The market is stuck in a holding pattern until the Fed announces its decision on an immediate rate cut and the plan for future cuts. Investors have been arguing over a 25 or 50-basis point cut and will finally get the answer around 2 pm EST. The broader market indexes traded above resistance levels intraday yesterday but retreated by the close. While waiting for the next catalyst likely to move the market, we will look at small caps to see how willing investors are to dip into the riskier investment pool. Are the small caps signaling the next market move?

There are a number of ways of looking at how the small caps are doing. Many use the Russell 2000 index as a barometer, so we will start there. Let’s look at a 4-hour chart dating back to December 2023 through yesterday’s close. The small caps have largely sat on the sidelines, trading in a range until the first breakout in July of 2024. That breakout was met with double-top resistance and the index has struggled to show conviction.

We have a series of lower highs, but we also have higher lows. The index is facing a lower trend line and is sitting near a shorter-term double-top resistance level. The index is coiling for a breakout in one direction or another, but it’s uncertain which way the IWM is going to move.

Let’s look at a lesser-known small-cap ETF to see if the broader market picture becomes more clear. The Invesco S&P Small Cap 600 Revenue ETF (RWJ), weights the companies based on their revenue, such that companies with higher revenue will have a larger weighting within the fund.

I’ve included a weekly chart of the ETF to show you that it has been in a trading range since early 2021 and only recently has it started to break out! Over the last few years, investors have been focused on the Mag-7 mega-cap stocks for exponential growth. As a result, small caps have been left behind.

So, why the breakout now?

When interest rates were high the fear of a recession was looming, investors went to the safety of mega-cap stocks like NVIDIA and APPLE to weather the storm. Small companies struggle with higher interest rates because they rely on loans for operating capital. The thought of the Fed cutting interest rates has renewed interest in small-caps, especially those that can show positive revenue growth.

How will investors react?

It depends on how you feel about the soft landing scenario. Some investors are screaming at the Fed to cut rates by a jumbo 50 basis points. They are the ones who insist inflation is under control, the economy needs a production injection, and the Fed is always too slow to react. These investors are likely going to be disappointed in a 25 basis point cut and may feel that it’s not enough to keep going with small caps.

On the other hand, we know the Fed is slow to react and they don’t often make rash decisions, so I believe they are likely to kick off with a 25 basis point cut. But if their messaging indicates future rate cuts faster we could see a rush of volume into small caps once again.

With a triple top in the RWJ, it’s hard to say which way the market will react, but a breakout from a triple top and a multi-year trading range would be pretty powerful and hard to ignore.

