Happy New Year and welcome to your first Weekly Income Report of 2025.

We closed 15 trades last week, 13 winners and two losers, across all our services, booking nearly $5,150 in cash in the live account despite the holiday-shortened week.

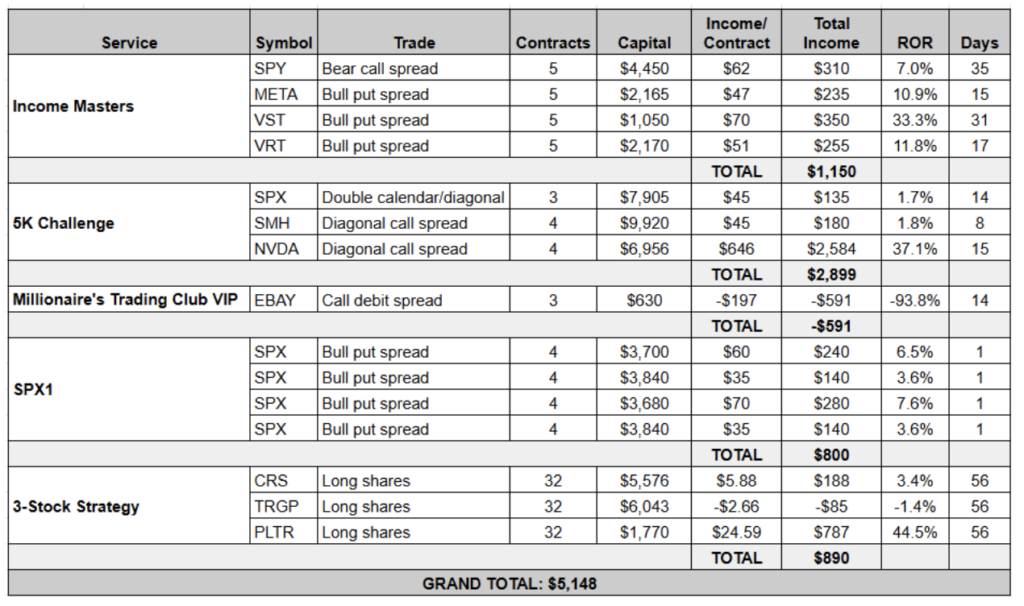

Here are all the closed trades from the week of Dec. 30-Jan. 3:

For the first time since we began bringing you the Weekly Income Report, we have results to report from our 3-Stock Strategy portfolio. Software company Palantir Technologies (PLTR) was the clear leader of the three with a nearly 45% return in less than two months.

Last week’s closeouts also included four Income Masters credit spreads that we exited on Thursday and Friday. So, in the first two trading days of 2025, members pocketed $1,150. That’s a great start to the new year!

We also doubled up on our SPX1 traders after skipping the week of Christmas, entering trades on both Monday and Thursday. The first pair of trades took until the final hour of trading on Tuesday to close due to the light volume heading into New Year’s Day. The second pair, however, closed within the first 40 minutes of trading. Between the four trades, we netted $800 in the live account.

But the clear standout from last week was the Nvidia (NVDA) diagonal call spread from the 5K Challenge program. It earned us $2,584, which was more than the other 10 winning option trades combined. So, let’s take a closer look at it.

NVDA was the most actively traded stock in the S&P 500 in 2024. Shares advanced more than 170% for the year, as traders clamored to take advantage of the AI-driven tech boom. This followed an incredible 240% increase in 2023.

The AI chip behemoth benefitted as major tech companies invested heavily in AI datacenters and cloud computing infrastructure. A 10-for-1 stock split in June also made the stock more accessible to a wider range of investors by lowering the share price.

Also of note was the fact that Nvidia replaced former chip darling Intel (INTC) on the Dow Jones Industrial Average, further cementing Nvidia’s place as an AI leader.

At Traders Reserve, we trade Nvidia across multiple services using a variety of strategies including bull put spreads in Income Masters, straddles in Income Madness and the Millionaire’s Trading Club, and even cash-secured puts in Options Income Weekly following the stock split. But in the 5K Challenge program, we utilize an option strategy known as a diagonal call spread.

A diagonal call debit spread is an options strategy that combines elements of a vertical debit spread and a calendar spread. It’s generally considered a neutral-to-bullish strategy that aims to benefit from a stock price increasing, but with limited risk and defined potential profit.

A vertical debit spread involves buying a call option (long call) at a certain strike price (usually lower) and simultaneously selling another call option (short call) with a higher strike price but the same expiration date. This limits your maximum profit but also caps your potential loss to the debit paid upfront (difference in price between the options).

A calendar spread involves buying a call option (long call) with a later expiration date and selling another call option (short call) with an earlier expiration date, both at the same strike price. This takes advantage of the fact that options with later expirations generally cost more than those with closer expirations (time value).

With a diagonal call debit spread, you buy a long call option with a lower strike price and a later expiration date and sell a short call option with a higher strike price but an earlier expiration date. The strategy can yield profits whether the stock stays flat or increases over time.

If the stock price rises by the expiration of the short call, you can exercise your long call at a lower strike price and immediately sell it at the higher market price, locking in a profit.

You can also profit from time decay on the short call. As the short call nears expiration (assuming the stock price stays below the higher strike price), its time value will erode, benefiting the option seller.

However, we rarely let these trades go to expiration, as moves higher in the underlying often present opportunities to cash out early.

On Dec. 19, with the stock trading at $131.27, we bought a NVDA 21 Mar 118 call and sold a NVDA 3 Jan 138 call for a net debit of $19.89, trading four contracts in the live account.

By Jan. 2, NVDA had run up about 5% to $137.35. This allowed us to roll our short call out two weeks and up two strikes to the NVDA 17 Jan 140 call for a credit of $2.50, reducing our net debit to $17.39.

With Nvidia set to be one of the star players at this week’s Consumer Electronics Show, we expected the stock price to climb higher.

But we didn’t have to wait that long. As the close of the market approached on Friday, NVDA was nearing the $145 level and our position was sitting at a hefty profit.

Rather than risk a sell-the-news situation reducing our gain on the position this week, we issued an alert to exit the trade around $23.85, booking a profit of $6.46, or $646 per spread. And since we traded four contracts in the live account, our total profit was $2,584 for a 37% return in just over two weeks.

Now, we closed our previous Nvidia diagonal call spread in the 5K Challenge program at a big loss. But this win went a long way in making up that debit. And overall, we’re ahead on NVDA, trading this strategy seven times in the 5K Challenge program since mid-June.

Analysts generally expect Nvidia stock to continue its strong growth trajectory in 2025 given its leading position in the AI chip market. Price targets generally range from $200 to $225, with some even higher.

We plan to put on a new Nvidia trade in the 5K Challenge program this week or next week depending on how the stock trades around news coming out of the Consumer Electronics Show. And we’ll also look for opportunities to trade it with other strategies when attractive setups arise.