We often say that we are not market forecasters. As option sellers, we really don’t care if the broader market is headed higher or lower (although we’ll admit that a rising market generally makes things easier).

The ability to be market agnostic is part of the appeal of selling options. We’re not trading purely bullish or bearish strategies like people who are purchasing long calls and puts. Instead, we’re making neutral-to-bullish trades in the case of cash-secured puts, bull put spreads and covered calls, and neutral-to-bearish trades in the case of bear call spreads.

In other words, we stand to make money not only if the underlying moves in the direction we expect it to, but also if it stays flat or even moves slightly against us.

As we’ve mentioned before, we tend to favor neutral-to-bullish strategies because the market has a long-term bullish bias, rising more than it falls over time. And much of an individual stock’s move has to do with the overall market direction. Furthermore, on a psychological level, individual investors tend to react more unfavorably to bearish trades going against them than bullish ones.

However, we’ve had success trading bear call spreads in the Income Masters program, most recently with Humana (HUM).

Humana is a health insurer that offers individual, employer-sponsored and Medicare Advantage plans. It also offers other health-related services, such as wellness programs, disease management programs and pharmacy benefits management.

A number of headwinds have created a challenging environment for Humana and its peers. These include rising health care costs, changes in Medicare and Medicaid reimbursement rates, and regulatory uncertainty.

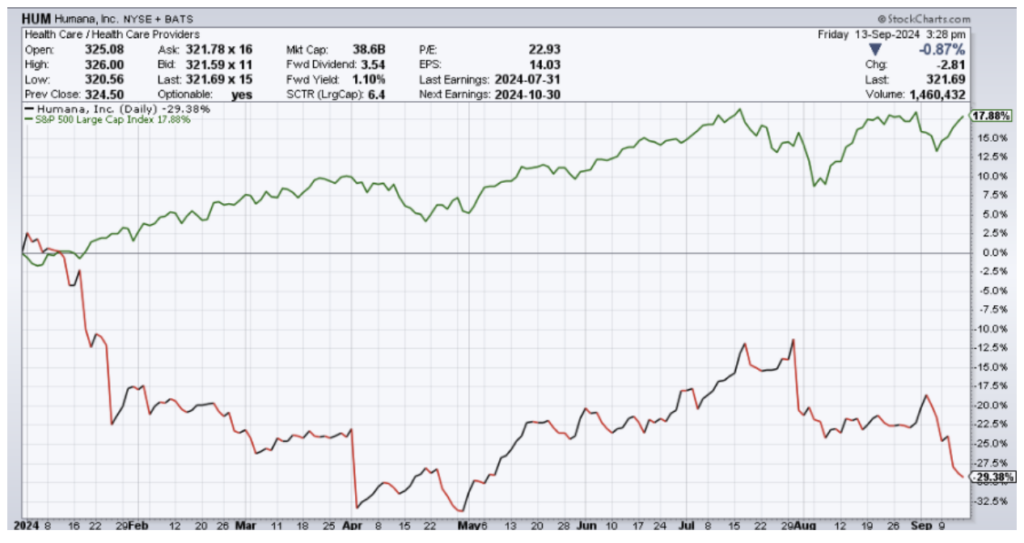

HUM has been a clear underperformer this year, down almost 30% while the S&P 500 has advanced 18%.

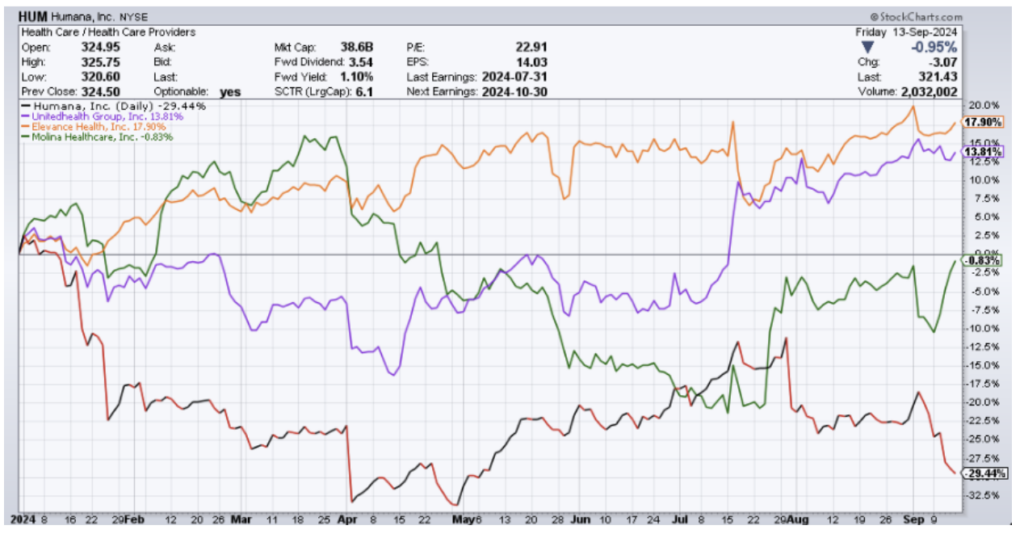

In addition to significantly lagging the broader market, HUM is also a clear underperformer in terms of its sector. Other managed health care stocks like UnitedHealth Group (UNH), Elevance Health (ELV) and Molina Healthcare (MOH) have been trading flat to higher.

