Welcome to the Breakfast Club, your weekly dose of market insights and trading strategies! Join us live every Monday and Wednesday at 8:30 AM ET on Traders Reserve Live, where our experts break down the latest market movements, share actionable trade ideas, and answer your most pressing questions.

Weekly Market Recap & Income Report

Last week, our trading accounts took a big step forward. This isn’t about luck; it’s about a process that delivered a 10.3% return on capital while the rest of the market was on vacation. This week, we’re breaking down exactly what happened, and we’re giving you the blueprint for what’s coming next.

The Numbers Tell the Story

The market is quiet, but our results are anything but. Our trading club, Tres Reserve, closed a total of seven trades last week, bringing in a net income of $1,627 on just $15,828 in capital. That’s a whopping 10.3% return for the week.

Our Income Masters traders closed two longer-term trades for a net income of $301, generating an 11.4% return on capital.

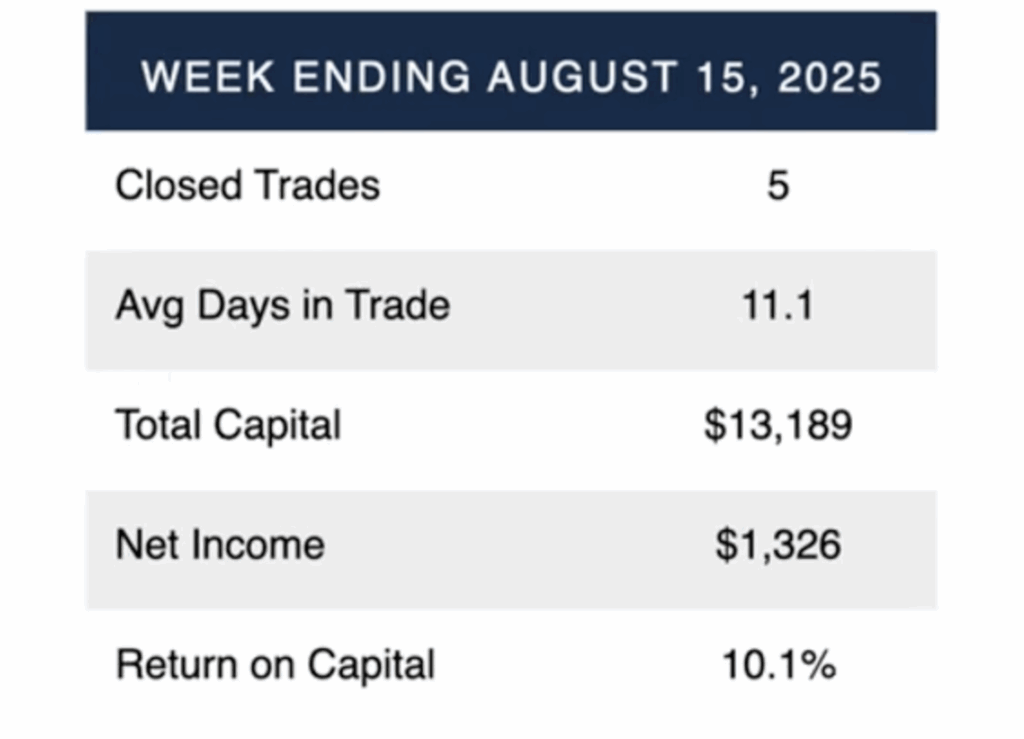

And our Millionaires Trading Club (MTC) had a massive run with the Russell 2000, which led to a flurry of 23 closed trades and contributed to MTC closing 5 total trades for a 10.1% return and a net income of $1,326.

This isn’t just about a good week; it’s about consistency. These numbers prove that our method works, even in a quiet, low-volatility market. We focus on successful trades and let the results speak for themselves.

Macro Outlook: The Calm Before the Storm?

While we were busy closing trades, the broader economy was sending mixed signals. The market largely ignored a significant rise in the Producer Price Index (PPI), but we’re not so fast to dismiss it. Here’s what you need to know:

- PPI vs. CPI: The PPI, which measures what producers pay, jumped 0.9% month-over-month, far exceeding expectations. The Consumer Price Index (CPI) rose, but within expectations. This creates a critical question: when will companies start passing their higher costs on to consumers? When they do, expect a hit to retail sales and, ultimately, to corporate earnings.

- Tariffs & Consumer Behavior: The rise in PPI is likely tied to tariffs. Companies are currently absorbing these costs, but it’s a game of chicken. We believe this will start to impact earnings in the next quarter. Consumer sentiment is already trending down, a leading indicator that people expect to pay more in the future. We’ll likely see consumer behavior change after the holiday season, which could be a major catalyst for a market slowdown.

- The Fed’s Next Move: This week, all eyes are on the FOMC meeting minutes and the Jackson Hole Symposium. While the market is pricing in a more dovish Fed, we think the meeting minutes could be a bigger catalyst for volatility than the symposium itself. Don’t forget the “2022 surprise” when Powell’s hawkish tone shocked the market. We’re expecting a quiet week, but we’re prepared for anything.

Our Top Trade Ideas

Forget the noise and focus on what’s actionable. We’re always scanning the market for high-potential setups. This week, we found two worth watching:

- A Potential Buy Signal: We’ve identified a stock, that hit our scan based on a strong moving average crossover. This setup, where the 10-day moving average crosses above the 30-day, and both are above the 200-day, is a powerful indicator of momentum. While we’re still watching it for a proper entry, the chart looks compelling.

- A Seasonal Power Play: We’ve found a seasonal trade with an incredible track record: Lululemon (LULU). Nine out of the last 10 years, LULU has found its footing in August and moved higher. The setup looks similar to last year. If you’re interested in a trade with a potential 100%+ return on capital, here’s the play:

- Strategy: Buy a September 12th $200 Call for a debit of $14.30.

- Offsetting Cost: Sell a $205 Call for a credit of $12.18.

- Net Debit: This brings your total net debit down to just $2.12.

- Max Profit: The maximum profit is $2.88, which represents a potential return of over 100% on your capital risked.

This is exactly how we approach the market: by identifying high-probability setups and executing with precision.

Don’t Just Read About It.

Action: You’ve seen the numbers and the analysis. Now it’s time to take action. If you’re tired of watching from the sidelines and want to start trading with an edge, we invite you to join our community. We provide the research, the analysis, and the trade ideas—you just need to execute.

Go here to join us and get started today.

We’ll be back Wednesday morning at 8:30 AM EST on “Breakfast Club Live” with more market insights. But don’t wait.

Don’t wait for permission to win. Join our trading community and get access to the tools, data, and strategies that are helping us win week after week. Join Traders Reserve today.