Welcome to the Breakfast Club, your weekly dose of market insights and trading strategies! Join us live every Monday and Wednesday at 8:30 AM ET on Traders Reserve Live, where our experts break down the latest market movements, share actionable trade ideas, and answer your most pressing questions.

Markets today feel like they’re living a double life. On one side, we see AI-driven excitement sending certain stocks soaring. On the other, persistent inflation, labor-market weakness, and tariff pressures are creating serious headwinds. At Traders Reserve, our job is to navigate both realities—and help you build a playbook that works whether the market decides to break higher or lower.

The Bright Side: AI Still Carrying the Torch

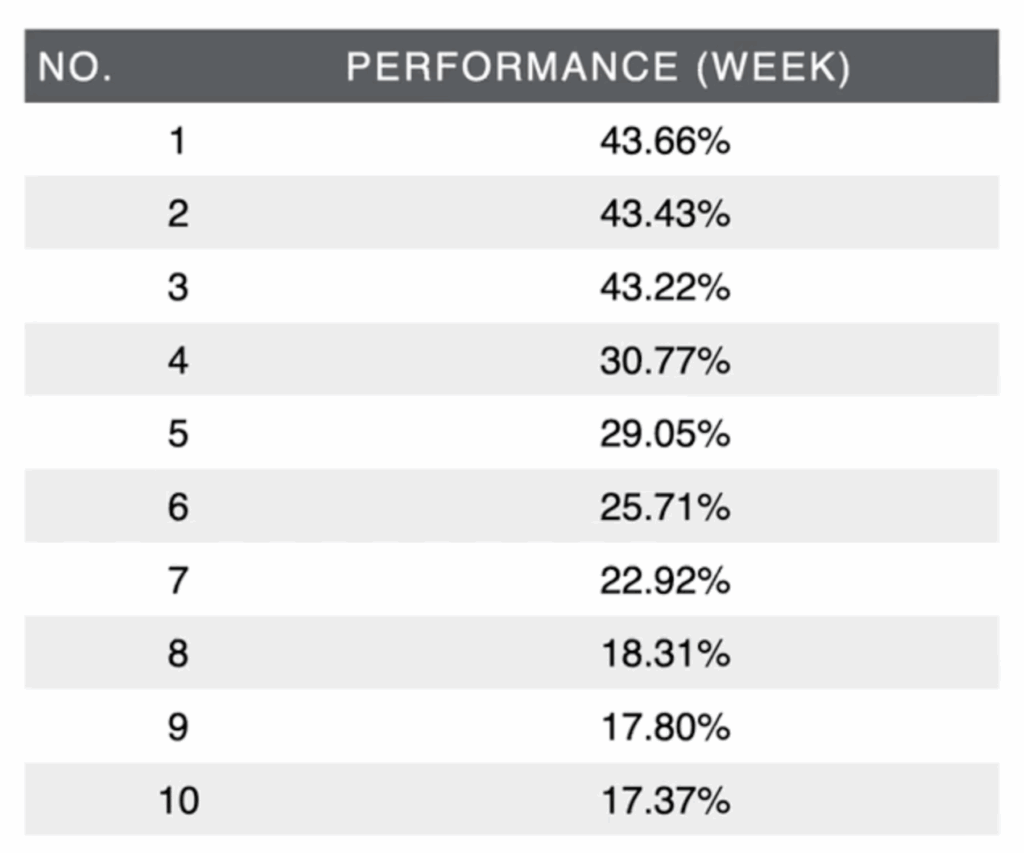

In the past week alone, some AI-linked names have delivered jaw-dropping gains of 17–40% in just days. That’s not just hype—it’s Wall Street putting real capital behind the AI revolution. But here’s the catch: if your portfolio is limited to megacaps like NVIDIA, Apple, or Alphabet, you may be late to the fastest-growth phase.

