The 2023 rally continued in the first quarter of 2024 as a positive combination of stable economic growth, falling inflation, impending Fed rate cuts and ever-growing enthusiasm towards artificial intelligence (AI) propelled stocks higher, as the S&P 500 rose above 5,000 for the first time and hit new all-time highs.

The year began with a modest uptick in volatility, as traders and investors initially booked profits following the strong 2023 gains.

However, those initially small declines intensified shortly after the start of the year when the December Consumer Price Index, an important inflation indicator, declined less than expected. That reading challenged the idea that inflation was quickly falling towards the Fed’s 2.0% target and caused investors to delay the expected date of the first Fed rate cut, as expectations for that first cut moved from March to June.

Fears of potentially higher-than-expected rates pushed stocks temporarily into negative territory early in January. However, the declines didn’t last.

First, fourth-quarter corporate earnings were again better than feared and that helped stocks recover from those early declines. Then, in late January, the Federal Reserve clearly signaled that rate hikes were over and strongly hinted that rate cuts would occur in the coming months.

Investors seized on that positive message and the S&P 500 hit a new all-time high late in the month and finished with a modest gain, up 1.59%.

The rally continued and accelerated in February as fears of a potential rebound in inflation subsided. Inflation metrics released in February largely met expectations and importantly did not imply that inflation was reaccelerating.

As such, investor expectations for a June rate cut were strengthened and that helped stocks extend the year-to-date gains.

Then, on February 21st, Nvidia, the semiconductor company at the heart of the AI boom, posted much-stronger-than-expected earnings and guidance.

Those results further fueled investors’ AI enthusiasm and large-cap tech stocks powered the S&P 500 higher into month-end as the index hit a new record high above 5,000. The benchmark domestic index gained 5.34% in February.

The final month of the quarter saw even more gains, aided by familiar factors such as solid economic growth, generally as-expected inflation data, AI enthusiasm and bullish Fed guidance. Broadly speaking, economic and inflation data largely met expectations in March and continued to point towards stable growth and (slowly) falling inflation.

Then, in mid-March, updated Federal Reserve interest rate projections still pointed towards three rate cuts in 2024, further reinforcing investor expectations for a June rate cut.

Those positive factors combined with additional strong AI-related earnings reports (this time from Micron) to push markets broadly higher as the S&P 500 crossed 5,200 for the first time late in the month and ended March with strong gains.

In sum, the 2023 rally continued and accelerated in the first quarter of 2024 thanks to positive news flow that implied stable growth (no recession), still falling inflation, looming Fed rate cuts and continued AI enthusiasm and those factors propelled the S&P 500 to new all-time highs.

First Quarter Performance Review

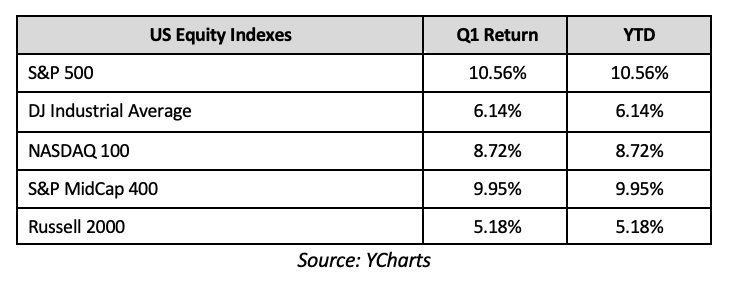

The first quarter of 2024 reflected a much more evenly distributed rally compared to the fourth quarter of 2023, where tech and tech-aligned sectors handily outperformed the rest of the markets. Over the past three months markets saw broad gains distributed more equitably amongst various sectors and industries.

However, while the rally in stocks did broaden out in the first quarter, that did not benefit small caps as they were some of the notable laggards over the past three months.

Small caps registered a positive return for the first quarter but lagged large caps as concerns about stubbornly high interest rates weighed on small caps, as they are more sensitive to higher funding costs and slowing growth.

From an investment style standpoint, growth once again outperformed value in the first quarter but the margin was much closer than last year, as both investment styles logged strong quarterly returns.

