Last week, we closed the books on another successful round of Income Madness, our fourth so far in 2024.

We held four back-to-back live trading sessions, beginning on Aug. 19. We called it a “mini” Income Madness since we typically do six straight days of live trading. But there was nothing “mini” about our results.

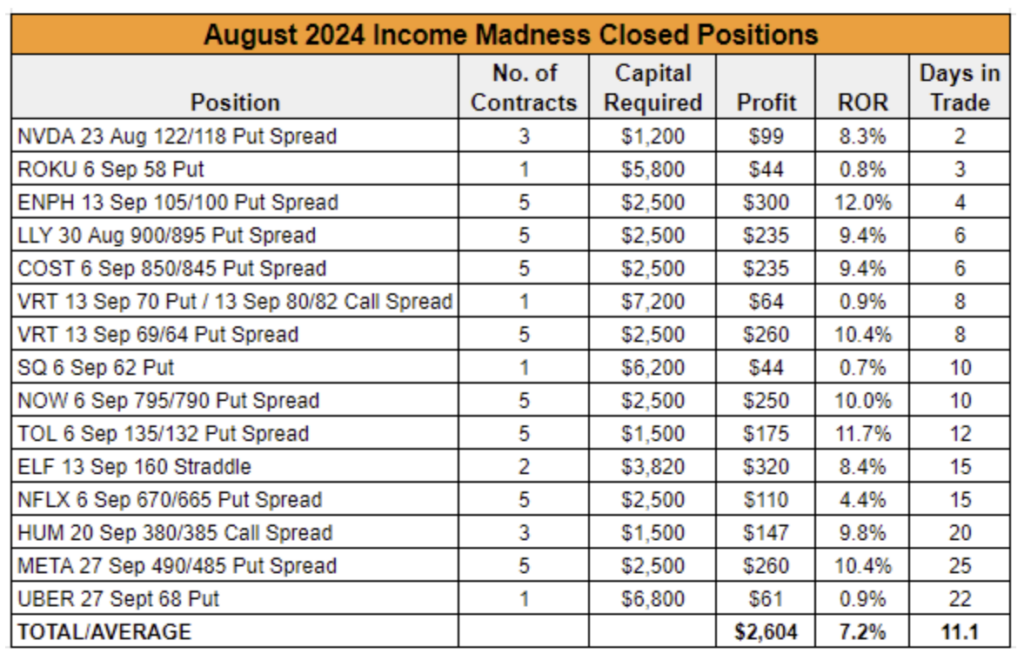

Over the course of 25 days, we opened and closed 15 winning trades in a row, booking around $2,600 in cash in our live account and averaging a 7.2% return per trade.

The goal of Income Madness has always been to generate a large amount of cash in a short amount of time selling options. However, we made some big changes to the program this year, introducing new tactics that have yielded great results. This has allowed us to adapt to the current market environment, whether it’s giving us record low-volatility or a sell-off induced volatility spike.

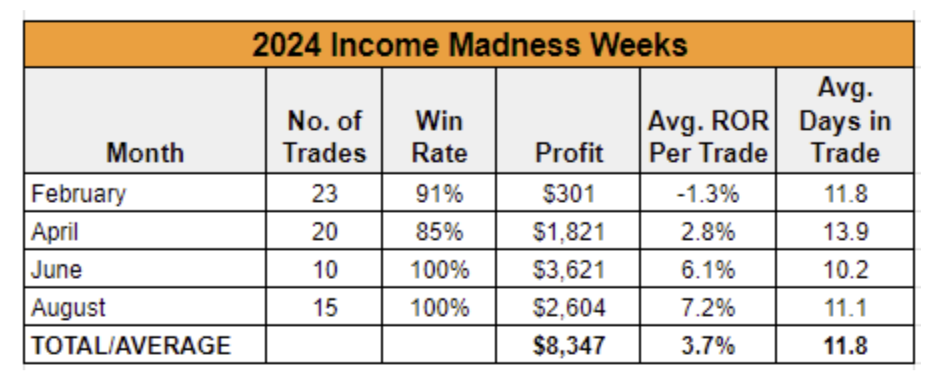

While we’ve traded through some rough patches, most notably in April when stocks slumped, we’ve done very well navigating the ups and downs of the market this year, as you can see below.

