Data-center systems specialist Vertiv Holdings (VRT) has become one of our go-to income stocks in the Income Masters program, especially as an Income Madness trade. We’ve traded it successfully numerous times going back to mid-March, including some earnings plays that we closed in less than 24 hours.

When trading VRT, we often offer both a straight cash-secured put (CSP) trade as well as a bull put spread (BPS) option for those who want to reduce their capital requirement and boost their potential rate of return. Both strategies have worked well for us with this stock.

While we trade both positions in our live account, we do not recommend that members double up on a stock. Rather, we encourage them to choose the strategy that best suits their trading goals and capital limitations.

As we mentioned earlier, we often trade VRT during Income Madness week, which typically means a shorter-term focus where we look to turn over our capital quickly with new trades.

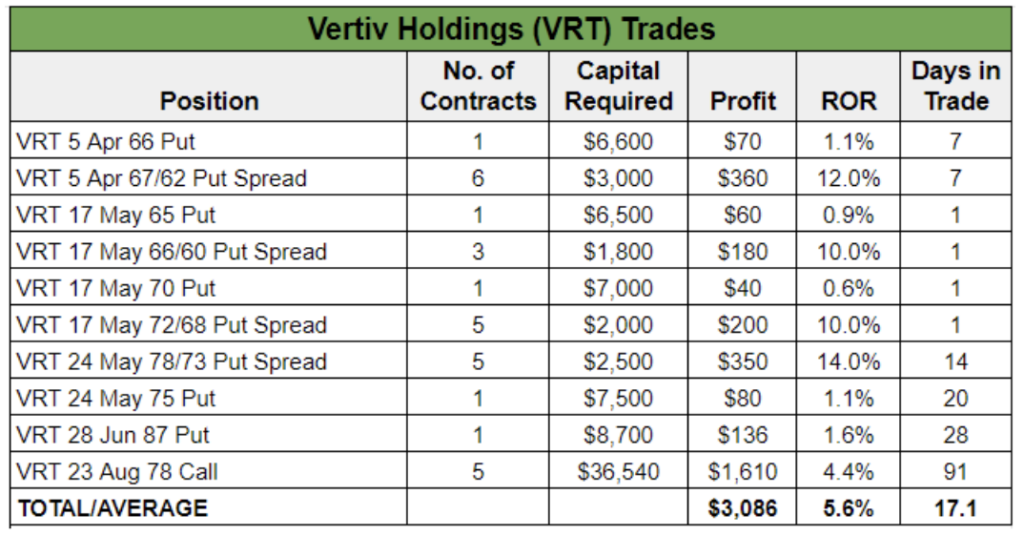

Looking at the table above, our most recent VRT closeout stands out for a number of reasons. For starters, it’s the largest profit by a long shot. It also required the most capital, and we were in the trade for nearly three months. It is also the only call trade of the bunch, but as you probably can guess, it didn’t start out that way. So, let’s start at the beginning.

Back in May, when VRT was trading around $99.50, we put on a new trade offering both a cash-secured put and bull put spread option.

Typically, when we take this approach, the two positions hit their target exit prices on the same day, although it can take longer for the spread position to fill given the multiple legs. Yet, that’s not what happened this time around with Vertiv.

The stock initially moved higher after we put on the trades, hitting a new all-time high of $109.27 on May 24. But then shares reversed, falling more than 20% over the next two weeks and putting our positions in the money (ITM).

A few days before the CSP and BPS were set to expire on June 14, we adjusted the positions, rolling them down and out to the June 28 expiration. A few days later, with shares stabilizing, we set good ‘til canceled (GTC) orders to exit both of the positions at a nice profit.

On June 18, VRT shot up more than 6% and the cash-secured put hit its target exit price. Those who took that route booked a profit of $136 per contract for a 1.6% return on the $8,700 in capital required in 28 days. However, the GTC order on the put spread never triggered so we told members in that position to hang tight.

And then came the summer tech sell-off that roiled the markets and left many of our positions underwater. VRT continued lower, and we rolled the spread twice more for a debit each time as we waited for a recovery in shares.

But with our VRT 9 Aug 88 Put well in the money, we were assigned 500 shares on the five contracts we sold in early August.

Thankfully, we were able to close the five long VRT 9 Aug 84 Puts we purchased as part of our spread for $14.40 apiece. This brought our cost basis on shares down to $74.23, even factoring in the debit we incurred from rolling. But this was still well above where shares were trading at the time around $69.50.

After being assigned in early August, we sold five VRT 23 Aug 78 Calls to generate more income and reduce our cost basis further to $73.08. Yet, with 500 shares, this meant we were tying up $36,540, which is a lot for a single position.

However, our patience paid off. Vertiv moved higher off its early August lows and by Aug. 20, our recovery position was sitting at a nice profit.

We sold our shares for $78.20 apiece and bought back the calls for $1.90 each, booking a profit of $322 per 100 shares, or $1,610 for 500 shares.

Even with the high capital requirement, this yielded a 4.4% return and was a far better outcome than closing the position a few weeks prior at a substantial loss would have been.

So, while we were thrown a bit of a curve ball with our bull put spread, we successfully managed the position back to a profit, once again proving the power of patience and active position management when selling options.

Now that we closed the recovery position, we were able to go back to Vertiv during our latest round of Income Madness, which took place last week. We entered another bull put spread and a cash-secured put. However, with the CSP, we also sold a call spread above it – a strategy known as a jade lizard that offers a way to boost income and take a bit of risk off the table.

VRT is up 4.3% since we entered those positions, so we’re likely to get an early closeout, especially if the market likes what Nvidia (NVDA) has to say when it announces earnings.