Continued heightened AI enthusiasm was the main reason for the modest growth outperformance over the past three months, as large-cap tech stocks again saw strong rallies in Q1.

On a sector level, as mentioned, gains were broad as 10 of the 11 S&P 500 sectors finished the first quarter with a positive return. Unlike 2023, however, tech and tech-aligned sectors didn’t substantially outperform. To that point, the best-performing sectors in the market in the first quarter were communication services, financials, energy and industrials.

That sector mix reflected the influences of AI enthusiasm, strong financial stock guidance, solid U.S. economic data and rising optimism towards a rebound in Chinese economic growth. The diversified gains demonstrated that the Q1 rally was driven by a more varied set of influences beyond just AI enthusiasm.

Turning to the laggards, the only S&P 500 sector to log a negative return for the first quarter was the real estate sector, as it continues to be weighed down by concerns about the health of the commercial real estate market. Specifically, terrible quarterly earnings from New York Community Bank reminded investors of the sustained weakness in the commercial real estate market and that weighed on the real estate space. Consumer discretionary also lagged and registered only a slightly positive return as numerous retailers warned about a potential slowing of consumer spending during the first quarter (this is something to monitor as we begin the second quarter).

Second Quarter Market Outlook

We see a flatter market in Q2 ‘24, depending upon the April earnings season across the next three months. For the S&P 500 to continue higher, it will require catalysts in growth, earnings, inflation, or data beating current expectations because all the good news is currently priced into the stock market at these levels.

Specific data we’ll be watching this month include:

- ISM Service and Manufacturing PMIs (Service >50, Manufacturing rising above 50)

- Unemployment (<4%-4.2%)

- 10-Year US Treasury Yields (<4.25%)

- Inflation (<2.9%)

We begin the second quarter during a positive macroeconomic environment as growth appears stable, inflation is still falling, the Fed is likely going to deliver the first rate cut in four years and AI enthusiasm keeps earnings estimates high.

But while this is undoubtedly a favorable set up, the strong rally of the last six months has left the S&P 500 at previously historically unsustainable valuations (PE Ratio >21x), while investor and analyst sentiment is very bullish and, potentially, too complacent.

So, while the outlook is currently positive, it’s essential we continue to monitor the macroeconomic horizon for risks because at current stretched valuations and with sentiment very bullish, the market is vulnerable to a negative surprise.

Specifically, while it’s true that economic growth has remained resilient in the face of higher rates, some data is pointing to a loss of momentum. Retail sales missed expectations in January and February; home sales have been down until February, Business expenditures were lower through much of Q1 until rising in March; at the same time the unemployment rate jumped to the highest level since 2022 during the first quarter, continuing claims for unemployment reached 2019 levels, but job additions have remained consistent.

The scourge of Inflation, meanwhile, is still retreating but the pace of that decline has slowed meaningfully.

Core CPI, one of the Fed’s preferred measures of inflation, has barely declined over the past several months as it sat at 4.0% y/y in October and in February was just 3.8% y/y.

Meanwhile, other anecdotal indicators of inflation have hinted at a rebound in prices. If inflation bounces back that will reduce the number of Fed rate cuts in 2024 and that disappointment could pressure stocks and bonds.

To that point, markets fully expect – and have priced in – a June rate cut from the Fed and two additional rate cuts in 2024 and that assumption was central to the first-quarter rally.

However, those rates cuts are not guaranteed and if the Fed does not cut as aggressively as markets expect, that will result in disappointment and a potential decline in stocks and bonds.

Finally, investor enthusiasm towards the potential for artificial intelligence remains a critical part of the bull market and strong earnings from Nvidia in February furthered investors’ hopes that AI integration will lead to a profitability and earnings boom, not just for tech companies, but for the entire market.

AI integration has produced a lot of flashy headlines but not a lot of profit maximization for non-tech industries. If AI fails to broadly boost profits and demand declines, that will be a significant negative for this market in Q3-Q4 ’24.

This quarter will likely require patience – but we’ll navigate it with you.

Sincerely,

John Hutchinson and David Durham

Traders Reserve