Our February results were dinged by a big loss on Super Micro Computer (SMCI). We entered a neutral-to-bearish call spread on the data-center solutions provider. The stock had been on a crazy run during the early part of 2024 but was starting to look overdone. Yet, shares still had one more leg up in them, and our position quickly went into the money. We closed our bear call spread and attempted to recoup the loss by trading bull put spreads. However, we got caught on the wrong side again when SMCI finally reversed lower.

That loss significantly reduced our February Income Madness profits, but we still came out ahead given our high success rate with our other trades.

The April, June and August rounds of Income Madness yielded much better results, with thousands of dollars in cash generated. Although we had three losing trades during the April round, we achieved a 100% win rate in June and August.

Let’s delve into the changes we’ve made that have contributed to our success.

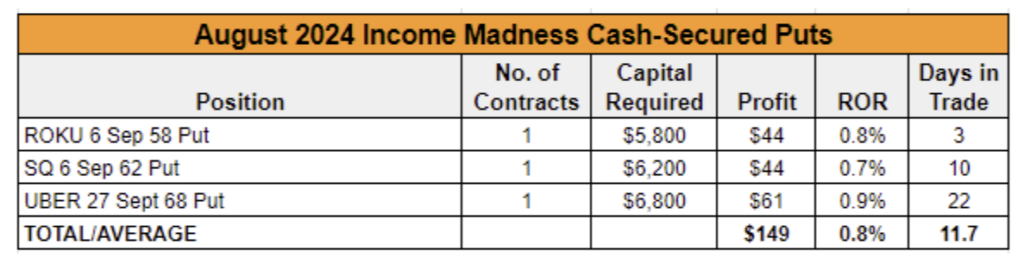

If you’ve been with us for a while, you may remember that the vast majority of Income Madness trades used to be straightforward cash-secured puts. And we still traded a handful of those in the latest round.

But cash-secured puts have the potential to tie up a large amount of capital. And fewer low-priced stocks have shown up on our scans recently. Many of the best opportunities we see are in stocks with triple-digit share prices, which require a lot of options buying power when selling puts.

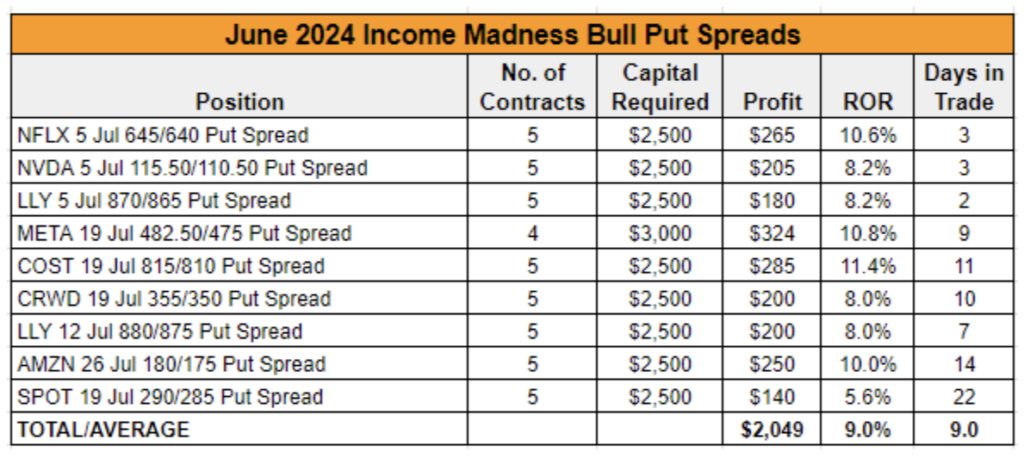

As a result, we’ve begun to favor bull put spreads, which serve to both reduce our capital requirements and boost our rates of return, as you can see below.

