In the latest Weekly Income Report, we reviewed the unprecedented week of closeouts we had, booking 23 winners across our services and netting nearly $6,300 in cash in the live account.

The standout trades from a pure profit perspective were the diagonal call debit spreads on SPDR S&P Biotech ETF (XBI) that we traded in the 5K Challenge program. This pair of trades accounted for more than 30% of the total cash we earned.

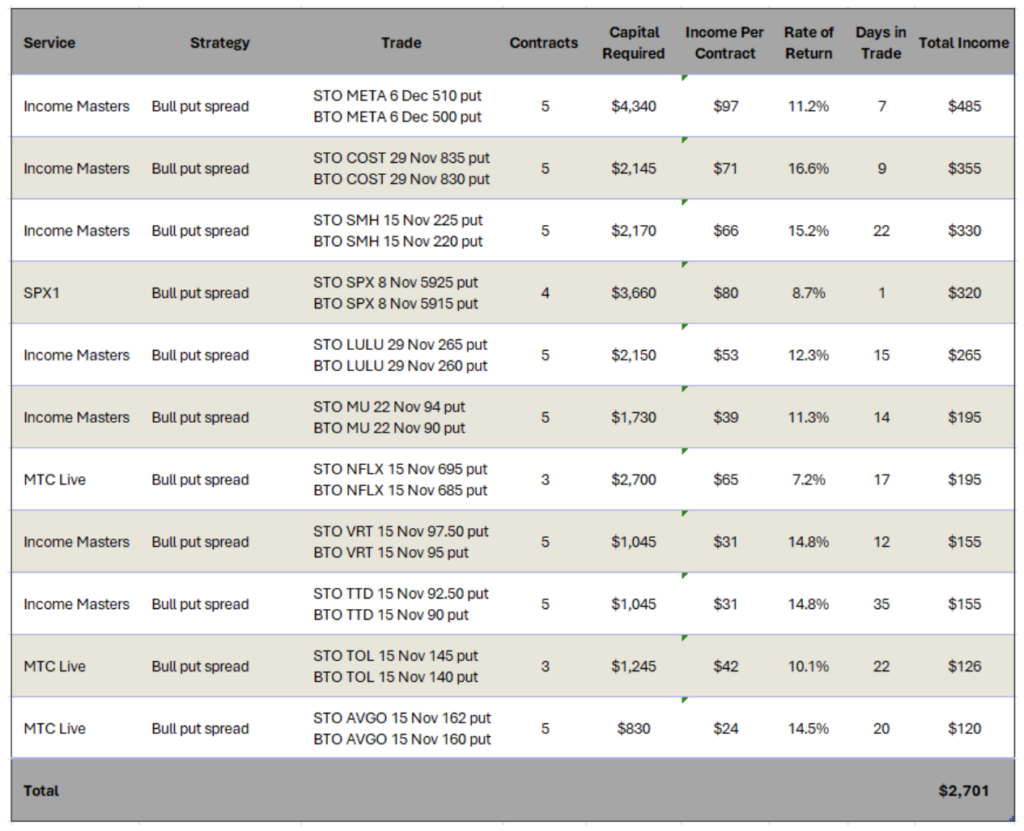

However, when looking at our most-oft traded strategy, it was the bull put spread.

We closed 11 of these trades, pocketing just over $2,700 in income.

For those who are not familiar with the strategy, a bull put spread, also known as a put credit spread, involves selling a put option and purchasing a put option at a lower strike price with the same expiration date to generate a net credit.

The maximum profit is the credit received and is achieved if the top leg finishes out of the money (OTM). While the profit is capped, so too is your risk, as the most you can lose on the trade is the width of the spread minus the credit received.

In addition to limiting risk, bull put spreads offer leverage, allowing you to potentially book high rates of return on the limited capital required.

A bull put spread is considered a neutral-to-bullish strategy. So while it will benefit from a stock moving higher, it isn’t necessarily required. The share price simply needs to be above the short strike price at expiration.

Then again, a move higher certainly helps, as we saw last week. As the market shot up following the election results and Federal Reserve Chair Jerome Powell’s comments, we saw many of our bull put spread positions hit their target exit prices.

Not only did these trades benefit from the strong move up in stocks, but they also benefitted from a collapse in volatility.

With the election uncertainty resolved as Donald Trump secured re-election, the CBOE Volatility Index (VIX) fell sharply to test its three-month lows.

Generally, as volatility declines, so do option premiums. And since a bull put spread is an options selling strategy, the idea is to sell when volatility is high and buy it back when volatility is low.

We saw many of our credit spreads benefit from this one-two punch of higher stock prices and lower volatility.

Of course, last week’s market action was not the norm. But we’ve been using this strategy with great success across many of our services in every kind of market –up, down and flat. And, as Jeff Wood pointed out in a recent article, it’s often an ideal strategy for trading earnings.

It’s also one of our go-to strategies in Income Madness.

Income Madness typically consists of four to six days of back-to-back live trading sessions. By utilizing bull put spreads, we can greatly reduce the capital required compared to trading cash-secured puts, which is important when you’re putting on 10 to 20 new trades over the course of a few days.

This allows us to trade higher-priced stocks than we might if we were using straight cash-secured puts. For instance, selling a single cash-secured put on Netflix (NFLX) that is 6% out of the money would require $77,000. But if you sell a 5-wide bull put spread, you are only risking $500 per spread less the capital received – a reduction of 99%.

Our next round of Income Madness kicks off next week, running from Nov. 18-21. Income Madness is exclusive to the Income Masters program. But if you’d like to learn more about it, David Durham and John Hutchinson are hosting a special preview session for the upcoming live trading event with special stocks to trade for instant holiday cash.