July marked the start of what people are calling the “Great Rotation.” For the first six and a half months of the year, investors were buying tech stocks in force, with a particular focus on any beneficiaries of the AI revolution. However, things shifted abruptly mid-month, as traders sold Big Tech names and piled into value stocks and small caps.

The Dow Jones Industrial Average rose 4.4% for the month, while the S&P Small Cap 600 Index was up 10.7%. The Nasdaq Composite finished July off 0.8%. That doesn’t seem like much, but it underscores just how quickly things changed. The index entered a full-blown correction on Friday, just three weeks after making an all-time high on July 11.

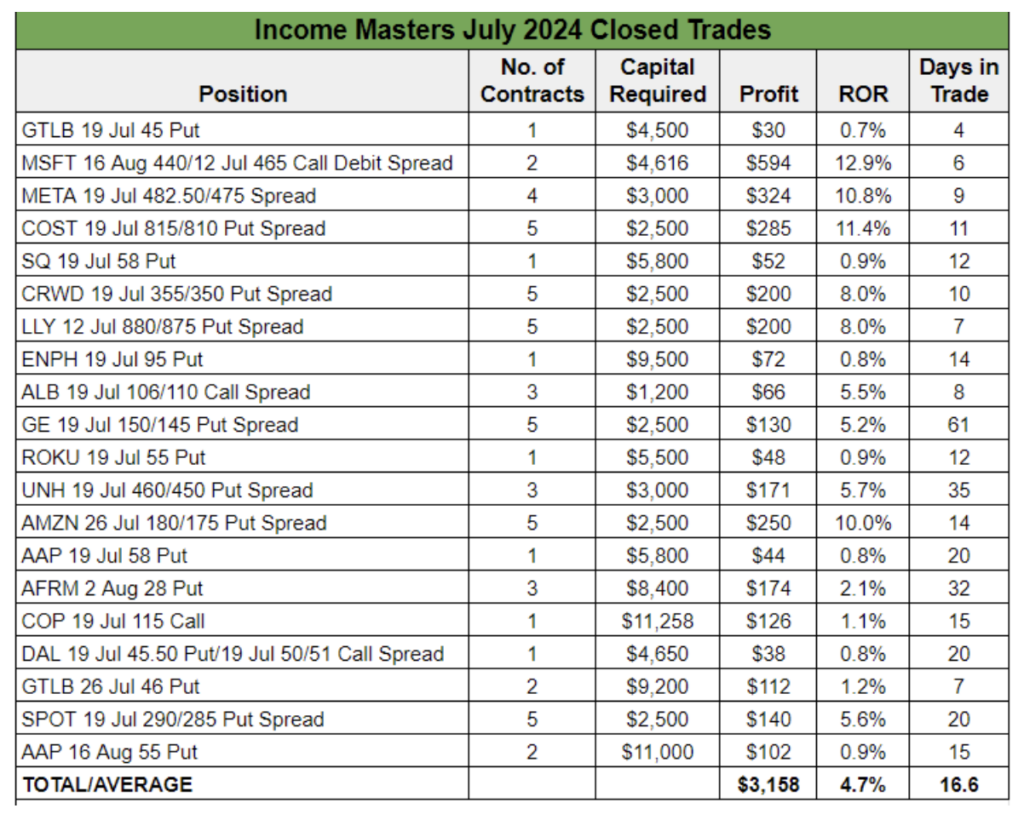

In the Income Masters program, we closed 20 trades in July, all of them winners, pocketing more than $3,100 in cash and averaging a 4.7% return with an average holding time of less than 17 days.

The positive results were boosted by a very successful round of Income Madness, which kicked off in late June with six consecutive days of live trading. We closed 19 winners in a row over a 25-day period, using a variety of option tactics to maximize income and adapt to market conditions.

Adaptation is likely to be the name of the game for the next few weeks as we wait to see whether stocks can recover or if this is the start of a broader market downturn.

At present, we have a number of Income Masters positions that are underwater. Yet, when you get a sell-off like the one we experienced on Thursday and Friday, it is not an ideal time to be making adjustments.

With most of our underwater positions, we have one to three weeks to expiration. And it’s possible we could see a reflexive bounce this week. And here’s hoping! Yet, even if we don’t get the move higher we’re hoping for, it’s never wise to chase a position lower if you can wait for some stabilization.

Rest assured that we’re watching the market and all of our positions very closely. We’ll be looking for opportunities to make adjustments to improve our chances of exiting existing positions profitably, as well as looking for new trades that will perform well even if the market continues to struggle.

To this end, we recently received a question from a member asking why we are not selling bear

call spreads, versus our typical bull put spreads, if we are heading into a bear market.

First, while it certainly may not feel like it, we are still in a bull market run. Of the major indices, only the Nasdaq has fallen into correction territory, down 10.2% from its high. The S&P 500 is down 5.7% as of Friday’s close, and the Dow is off 4%.

