Welcome to the Breakfast Club, your weekly dose of market insights and trading strategies! Join us live every Monday and Wednesday at 8:30 AM ET on Traders Reserve Live, where our experts break down the latest market movements, share actionable trade ideas, and answer your most pressing questions.

Your Weekly Income Report: Patience Pays, Profits Prevail!

This past week, we saw some exciting developments across the market, alongside powerful lessons in long-term investing. The Millionaires Trading Club got off to a fantastic start, already closing several trades with nearly $1,500 in gains! This momentum highlights the power of a disciplined approach, even as broader market conditions present their own set of challenges.

Decoding the Market’s Signals

This week, the market presented a mixed picture, with the Dow and S&P seeing slight upticks while the Nasdaq experienced a pullback. The Russell, however, continued its upward trajectory.

These movements underscore the importance of individual stock analysis and the ability to differentiate between short-term noise and long-term potential.

We’re also keeping a close eye on the economic calendar. The Producer Price Index (PPI) came in flat, a positive sign, but the Consumer Price Index (CPI) ticked slightly higher year-over-year.

This creates a fascinating dynamic, especially with ongoing discussions around interest rates and tariffs. The administration’s push for lower rates and pharmaceutical/semiconductor tariffs will undoubtedly introduce volatility in the coming weeks, making selective stock picking and adaptable strategies even more crucial.

Unearthing Value in Patience and Performance

One of the most valuable lessons shared this week centered on patience in investing, particularly for options traders. Unlike stock investors who can hold positions indefinitely, options have an expiration date, creating a sense of urgency. However, as demonstrated by examples from a 2024 portfolio, patience can lead to significant turnarounds.

Consider Dexcom (DXCM), a stock in the insulin market that took a substantial hit over a year ago due to a sales force reorganization. By doubling down on the position when it was significantly down, the overall loss was substantially reduced.

Despite missing earnings in several quarters, the stock has patiently worked its way back, demonstrating that strategic additions during dips, coupled with patience, can bring a position close to break-even.

Another compelling example is Nextracker (NXT), a solar industry company, an industry currently out of favor. Yet, this stock has shown remarkable earnings consistency, beating estimates by significant percentages (33%, 77%, 60%). Nextracker, which provides sun-tracking devices for solar panels, is a “foundation stock” – it sells to anyone using solar panels, regardless of who makes them.

This resilient business model has allowed it to break out to new 52-week highs, proving that strong fundamentals can thrive even in challenging sectors.

Finally, Howmet Aerospace (HWM) in the defense industry continues to be a top performer, up a staggering 244% since a couple of years ago. With consistent positive earnings, a long-term uptrend, and reasonable forward earnings multiples, it remains a strong candidate for both investment and options trading.

These examples highlight the types of earnings-driven, fundamentally sound companies that Traders Reserve aims to identify.

Navigating Key Reports & Seizing Opportunities

Earnings season is in full swing, with major financial institutions like Bank of America, Morgan Stanley, and Goldman Sachs all beating earnings expectations. This positive news for financials suggests potential opportunities in this sector. Additionally, United Airlines is one to watch, especially after Delta’s strong performance, indicating that airfare prices, despite feeling high to consumers, are actually trending lower, benefiting airlines.

For those interested in identifying new trading ideas, a simple scan focusing on stocks with weekly options, a price over $1, and a 5-day percentage change over 5% can reveal interesting candidates. MP Materials (MP), a metal mining company, recently surged 86% in five days due to new deals with major tech players, showcasing the potential of such scans.