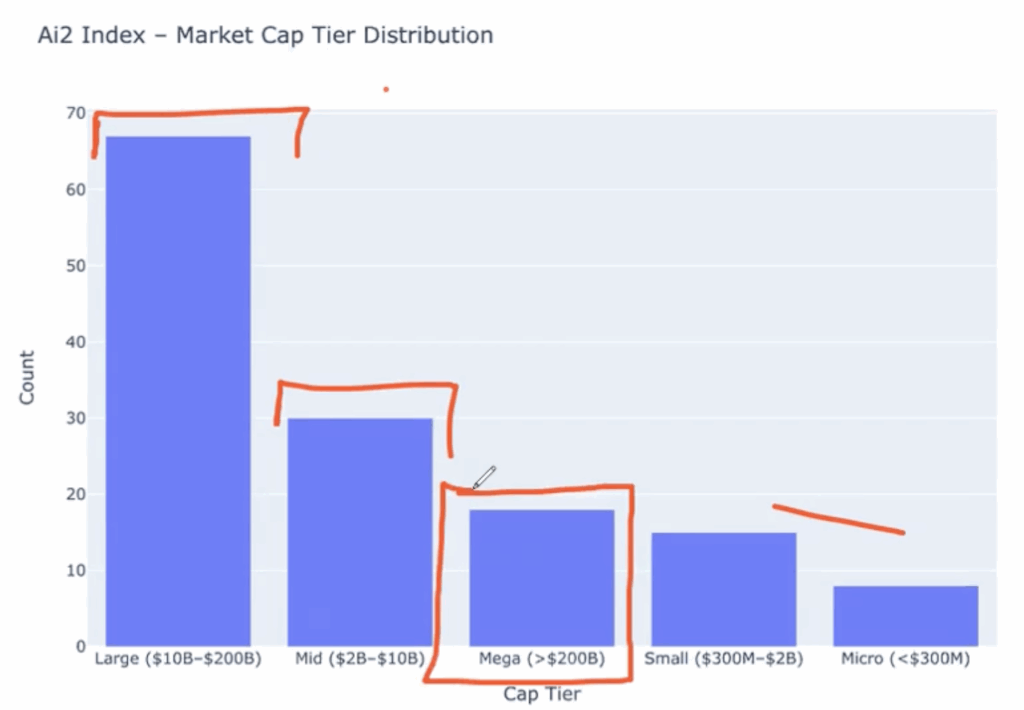

That’s why we’re building our AI² Index—a next-generation basket of companies positioned to benefit from the AI build-out across every market-cap tier, from mega to micro.

Early data shows the index is tech-heavy now, but we see the next wave in healthcare and defense. Think about AI reshaping how medical records are managed or how logistics flow through defense systems. These quiet revolutions could define the next decade of growth.

The Drag: Inflation, Labor, and Tariffs

While AI rallies, the macro backdrop isn’t giving us a free ride. Inflation remains sticky, and the Bureau of Labor Statistics just revised job creation lower—nearly a million fewer jobs than previously reported. That weakens the labor-market picture. If unemployment ticks above 4.5% and drifts toward 5%, equities face a serious headwind.

Add tariffs into the mix. Reciprocal tariffs went live in August, and we’ll only start to see their impact in Q4 earnings and beyond. Early anecdotal signs from small businesses suggest higher costs for wood, steel, and other essentials—and consumers beginning to spend more cautiously.

The 10-Year Yield: Our Macro Compass

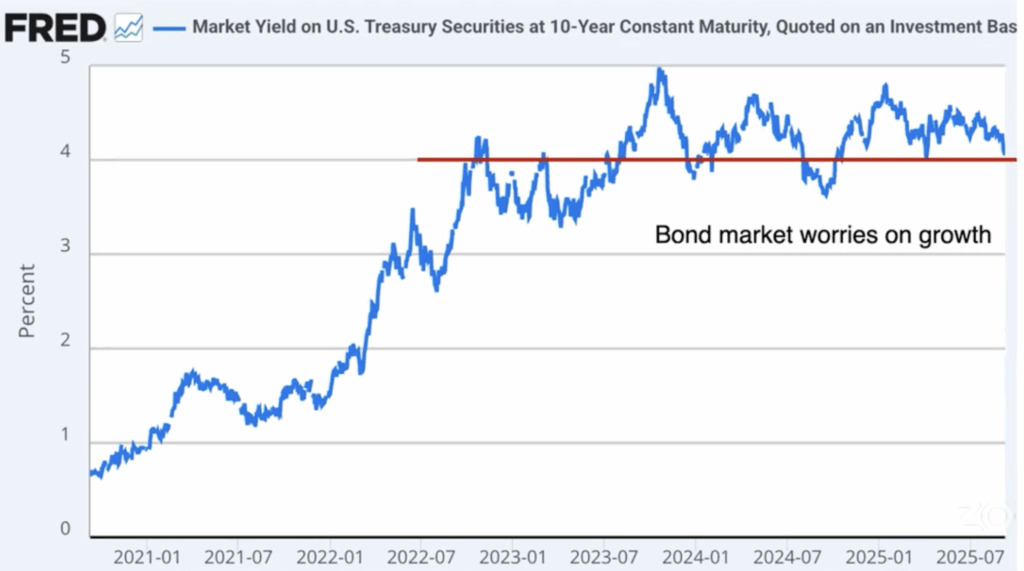

One of our favorite macro gauges is the 10-year Treasury yield. The 4% level has become a line in the sand. Sustained yields above 4% suggest bond markets are less worried about long-term growth. Yields trending below 4% signal anxiety about future economic strength.

We’ll explore more on bull vs. bear steepening next week, but for now, this simple threshold tells us plenty about where the bond market stands on growth.

