Welcome back to the Weekly Income Report. Markets are closed today in honor of Martin Luther King Jr. Day. This makes it our third holiday-shortened trading week of the new year. But we’re still bringing you a recap of last week’s results.

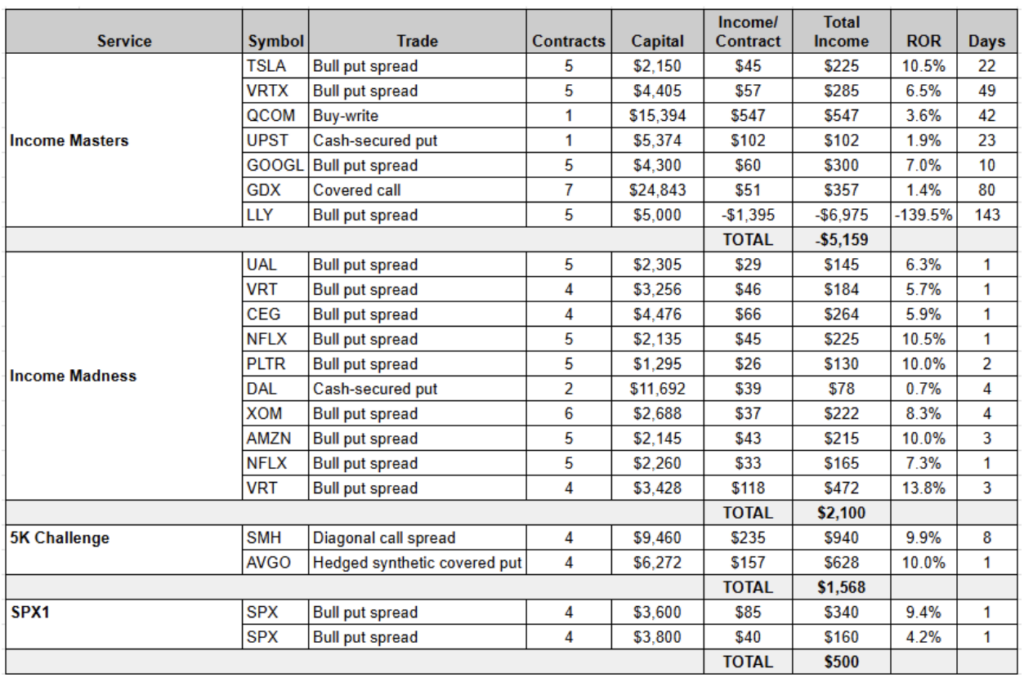

Here are all of the closed trades from the week of Jan. 13-17:

We typically choose one trade from the prior week to highlight in the Weekly Income Report.

Looking at the table above, you might think that the VanEck Semiconductor ETF (SMH) diagonal call spread would be the obvious candidate. It certainly was our highest-earning trade last week, with 5K Challenge members banking $940 on four contracts for a roughly 10% return in just eight days. (For those who are interested, we covered this powerful options strategy in the Jan. 6 Weekly Income Report, highlighting a Nvidia (NVDA) trade that delivered a nearly $2,600 profit in 15 days.)

Or we might choose to review the loser of the bunch — our Eli Lilly (LLY) Income Masters trade — to discuss the reasons we chose to book the loss rather than continue with the position.

Prior to this trade, LLY was one of the most frequently traded stocks in the Income Masters program. Between mid-2023 and mid-2024, we traded the stock successfully 21 times in a row using bull put spreads as we cashed in on the weight-loss drug craze.

As you can see in the chart below, Eli Lilly shares roughly doubled in a year buoyed by the promise of the company’s GLP-1 drugs, which are used to treat type 2 diabetes and obesity.

We closed winner after winner, even navigating the swift downdraft this summer to earn our biggest profit from the stock yet. All told, we made nearly $6,000 trading LLY.

Yet, try as we might, we were unable to salvage our most recent trade. A combination of disappointing third-quarter earnings, reduced guidance, valuation concerns and regulatory uncertainty has stopped any attempt at a rally in its tracks.

None of those issues appear to be ones that will be resolved quickly. So, rather than continue to chase LLY lower, we made the difficult decision to move on from the trade. This loss hurt, as all losses do, but perhaps more so because it wiped out all our previous gains in LLY. But that is not a reason to continue on with a position. In trading, you sometimes have to take your lumps, and that’s what we’re doing with this trade.

But the trade, or group of trades rather, that we want to look at a bit closer this week are our Income Madness closeouts.

For those who are new to Traders Reserve, Income Madness is our most popular live trading event. We host four to six days of live trading with a goal of making 15 to 20 short-term trades and generating $1,000 to $3,000 in cash.