That’s not to say we’re not heading for one. The market still looks overvalued in certain places, and we’re in a news-driven environment between the Fed, economic reports and, of course, earnings season. Rising geopolitical tensions may also unnerve investors and push stocks lower. Markets crave certainty and that is something that is in short supply on numerous fronts.

So, it’s reasonable to consider a strategy that takes advantage of neutral-to-bearish moves in individual stocks even if we’re not seeking to predict overall market direction.

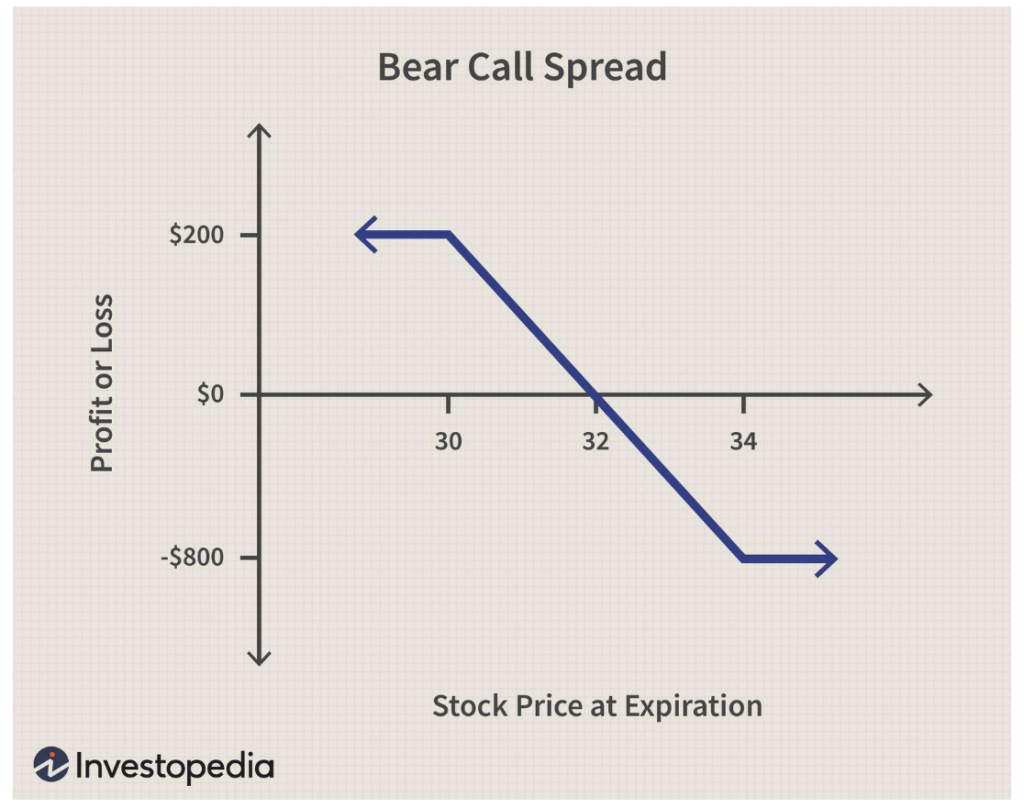

For those who are not familiar with the strategy, a bear call spread involves simultaneously selling a call option and buying a call option with the same expiration date but a higher strike price. It is a neutral-to-bearish strategy that is generally used when you expect the price of the underlying asset to remain flat or decline by expiration.

The maximum profit is the net credit received upfront, while the risk is limited to the difference between the strike prices minus the net credit received. In other words, the risk profile of a bear call spread is similar to that of a bull put spread.

What we’re looking for when trading bear call spreads is the same as what we’re looking for when we trade neutral-to-bullish put spreads:

- High implied volatility rank (IVR): 30+

- Liquidity: 500 open contracts

- Expiration: 30 to 45 days to expiration (DTE)

- Probability of OTM (Delta): < 20

- Acceptable credits: 10%+ return on risk

We recently entered a bear call spread on VanEck Semiconductor ETF (SMH) to take advantage of the negative sentiment in semiconductor stocks. Since we entered the position, the ETF is down 4.4%. We have nearly four weeks left to expiration, but we set our target exit price at 55% of the max profit in hopes of getting out much sooner.

While we expect to trade some more bear call spreads in the weeks ahead, Income Masters members should not expect to be trading them exclusively, even if the market continues to sell off, for a couple of reasons.

First and foremost, the market has a long-term bullish bias, rising more than it falls over time. And much of an individual stocks’ move has to do with the overall market direction. A rising tide lifts all ships, as they say, and stocks tend to move higher even on bad news. Furthermore, on a psychological level, individual investors tend to react more unfavorably to bearish trades going against them than bullish ones.

But we will be looking for selective opportunities to make bearish trades, as well as looking to

actively manage our ongoing positions. The market is throwing traders for a loop right now, but we’ll get through it.