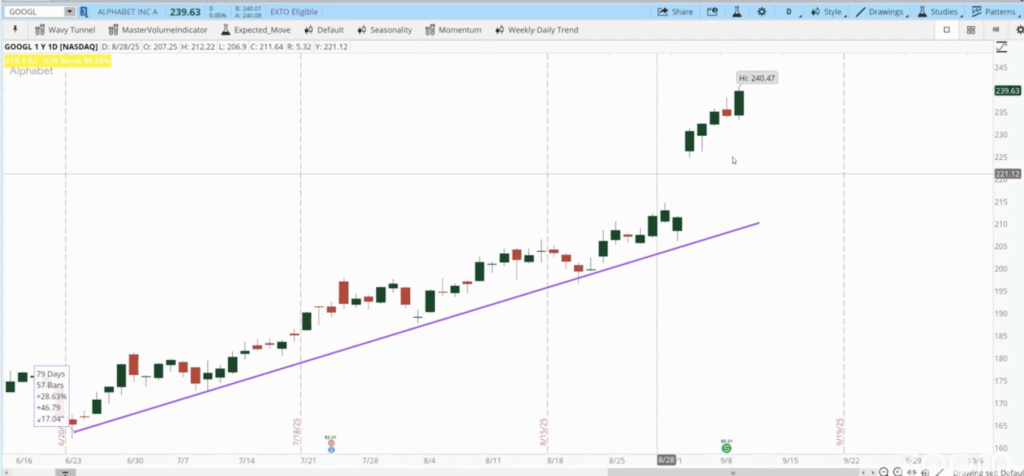

Trading Desk Case Study: Alphabet (GOOGL)

Alphabet has been on a tear, gapping higher last week. Naturally, we asked: is there a smart trade here? A laddered bull put spread starting near $225—the bottom of the gap—looked tempting. But the premiums didn’t justify the risk unless we crept uncomfortably close to the money.

Our conclusion? Discipline is a position. We passed on GOOGL rather than forcing a trade with poor odds.

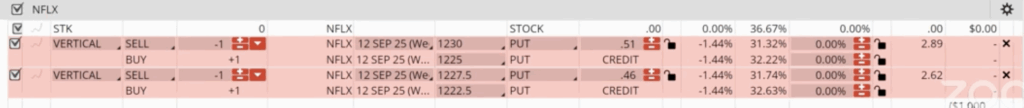

Trading Desk Case Study: Netflix (NFLX)

Netflix, by contrast, offered a cleaner setup. With support forming around $1,225, we built a two-leg laddered bull put structure centered near $1,225–$1,230 for this Friday’s expiration. The trade screened at roughly 9–10% potential return on risk over two days.

Scaling contracts and setting exit rules ($0.10 on the upper leg, $0.05 on the lower) turns this into a high-probability income play.

Lessons in Risk Management

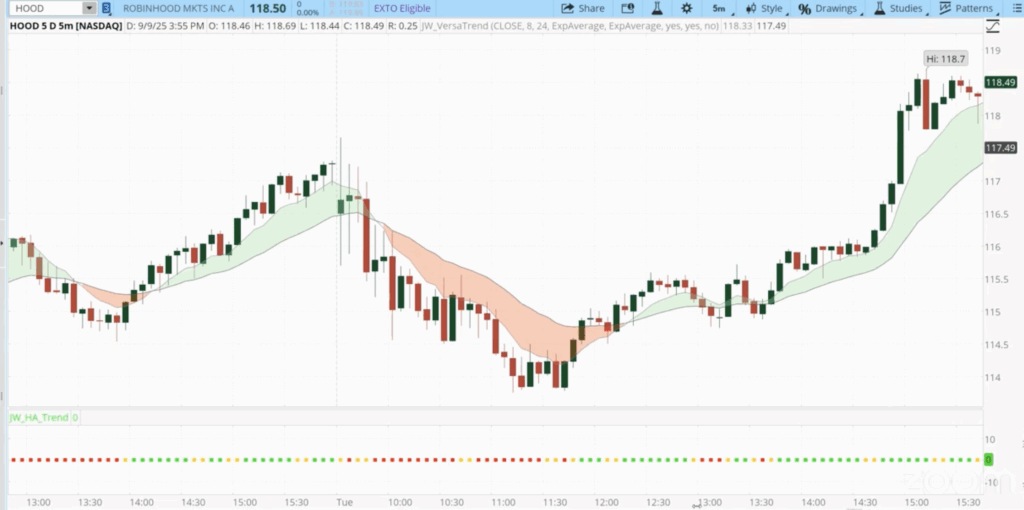

This week, we’re reducing exposure rather than betting on macro prints like CPI or consumer sentiment. If you missed entries like Robinhood earlier this week, chasing may not be the best move.

Markets full of tension eventually resolve—up or down. Our edge comes from readiness: tracking the right signals, targeting the right stocks, and sizing positions so surprises are survivable, not fatal.

We’ll be back Monday morning at 8:30 AM EST on “Breakfast Club Live” with more market insights. But don’t wait. Watch the full video now to see the strategy in action.

Ready to see how we apply this knowledge to our trades? Join our trading community and get access to the tools, data, and strategies that are helping us win week after week. Join Traders Reserve today.