Once again, this go-to strategy made up the bulk of our profits, with nine trades netting us nearly $2,050 in cash in the live account.

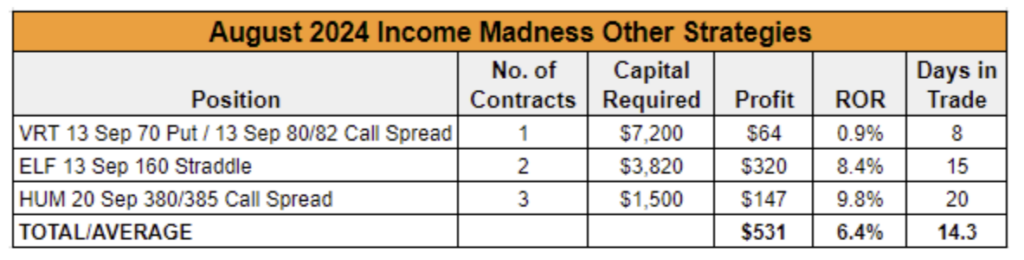

In addition to cash-secured puts and bull put spreads, we traded a handful of other strategies during August Income Madness.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The first was a jade lizard on data-center systems specialist Vertiv Holdings (VRT).

A jade lizard involves selling a put option with a strike price below the current stock price and selling a call spread above where the stock is trading to collect additional premium. The call spread offers downside protection in the form of more credit brought in. And as long as the total credit generated is greater than the width of the call spread, there is no risk to the upside even if the stock takes off running. (For more on how this strategy works, read about our recent jade lizard trade in a rising star in fast-casual dining.)

Next, we traded a long straddle on cosmetics company e.l.f. Beauty (ELF).

The strategy involves buying a call and a put option at the same strike price and same expiration date for a debit. It seeks to take advantage of increasing volatility in an underlying but doesn’t require a trader to correctly guess which way a stock might move.

Long straddles are a defined-risk trade, as the maximum loss is limited to the total debit paid to enter the trade. However, unlike when selling options, time decay works against us rather than for us, as the value of the options we bought will decline as expiration approaches. So, if the underlying does not move enough to reach profitability before expiration, the position may require an adjustment.

But a lack of movement wasn’t a problem for ELF. Over the next two weeks, the stock fell 13%. With our spread sitting at a nice profit, we exited the position with $320 in cash, earning us a more than 8% return.

Finally, we traded a bear call spread on ailing health insurer Humana (HUM). A bear call spread has a risk profile similar to that of our favored bull put spread strategy. And like a bull put spread, the use of this strategy greatly reduces the capital required, offering the potential for high rates of return.

We’ve actually been trading bear call spreads on HUM for the past seven months in the Income Masters program. Including the August Income Madness trade, we’ve booked five winning trades in a row, pocketing more than $1,200 in cash and averaging a 9.8% return per trade.

Taken together, these new tactics allowed us to boost our income while offering downside protection, another way to profit from volatility and a way to take advantage of short-term negative sentiment in a stock.

But the addition of new strategies isn’t the only change we’ve made to Income Madness this year. The other big one is that Income Madness is now exclusive to Income Masters. In other words, you have to be an Income Masters member to take advantage of it.

However, we’ve decided to run a special one-time event for Investor’s Blueprint Live attendees in February.

This trading event will run Feb.19-25, featuring five days of live trading. The first three days will be held via webinar only, while the last two days will take place in person (or virtually) at Investor’s Blueprint Live in Boca Raton, Florida.

During these five days of live trading, we’ll aim to put on two to three trades a day using a variety of the strategies we discussed above. We’ll be targeting short-term profits with an eye on exiting as many trades as we can in the days after the event.

Interested in joining us at Investor’s Blueprint Live 2025?

Just be aware that early registration closes on Sept. 29. So, if you want to get $200 off your ticket price and secure your seat, you’ll need to act soon.