The inflation story in the U.S. continues to improve, but August’s Consumer Price Index report indicates that prices are slow to drop across the economy. The slowdown of inflation will prevent the possibility of a big Fed rate cut in the weeks ahead. The market is reacting positively since the uncertainty of the size of the rate cut is now becoming clear. But how long will the optimism last and what sectors are likely to continue pushing higher from here?

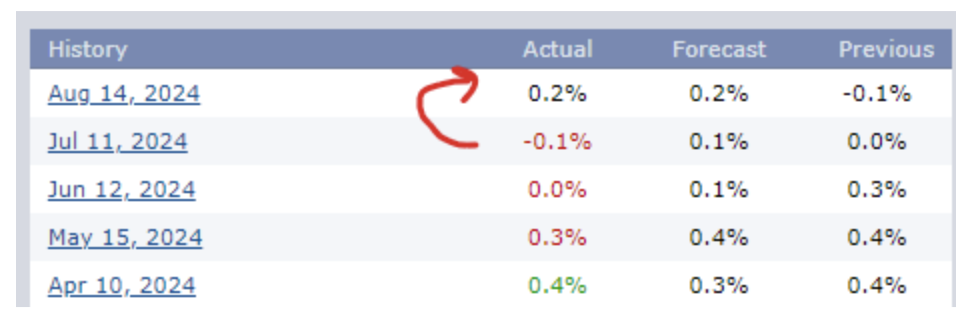

First, let’s review how we got here. The Consumer Price Index (CPI) month-over-month came in exactly as forecasted at an increase of 0.2%. The problem is that it was -0.1% last month, so consumer prices are moving higher – in other words – in the wrong direction.

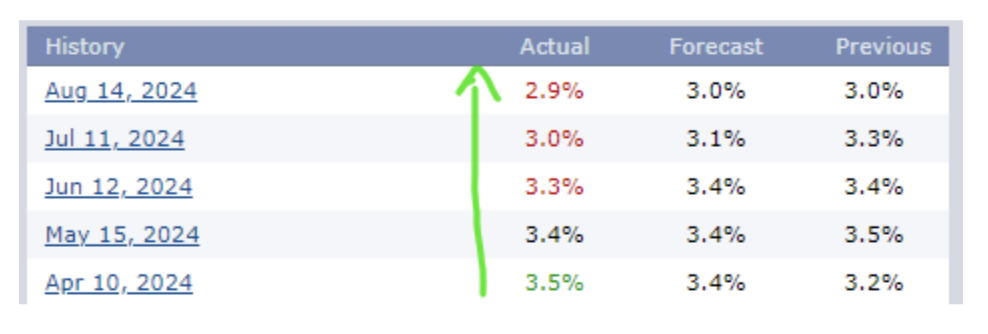

The year-over-year numbers looked slightly better, but they came in just slightly better than the forecasted amount of 3.0%. The trend is moving in the right direction with the August 2.9% reading quite a bit less than the April 3.5% reading, but is it fast enough for the Fed?

Inflation isn’t dropping fast enough and that means the Fed will have to stick to a 25 basis point cut during their upcoming meeting. As much as investors wanted to see a 50 basis point cut to help spur economic growth, the Fed doesn’t want inflation to creep back higher.

The nail in the coffin was Thursday’s Producer Price Index numbers, which increased 0.2% on the month. While it was in line with expectations, it’s an increase and the Fed needed to see a significant drop if they were going to entertain a larger cut.

Still, investors hate uncertainty and now the projected move from the Fed is becoming more clear. Despite a seasonally soft September, the market has ticked higher for a few days after one of the worst weeks last week.

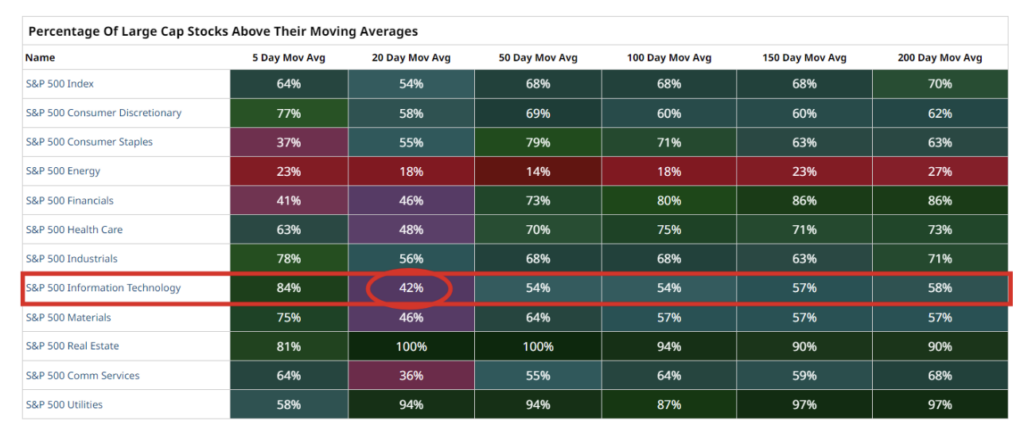

Let’s first take a look at how many stocks within the S&P 500 sectors are above key moving averages. A week ago, Consumer Staples – a very defensive market sector – was the only sector with more than 50% of its stocks above their 5-day moving averages. And a week ago, the Information Technology sector only had 4% of stocks above their 5-day moving averages.