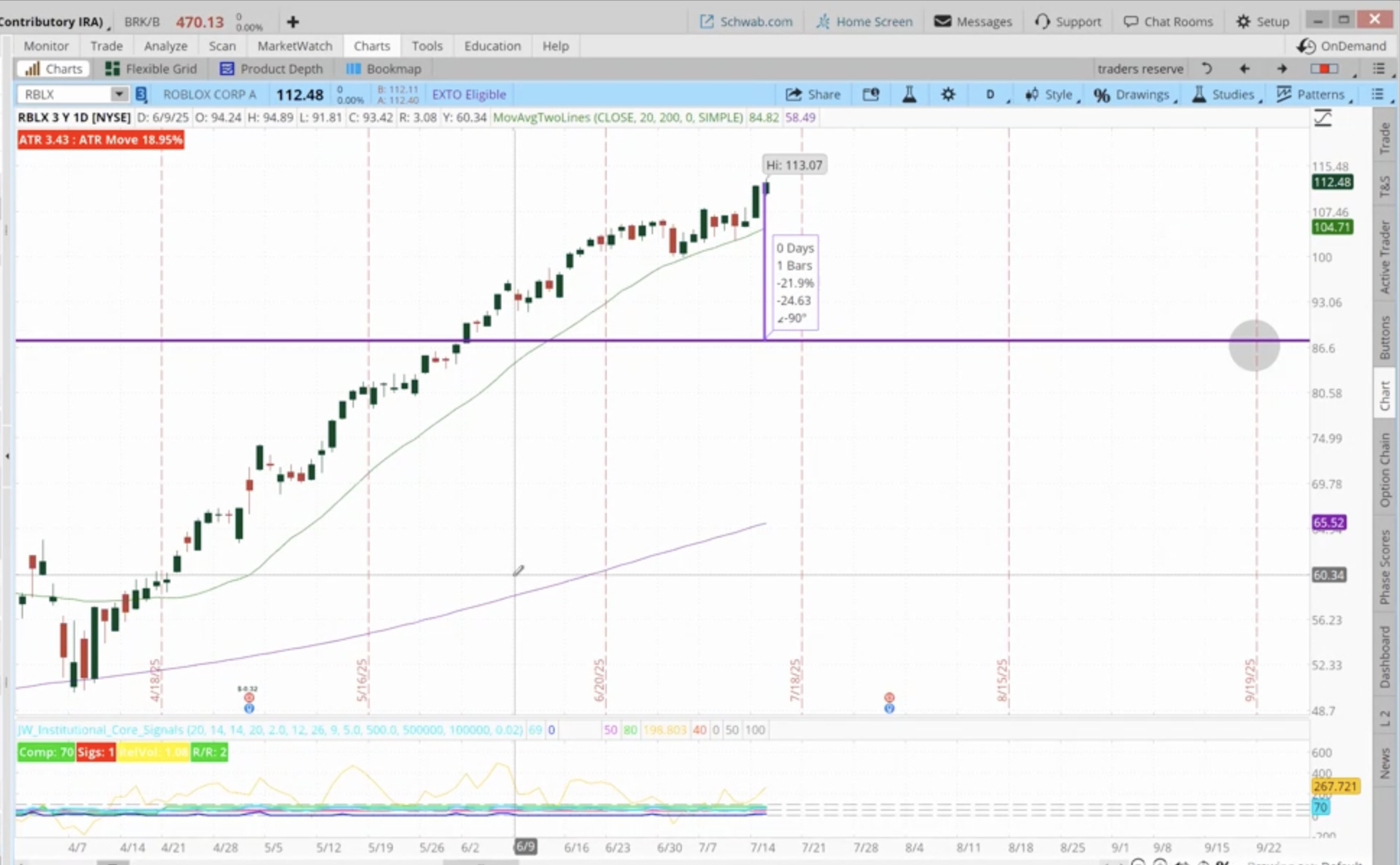

Jeff also shared an intriguing trade idea of the day involving Roblox (RBLX), a popular gaming platform. The idea focuses on selling a cash-secured put with a 60-90 day expiration, specifically the September 19th expiration at the $87.50 strike price.

This strategy, going for $2.25, offers a 22% discount to current prices, providing a buffer against potential drops. While it’s a longer-term trade, similar strategies have often closed out in just 15-20 calendar days, demonstrating rapid capital turnover.

This approach allows investors to potentially acquire a strong stock at a discount or profit from time decay if the stock remains above the strike price. Remember to set a profit target, typically 50-65% of the premium received.

Join Us for More Insights!

We invite you to continue your trading journey with us. Mark your calendars for next Monday, July 21st, at 4 PM ET for a special “Happy Hour” event. We’ll be revealing all the exciting details and changes for the upcoming Millionaires Trading Club Trading Conference in Las Vegas, October 21-23, at the Hyatt Place Silverton Village. You’ll be able to attend in person or virtually! Look out for an email with registration details over the weekend.

For our Millionaires Trading Club members, we’ll see you at 11 AM ET, and Income Masters members, at 12:30 PM ET.

We wish you a great trading day and look forward to seeing you in our next session!