We just wrapped up the 2024 Millionaire’s Trading Club (MTC) event in Las Vegas, which ran from Oct. 16-18. It was wonderful to see so many members attend the live event and to connect with those attending virtually as well.

This conference was one of the fastest-paced live events in Traders Reserve history. In our three days together, we put on 25 trades. And we closed out nine of those – eight winners and one loser – during the event, netting nearly $6,000 in the live account before we even hopped on planes to get home.

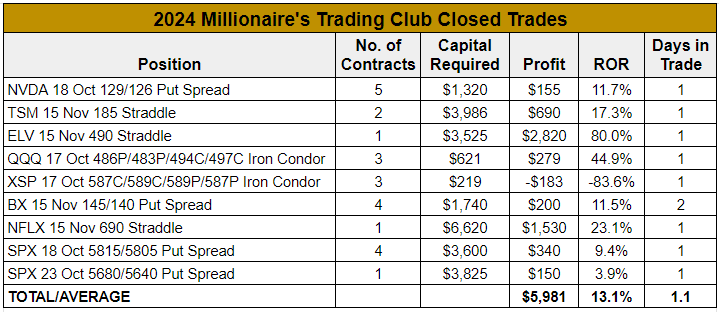

Here’s a look at the MTC trades we’ve closed so far:

We averaged a 13.1% return per trade despite holding these trades for less than 48 hours and many for less than 24 hours. This showcases not only the more advanced and aggressive style of trading we do at this event, but also the effective use of leverage. We utilized a variety of spreads, including credit spreads, calendar spreads, iron condors and straddles, to boost our rates of return and take advantage of volatility and directional moves, both bullish and bearish.

In the week ahead, we plan to highlight some of these trades in Filthy Rich, Dirt Poor, as well as the closeouts we are likely to see in the days ahead from our remaining positions.

Today, we’ll look at one of the clear standouts, which was our best trade from both a dollar amount and rate-of-return perspective: the pre-earnings straddle on Elevance Health (ELV).

This candidate was brought to our attention by Brad, a longtime member and frequent attendee of our live trading events.

During a session on trading earnings, Traders Reserve’s Dave Durham discussed when someone may want to trade over earnings events and the best tactics to use, as well as how to find good trade candidates.

Unlike traders who buy put or call options ahead of earnings results, we are not necessarily trading the outcome of a company’s report or betting on which way a stock will trade. Rather, we are attempting to take advantage of the higher-than-normal volatility associated with earnings.

Our preferred earnings tactics include vertical put and call spreads, iron condors and long straddles. The long straddle, in particular, has been our go-to earnings strategy in recent months, as it eliminates the need to correctly predict which way a stock may head after a company reports. Because even if you can accurately predict whether a company will beat or miss estimates, there is no telling how the market will react.