This was also the case back in February when we began trading the stock.

For those who are not familiar with a bear call spread strategy, it involves simultaneously selling a call option and buying a call option with the same expiration date but a higher strike price. It is generally used when you expect the price of the underlying asset to remain flat or decline by expiration.

The maximum profit is the net credit received upfront, while the risk is limited to the difference between the strike prices minus the net credit received. In other words, the risk profile of a bear call spread is similar to that of a bull put spread. And like a bull put spread, the use of this strategy greatly reduces the capital required, offering the potential for high rates of return.

The caveat is that while stocks can and do sell off, this strategy can be tricky when the broader market is moving higher, as a rising tide has the potential to lift all boats.

At the time we entered our first HUM trade, the market had been going almost straight up since October on FOMO-induced profit chasing.

And although HUM had been lagging, we were neutral on the stock. At the time, shares had an expected move of 21 points, but expected moves can be up or down. So, we did our research, comparing the premium we could collect and the risk profile of a bull put spread versus a bear call spread.

We decided that the call spread offered a more attractive opportunity, so we entered a trade with a short leg that was just outside of the stock’s expected move.

HUM ended up selling off 5% after we entered the position, falling 18 points, and the spread hit our target exit price, earning us a 10.3% return in just nine days.

We went back to the stock a few weeks later following a number of downgrades from analysts, who cited revenue and earnings growth headwinds as the company’s profit margins were getting squeezed by an unforeseen spike in medical utilization. With earnings on the horizon, we sought to take advantage of elevated premiums ahead of the announcement.

We didn’t have to wait for the company’s report, though. On April 2, shares fell more than 13% on news that Medicare Advantage plans would see an average rate increase of 3.7%, which was likely to cause Humana to fall short of reaching the upper end of its earnings-per-share growth target.

With this drop, our bear call spread hit its target exit price, earning us a 12.6% return well ahead of expiration.

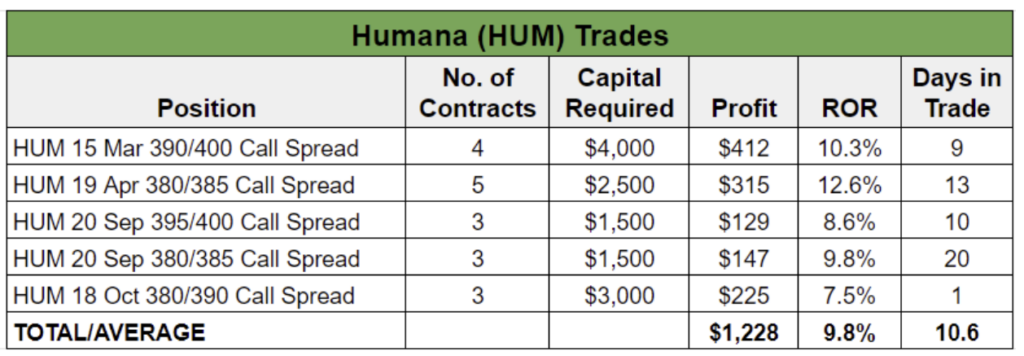

In total, we’ve traded HUM five times with bear call spreads over the past seven months. From those trades, we’ve booked more than $1,200 in cash in our live account and averaged a 9.8% return per trade.

The chart below shows when we entered and exited each of these trades. The green arrows mark where we got in, collecting a premium, and the red arrows mark where we got out, paying a debit to close but pocketing a profit on the trade.

As you can see above, our latest HUM trades came in quick succession. In fact, we opened a new HUM call spread less than 24 hours after closing the previous position.

With the stock trading at $345.77 on Sept. 10, we sold the HUM 18 Oct 380 Call and bought the HUM 18 Oct 390 Call for a net credit of around $1.35, or $135 per contract. We sold three contracts in the live account, generating $405 in cash. At the time, we set a target exit price at $0.50, placing a good ‘til canceled (GTC) order at that level.

But, the next day, HUM sold off hard and our spread was only $0.10 from its target exit price. We opted to take profits early, closing at $0.60 apiece and earning a 7.5% return in just one day.

Big down moves like this and the one we got back in early April certainly benefit us when trading a bear call spread, as they mean we get to book profits sooner. But keep in mind that the maximum profit is still the credit received, which will be earned whether the stock closes a penny below the short strike at expiration or well out of the money.

Then again, you’ll never hear us complaining about taking profits early!

Bear call spreads are a great strategy to take advantage of short-term bearish sentiment in a stock, and we may use them again with Humana when the time is right.

However, we actually went back to the stock the day after our latest closeout, putting on a new HUM trade during an Income Masters Live Trading Session. But with the stock appearing to flatten out, we opted for an iron condor, which is a delta-neutral strategy that profits the most when the underlying asset doesn’t move much.

As you look for trading opportunities in this potentially late-cycle market, it may pay to incorporate some neutral-to-bearish trades in the form of bear call spreads. The more tools in your trading arsenal, the better prepared you will be to trade whatever the market throws at you.