The S&P 500 rose 0.53% Thursday, with the Dow Jones up 1.06% and the Nasdaq 100 climbing 0.36%. Stocks found momentum late in the day as hopes for tax cuts and deregulation boosted investor confidence. The big winner was the Russell 2000 which rose 1.52% and showed that investors are willing to get back into small caps now that the election, Fed decision, and NVDA earnings are in the rearview mirror.

Speaking of Nvidia – it had a choppy session, finishing slightly higher after strong Q3 earnings. However, comments from CEO Jensen Huang about rising costs for their new AI chips put pressure on profit margin expectations. Seeing the market not fall apart after the announcement was nice since there was so much pressure on NVDA to outperform.

Here’s how NVDA did on a 5-minute chart after the market opened.

Fed officials also gave markets a reason to cheer. New York Fed President John Williams noted progress on inflation and hinted at future rate cuts, while Chicago Fed President Austan Goolsbee said he expects rates to “end up a fair bit lower” in the next year. Both statements reinforced the idea that the Fed’s monetary policy is working as intended, providing a lift to equities.

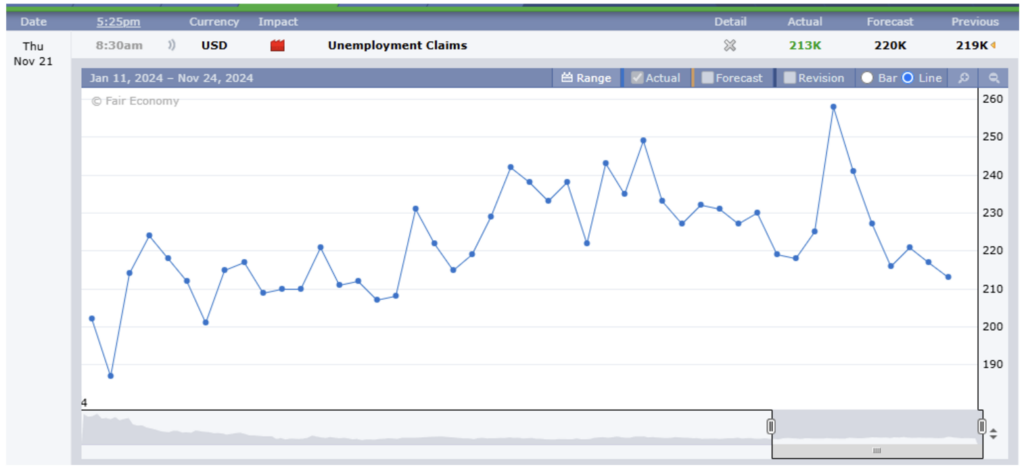

Labor market data sent mixed signals, with jobless claims dropping to a six-month low of 213,000 but continuing claims rising to a three-year high of 1.908 million.

Not all news was positive. Alphabet fell over 4% after antitrust regulators called for Google to divest its Chrome browser, citing unfair dominance.

You can see a significant drop using the daily chart:

But Alphabet found its footing after the initial news report. It eventually found a bottom and moved higher the rest of the day, but there is likely to be more volatility ahead.

On the cryptocurrency front, Bitcoin surged past $98,000, fueled by optimism that President-elect Trump might bring crypto-friendly policies. Reports suggest his team is considering a White House role dedicated to digital assets, signaling a potential shift in U.S. regulation.

Earnings season also remained in focus. With 90% of S&P 500 companies reporting, about 75% beat estimates, slightly below the three-year average. Quarterly earnings growth for the index averaged 8.5% year-over-year, well above early forecasts.

Looking ahead, market sentiment is mixed on the Fed’s next move. Current odds suggest a 56% chance of a 25-basis-point rate cut at the December meeting, but much will depend on how the data evolves in the coming weeks.

With the S&P 500 RSI indicator at 57 and a bounce off of a recent resistance level, it seems like the S&P 500 is happy to have more of the unknowns behind it, and looks like it wants to move higher. That would certainly coincide with the “Santa Clause Rally” we all look forward to towards the end of the year.

Of course, we can’t forget about the numerous geopolitical issues that could easily move the market lower, but I’m watching for the market to hold $5900 and see if it can move past $6000 with some conviction. We will see what happens next week when the pros go on vacation and leave the algos and junior workers in charge.

Until then, have a great weekend! Life is precious. Trading will always be waiting for us on Monday.