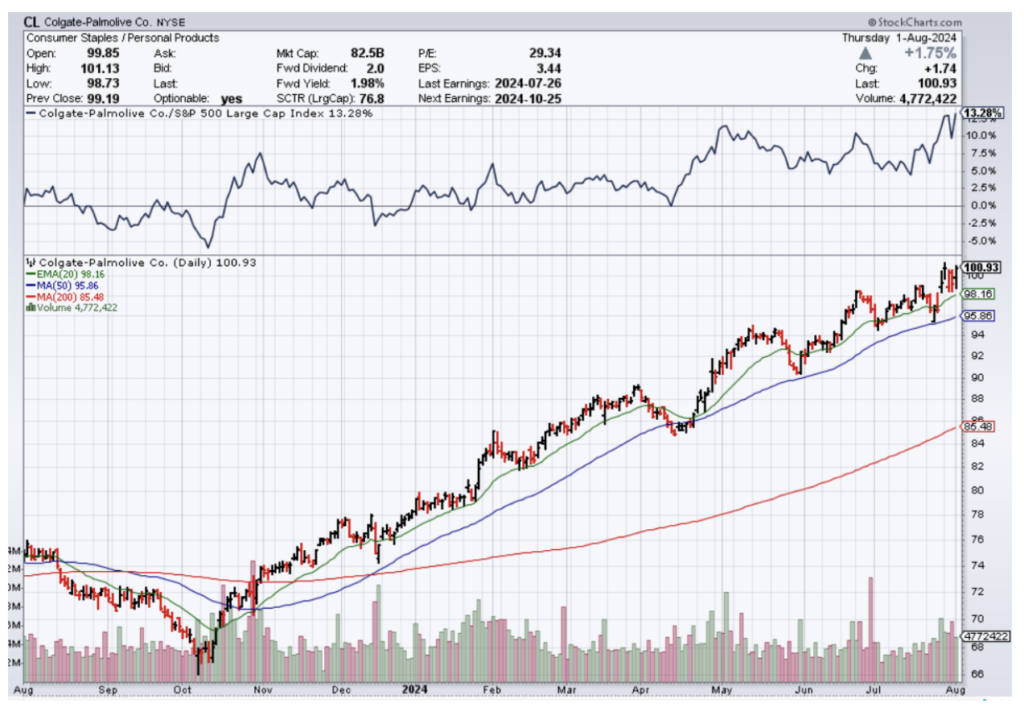

There are some bullish stocks out there. Look no further than Colgate-Palmolive (CL), sometimes considered a defensive stock. It’s gained 13.28% more than the S&P 500 return and is steadily bouncing off its 50-day moving average.

Let’s see if the market can hold these levels and if not, we will examine alternative sectors for the weeks and maybe months ahead.

Have a good weekend!