Now, let’s look at the data nearly a week later. Information Tech jumped to having 42% of their stocks climb above their 5-day moving average, while Consumer Staples essentially stayed the same.

What does this tell us? Investors are dipping their toes back into the risk pool and moving away from the defensive stocks – at least for now. But should they?

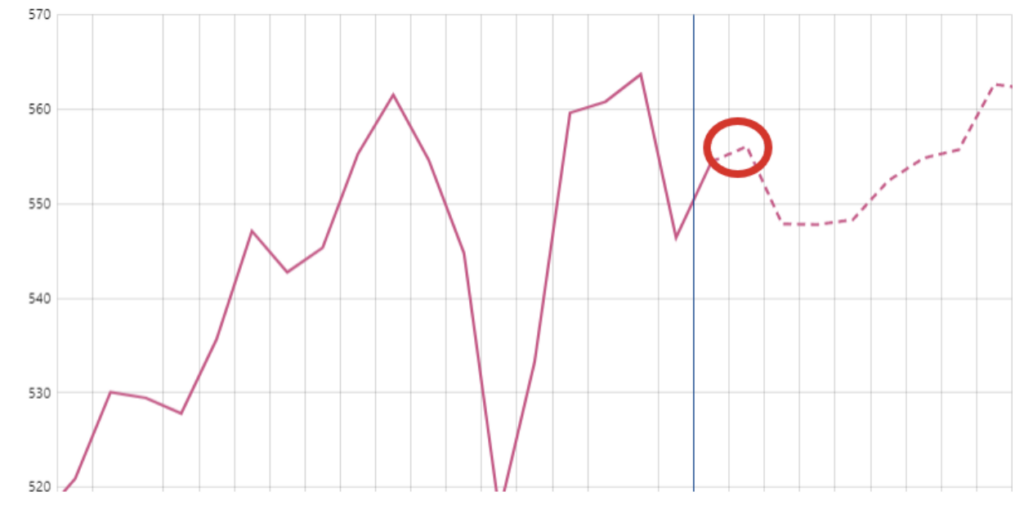

The S&P 500 is throwing out mixed signals. There have been multiple lower lows and now a lower high, but the low from last week made a higher low. That means as the market is creating a wedge (lower highs and higher lows) in the near term, the $5650 level is the one to watch. The chart is of the SPY, so look for $565 as a key resistance level. If we can break from that level, watch for a retracement down to that level and then a bounce higher.

It’s also important to be aware of seasonal trends. After all, I’ve mentioned in previous articles how the bears come out to play in September. This chart shows the seasonal expected move over the next coming weeks, with a near-term peak around September 18th before going back to the bears until the end of September. Meaning, that the market normally rises this week and next, before falling again through the end of the month.

Using these two charts together, you can now set up a thesis that we expect the market to rise this week and next, into and maybe above that $565 level of resistance. If it stays above that level, the seasonal pattern will no longer be valid, but given the seasonal pattern is weak and the S&P 500 is running up against potential resistance, it might be a good time to take profits and tighten up those stops just in case the market is ready to retrace.

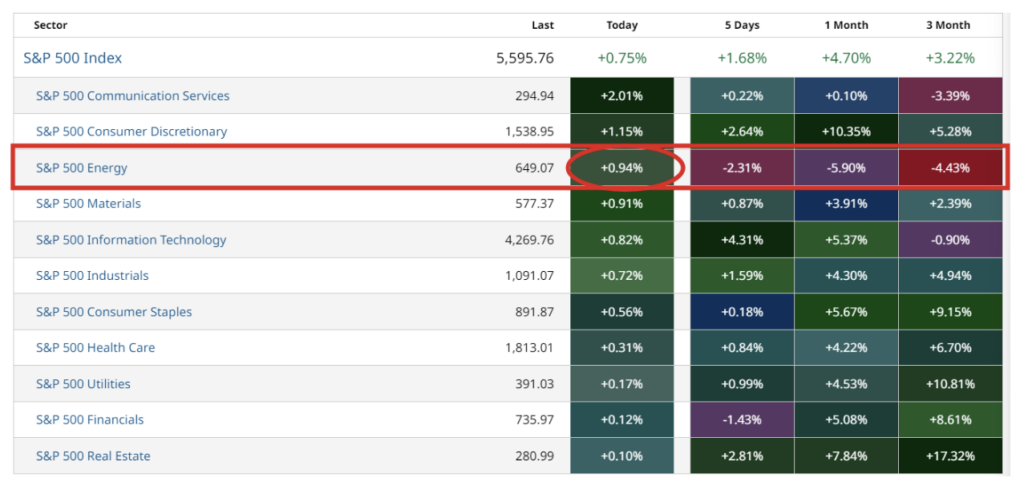

Over the coming days, pay close attention to the sectors rising to the top of the 5-day performance to see where the market is headed. One interesting potential trend reversal is in the Energy sector. It’s been one of the absolute worst performers over the last 3 months but look at the daily move. Could this oversold sector be on the rebound?

Consumer Discretionary still looks strong on multiple time frames. While some of the higher beta sectors have been moving the markets higher over the last 5 days, keep your eye on Consumer Staples to help see if the market is going to return to defensive positions.

The September rate cut from the Fed may help buck the seasonal trend and move this market higher though, so keep an eye out for strong stocks moving in strong sectors.

That’s it for me this week. Have a safe and happy weekend!