Stocks rallied last week with the major indices each gaining more than 1% despite the market being closed on Thursday for Thanksgiving and open for only a half day on Friday. This closed out a strong month in which the S&P 500 rose 5.7% following October’s choppy trading.

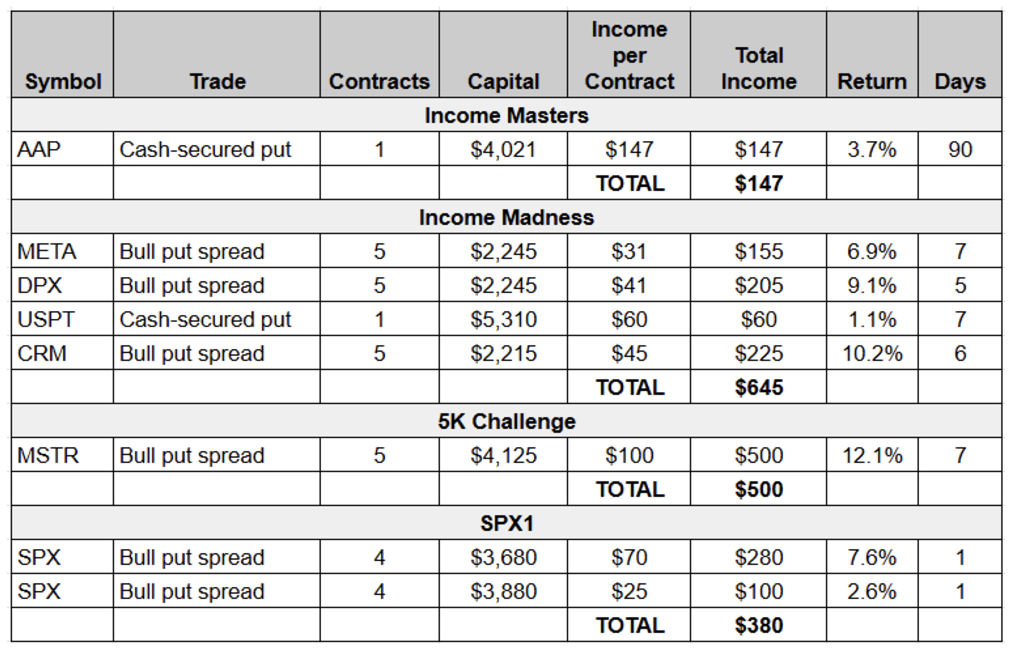

Even with the holiday-shortened week, we closed eight trades and booked $1,672 in profits across our services. Here are all the closed trades from the week of Nov. 25-29:

With this week’s four Income Madness closeouts, we’ve now exited nine of the 17 trades we put on during our four back-to-back live trading sessions. To date, we’ve pocketed $1,442 in income for the November round of Income Madness, averaging a 6.6% return per trade with an average holding time of 3.7 days.

This is exactly the kind of fast-paced results we are targeting with Income Madness. And we have several more trades that are close to hitting their target exit prices.

But the trade we want to look at more closely this week is the Advanced Auto Parts (AAP) cash-secured put. This Income Masters trade was not the most impressive from a cash nor rate-of-return perspective. However, it is a great example of how rolling can help you avoid losses when a trade goes against you.

We entered the original position in late August, following a post-earnings sell-off. Prior to putting on that trade, we had closed eight winning cash-secured put trades on the auto parts retailer in the first eight months of the year.

As you can see in the chart below, the stock gapped down after the company reported second-quarter results that included a weak start to the quarter and a lower full-year outlook.

For put sellers, negative overreactions to earnings announcements can create opportunity. Believing shares were finding a bottom around the $48 level, we sold an AAP 20 Sep 44 Put for $0.48, or $48 per contract.

But AAP continued lower. With expiration approaching and our put nearly $3 in the money, we rolled out two weeks and strike to strike, picking up $0.46 in credit and buying ourselves some time for shares to recover.

The stock kept falling, though, and with AAP trading at $38 on Oct. 1, we rolled again. This time we went out to the AAP 25 Oct 44 Put, collecting $0.43 and bringing our net credit to $1.37.

For our next roll, we pushed the trade out to Nov. 15. This time we picked up $1 despite lowering our strike to $43 because the put’s expiration happened to fall one day after the company was scheduled to report third-quarter earnings, meaning premiums were elevated.

The stock eventually bottomed out in late October, hitting a 52-week low of $35.59 on the final day of the month. Yet, even though shares had rebounded some by early November, we were still facing assignment on our AAP 15 Nov 43 Put.

When trying to determine whether to stick with a recovery trade or cut your losses, it’s important to consider your original thesis for entering a position to see if it still holds up.

At the time, we noted there were two sides to the auto parts store stock story. Inflation had led to consumers holding on to their used cars longer with the need to replace parts on a regular basis. But high interest rates had slowed spending on more discretionary items for cars, which was an important revenue source for AAP.

Higher-price competitors like O’Reilly Automotive (ORLY)and AutoZone (AZO) remained ahead of Advanced Auto Parts in terms of market share, and AAP’s stock price was reflecting that.

However, AAP had recently sold its subsidiary Worldpac to Carlyle Group (CG), netting $1.2 billion in cash. We assumed this would bolster the company’s financial picture in the short term and that Q3 earnings would give us a better idea of the full-year financial picture.

So, we decided to roll our put out to December to get past the earnings noise, going out to the AAP 6 Dec 43 Put and picking up another $0.42 in credit. With $2.79 in credit built up from our initial trade plus the rolls, we were hoping for a bounce in shares that would allow us to exit the position with a small loss.

When the company announced earnings on Nov. 14, it reported a loss of $0.04 per share. Not only was this a surprise to analysts who were expecting a profit of $0.44, but revenue also came in below expectations.

However, shares traded higher after an initial sell-off, perhaps bolstered by management’s plan to consolidate distribution centers by opening market hub locations and optimizing transportation routes. They also said they expect to improve their adjusted operating income margin over the next three years

By Nov. 25, with shares trading more than 20% above their recent low, we issued an alert to buy back the existing put position for $1.32, meaning we booked a profit of $1.47, or $147 per contract. This was a solid profit on a trade that would have been a big loser had we exited a few weeks prior.

The AAP trade was a reminder of the power of rolling to avoid losses provided your reason for entering a position still holds water. Rolling is a great way to buy yourself time and potentially bring in more credit while you wait.

We are likely to wait to see more strength in AAP before considering another position in the stock. But, for now, we’ll take the win.