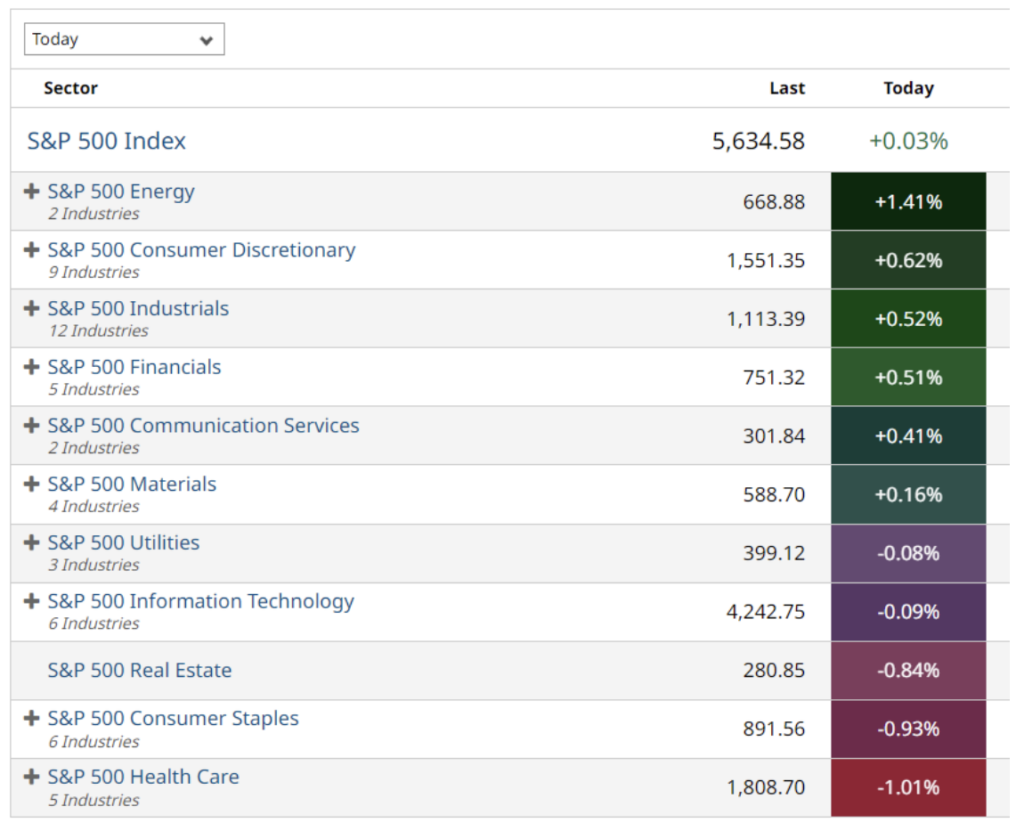

Interestingly enough, the S&P 500 sectors signaled indecision as well. Consumer Staples and Utilities are two sectors that are typically more defensive for investors and they finished in the lower half of the leaderboard. However, Information Technology also finished near the bottom. Consumer Discretionary had a bit of a bump from stronger than forecasted retail sales.

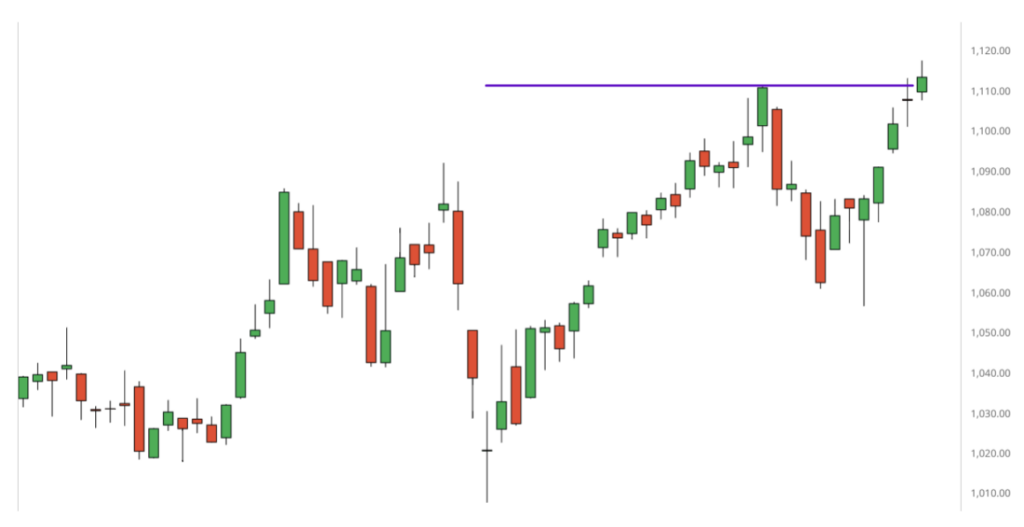

The Industrial sector is interesting right now because while so many others are struggling to break above previous highs, this sector is just edging above its last swing high.

Companies like United Rental (URI) are helping the sector with its breakout. URI broke through its double-top and looks like it wants to retest previous highs.

If you’re reading this and thinking to yourself that you don’t have an opinion and don’t know which way the market is likely to go, that’s ok too.

Unless you like trading straddles, an options strategy where you buy both a call and a put option for the same expiration date and the same strike price, it’s ok to sit on the sidelines and watch how investors react and then jump into the trend. Sure, you might be slightly late to the party, but trading while being worried about what happens next isn’t better.

Sometimes being casually late is arriving just at the right time.

Have a good rest of the trading week!