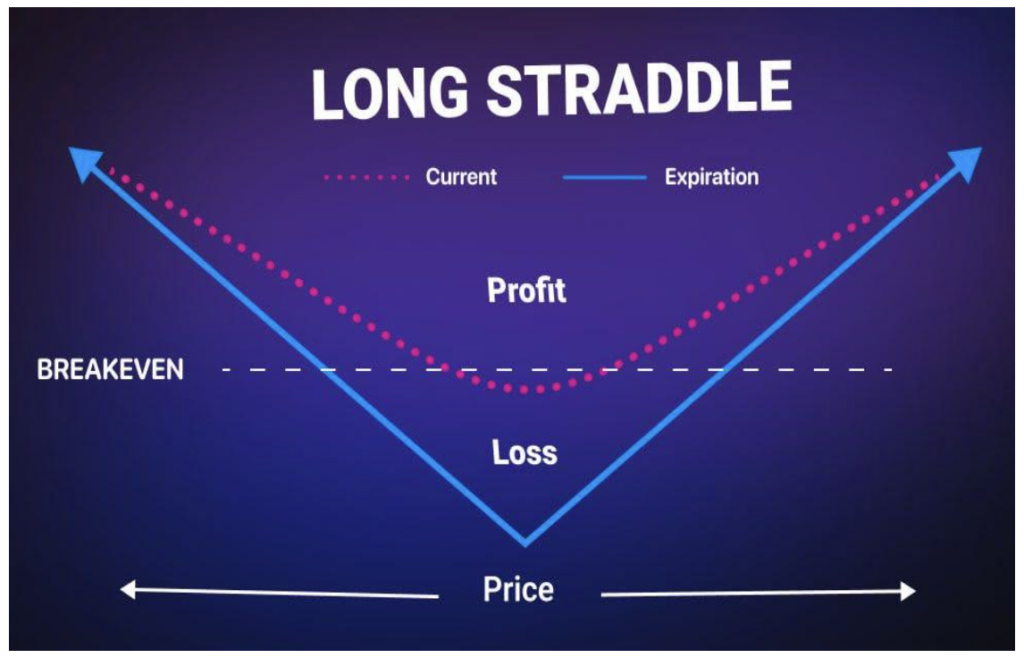

For those who are unfamiliar with straddles, this is an options strategy in which you buy or sell a call and a put option at the same strike price and same expiration date. When you buy the call and put, you have what is known as a “long straddle” versus selling them and creating a “short straddle.” While we are typically option sellers, we only trade long straddles.

A long straddle is an ideal trade when you’re looking to profit from increasing volatility but are unsure of which direction the underlying might go next. The goal is to profit from a big move in the underlying up or down. Since you pay a debit to enter the trade, you’re looking to close it by selling the position for a credit that is more than the debit you paid.

Long straddles are a defined-risk trade, as the maximum loss is limited to the total debit paid to enter the trade. However, unlike when selling options, time decay is working against us rather than for us, as the value of the options we bought will decline as expiration approaches. So, if the underlying does not move enough to reach profitability before expiration, the position may require an adjustment.

Because of the potential for outsized moves around earnings, right before a company reports is typically one of the best times to put a straddle on.

When looking for earnings trade, we screen for a number of things, including:

- Earnings within 1 to 21 days

- Stock price greater than $50 per share

- Implied volatility rank (IVR) of at least 30%, but above 50% is preferred

- High implied volatility (IV) relative to historical volatility (HV)

- Weekly options

- Decent liquidity

- Open interest of at least 500 to 1,000 contracts

One stock that met our criteria was Taiwan Semiconductor Manufacturing (TSM), which was due to report earnings the next day. This trade worked out beautifully. The stock rallied in the pre-market after the semiconductor manufacturer posted record profits, easily beating analysts’ revenue and earnings estimates.

Our straddle filled for an even higher credit than the target exit price we set, which is a nice surprise that happens sometimes with these trades, and we walked away with $690 in cash on two contracts for a 17.3% return in one day.

However, a few other potential trades that we considered during the session on earnings trades did not pan out for various reasons, including Tesla (TSLA) and Intuitive Surgical (ISRG). You should never force a trade, but you definitely don’t want to before an earnings report. So, we were comfortable passing on a number of names that didn’t quite line up the way we wanted them to.

Enter the Elevance trade.

The health insurance provider was set to report earnings the next morning. However, the stock only had monthly options. We generally look for stocks with weekly options, but ELV had a number of other things going for it, including an implied volatility rank of 84% and a penchant for outsized post-earnings moves.

We decided to take a chance on ELV, buying the ELV 15 Nov 490 Put and the ELV 15 Nov 490 Call for a net debit of $35.25. In other words, our maximum risk was $3,525 per contract, which could be incurred if ELV failed to move enough to get the trade beyond the breakeven point.

But that certainly wasn’t an issue. The next morning, shares plummeted after the company missed estimates and issued a soft outlook.

We exited the trade the next morning around 10 a.m. ET, just as we were starting Day 2 of the Millionaire’s Trading Club event. We closed the straddle for $63.45, booking a profit of $28.20, or $2,820 a contract, for an 80% return in less than 24 hours. We heard from some attendees that they exited earlier that morning for bigger profits, including a few who got out of the position in the mid-$80s!

ELV is a perfect example of the kind of trade we like to make at the MTC events. Not only did it deliver a huge profit in a short amount of time, but we utilized leverage effectively with a spread trade. Furthermore, it highlights the collaborative nature of these events, where we get to bounce trade ideas off each other.

So, thank you, Brad, for the trade idea and to everyone else who attended the event live and virtually. We are already looking forward to the next Millionaire’s Trading Club event!