Since the market was closed on Monday for the Memorial Day holiday, we’re bringing you the Weekly Income Report today.

We closed 10 trades across our services last week, nine of which were winners, netting nearly $1,300 in cash in the live account.

Here are all the closed trades from the week of May 19-23:

These included our first two closeouts from the latest round of Income Madness. During four days of back-to-back live trading, we put on 13 trades. We booked profits on two of them last week, earning $410 in cash.

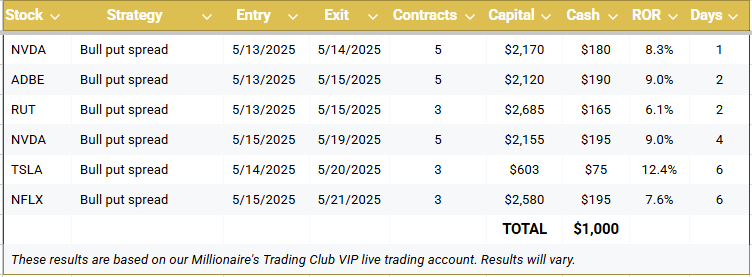

We continued to close out positions from our Millionaire’s Trading Club three-day virtual event. Of the 14 trades we put on, we had exited six by the end of last week, generating a combined $1,000 in the live account. This put us 40% of the way to our $2,500 income goal.

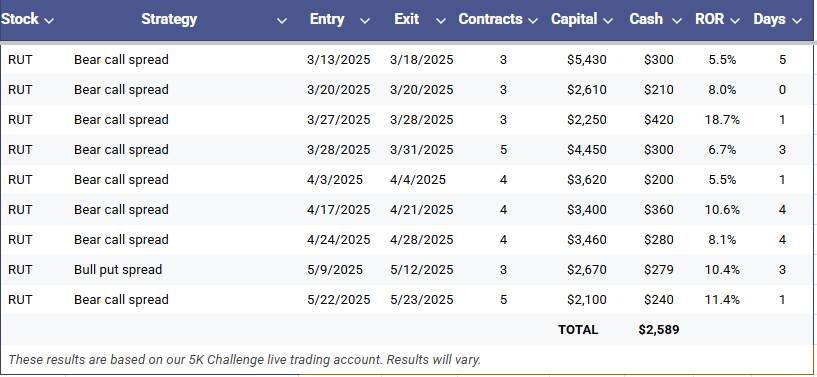

As the market pulled back on Friday on President Donald Trump’s threat of 50% tariffs on EU imports starting next month, our Russell 2000 (RUT) bear call spread from the 5K Challenge program hit its target exit price in less than 24 hours.

This was our ninth winning RUT bear call spread in a row in that service. Since mid-March, we’ve generated nearly $2,600 in income in the live account and averaged a 9.5% return on our capital with an average holding time of just 2.4 days.

We’ve been employing bear call spreads as an alternative hedging strategy this year. In addition to RUT, we’ve found a lot of success with SPDR S&P 500 ETF Trust (SPY) bear call spreads in the Income Masters program, closing seven profitable trades so far this year and banking more than $5,000 in profits in the live account. While our latest SPY hedge is being challenged by the market’s rebound off the April lows, we have managed previous trades that have gone against us to profitability.

While the SPY trades function as a hedging strategy that eliminates the need to perfectly time the market, the Russell 2000 trades might be better described as neutral-to-slightly-bearish positions. We’ve traded RUT on the call and the put side this year. In fact, in the previous Weekly Income Report, we had a RUT bull put spread from the Millionaire’s Trading Club virtual event that we closed out in just three days.

As most of you know, The Russell 2000 index measures the performance of the small-cap segment of the U.S. equity market, making it a crucial indicator for the health and performance of smaller businesses in the U.S. economy.

In general, small-cap stocks, like those in the Russell 2000, tend to be more susceptible to trade war headlines for a number of reasons:

- Less diversified revenue streams: Small-cap companies, by their nature, tend to generate a much larger percentage of their revenue from the domestic U.S. market compared to large-cap multinational corporations. Large companies often have sprawling global operations, manufacturing facilities and sales networks that can help them pivot or absorb shocks in one region.

- Greater sensitivity to U.S. economic conditions: When tariffs or trade disputes impact the U.S. economy (e.g., by increasing the cost of imported goods, dampening consumer spending due to uncertainty or disrupting domestic supply chains that rely on imports), small businesses with their high domestic focus feel the effects more directly and acutely.

- Less negotiating power: Small businesses typically lack the negotiating leverage of large corporations. They may have less power to demand better terms from suppliers facing tariff-induced price hikes or to quickly find alternative suppliers if existing supply chains are disrupted.

- Thinner margins: Many small businesses operate on tighter profit margins. Even a small increase in input costs due to tariffs can significantly erode their profitability, forcing them to absorb costs or raise prices, which could lead to reduced sales. Large corporations often have the financial cushions to absorb these shocks or strategically pass them on.

- Less diverse supply chains: Small businesses often have less diversified supply chains and may rely on a few key imported components or materials. If tariffs are imposed on these specific items, it can cripple their production or significantly raise their costs. Large companies usually have more robust and diversified supply networks.

- Limited access to capital: In times of economic uncertainty caused by trade wars, smaller companies might find it more difficult to secure financing, which can constrain their growth or even threaten their survival.

In short, small-cap companies are often seen as more economically sensitive than their large-cap counterparts. They are more vulnerable to shifts in domestic consumer sentiment, spending patterns and overall economic growth.

Trade wars introduce significant economic uncertainty, which can depress consumer and business confidence, impacting small businesses first and hardest.

During periods of heightened trade tensions, investors often seek “safe haven” assets or larger, more established companies perceived as having the resources to weather economic storms. This can lead to a “flight to quality” away from more volatile small-cap stocks.

Finally, trade war headlines can create broad market volatility, and small-cap stocks, due to their inherent volatility, can see their swings exacerbated during such periods, even if their direct exposure is limited.

For its part, the Russell 2000 has experienced a significant downturn in 2025, falling 8.3% and notably underperforming large caps. This weakness has been broad-based across most sectors within the index.

However, the elevated volatility is something we as options sellers have been able to capitalize on in recent months – both on the bearish side and occasionally on the bullish side.

Furthermore, like the other major indices, the Russell 2000 offers daily expirations, presenting opportunities for short-duration trades.

For our latest 5K Challenge RUT trade, we entered the position during Thursday’s live trading session. We went out to the May 27 options, which was five days to expiration (DTE). But with the weekend and the Memorial Day holiday, the options only had two trading days before expiration.

We put on the trade around 11:30 a.m. Eastern, with the small-cap index trading at 2,040.45. Specifically, we sold the RUT 27 May 2085 call and bought the RUT 27 May 2090 call for a net credit of $0.80. We traded five contracts in the live account, generating $400 in cash up front.

We set our target exit price at 50% of max profit, placing a good ‘til canceled (GTC) order at $0.40. Futures were down on Friday morning with traders concerned about escalating trade tensions between the U.S. and Europe, and our GTC was filled below the price we set, allowing us to exit the trade at the open for $0.30.

We booked a profit of $48 per contract, and $240 on five contracts, in a mere 22 hours.

We will continue to keep an eye on the Russell 2000 in the weeks and months ahead, both as a canary in the coal mine for the economy and broader market and as a trading vehicle capable of delivering short-term opportunities for income generation.