As you may have guessed, this is a fast-paced event, and it requires a solid understanding of options selling basics. For this reason, Income Madness is exclusive to Income Masters members, who get to attend multiple rounds of Income Madness each year as part of their membership.

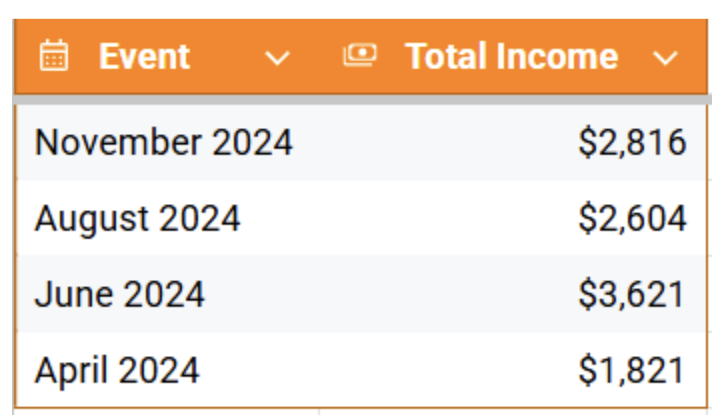

Here’s a look at the income we earned from the past four events:

We kicked off our first round of Income Madness of 2025 on Jan. 13, holding four back-to-back live trading sessions.

Prior to placing our first trade, we held a quick preview session. We discussed the current market environment and what traders should expect in the days ahead, setting a target of earning $1,750 in cash on about $35,000 to $45,000 of capital.

We also outlined some of the strategies and tactics we’d be employing to help us reach that goal:

- Bull put and bear call spreads

- Pre-earnings expirations to increase premiums

- DTEs (days to expiration) of four to 24 days

- Close trades at two to 12 days

- Work delta closer ATM (at the money)

- 1- and 2-DTE trades possible

Over the course of four days of live trading, we put on 14 positions. Of those, 13 were bull put spreads and one was a cash-secured put. There were a number of reasons for the heavy skew toward bull put spreads:

- The strategy is suitable for a neutral to slightly bullish outlook on the market/underlying stock.

- They are defined-risk trades, meaning the maximum potential loss is known upfront.

- They require much less capital than cash-secured puts, allowing us to trade higher-priced stocks.

- The lower capital requirement also allows us to sell more contracts, boosting our income, and generate higher rates of return.

As we said, we put on 14 trades. Yet, our maximum capital in play at one time was just $35,300, at the lower end of our target capital range.

In addition to using credit spreads, we kept our capital commitment low through our quick turnover of trades.

Before we even got to Thursday’s live trading session, we had closed out five positions. From those winners, we earned $948 in income, meaning we made it halfway to our $1,750 cash goal before we even put on our final trades.

By Friday’s close, we had blown past our goal, closing 10 trades and booking $2,100 in cash.

Part of this success was due to tighter target exit prices, as we targeted 50% to 70% of max profit. This allowed us to reduce our risk as we sold closer-to-the-money options, requiring a smaller bullish move in the underlying to trigger our good ‘til canceled (GTC) orders to exit the positions.

We also capitalized on earnings season to generate higher premiums. Our two Netflix (NFLX) trades are a great example of this.

The streaming giant is scheduled to report earnings tomorrow. Given this, we were seeing elevated premiums in the Jan. 17 expiration, which we traded on Jan. 15 and again on Jan. 16, meaning they were 2-DTE and 1-DTE trades, respectively.

We noted at the time of entry that these were higher risk trades than our other Income Madness positions and could require some active management should NFLX trade lower heading into expiration. And we mentioned that there was no harm in passing on the trades for those who were uncomfortable with that.

But NFLX traded higher into the end of the week, and both of our bull put spreads hit their target exit prices less than 24 hours after we put them on.

We earned a combined $390 on the two trades, helping push us over the $2,000 mark in just four days. Four trades remain open as we head into the holiday-shortened week. We’ll update you again here on our results once the final trade has closed.

As we mentioned above, Income Madness is exclusive to Income Masters members. However, we are also running a special one-time Income Madness event for Investor’s Blueprint Live attendees in February.

This trading event will run Feb.19-25, featuring five days of live trading. The first three days will be held via webinar only, while the last two days will take place in person (or virtually) at Investor’s Blueprint Live in Boca Raton, Florida.

During these five days of live trading, we’ll be targeting short-term profits with an eye on exiting as many trades as we can in the days after the event. If you’re interested in joining us but have yet to secure your spot for Investor’s Blueprint Live 2025, you can do so here.