We’re often asked by new Options Income Weekly members what some of our go-to income stocks are. In the past, that question was easy to answer. We made dozens of trades in stocks like Block (SQ), Roku (ROKU), The Trade Desk (TTD) and Chewy (CHWY), racking up hundreds to thousands of dollars in each stock over the years.

Looking back on our trading in 2024, we’ve had more diversity in the stocks we’re trading for income. There’s a fairly long list of stocks we’ve traded just once or twice this year, capitalizing on elevated volatility levels, earnings moves or something else.

That’s not to say that there is anything wrong with trading the same stocks for income again and again. We’ve traded all of the names mentioned above this year as well. And we’ve made a handful of trades in stocks like United Airlines (UAL), ON Semiconductor (ON) and Affirm Holdings (AFRM).

But if we had to pick the stock we’ve been trading the most for income recently, one name stands out: CAVA Group (CAVA).

CAVA Group is a rapidly growing Mediterranean-focused fast-casual restaurant chain. It opened its first location in 2011 and now operates more than 340 restaurants.

Revenue is growing at a fast clip, rising 35% year over year during the second quarter, while earnings surged 183%, blowing past analysts’ estimates. The chain saw a 14.4% increase in same-store sales over the second quarter of 2023, and traffic growth was up 9.5%.

The company is expected to report third-quarter results early next month. Analysts are calling for revenue to increase 32% to $231.9 million and for earnings to jump 67% to $0.10 per share. For the full year, analysts are forecasting 28% revenue growth and for earnings to nearly double to $0.41 per share from $0.21 in 2023. That’s a tall order, but CAVA has been exceeding analyst expectations.

CAVA’s aggressive expansion and strong financial performance have been reflected in the company’s share price. In fact, many are comparing CAVA to Chipotle Mexican Grill (CMG), both for its build-your-own-entree style dining experience and its stock’s bullish trajectory.

CAVA is up roughly 325% in the past year and more than 500% since going public at $22 a share in June 2023.

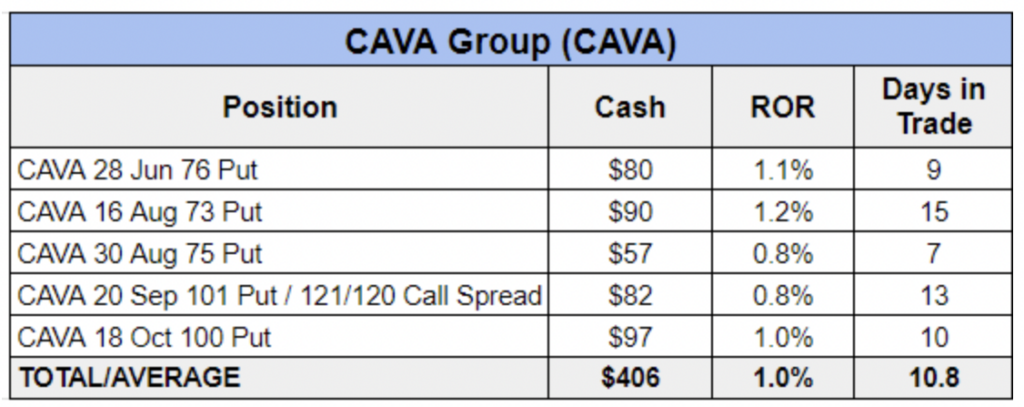

We began trading CAVA in the Options Income Weekly program in early June, following a Q1 earnings beat and an increase in forward guidance. We racked up some wins with cash-secured puts over the summer as the stock bounced around.

We then altered our strategy after the company reported better-than-expected second-quarter earnings on Aug. 22. Shares jumped nearly 20% the next day, making a new record high.

However, the following week, the stock sold off after several key executives and directors, including CEO Brent Schulman, disclosed sales of CAVA stock. This pullback gave us a nice entry point following the post-earnings run-up.

Yet, even with the pullback, the stock was still up significantly over the prior few months. Given this and broader market jitters amid heightened economic concerns, we wanted some added protection.

So, we used a strategy known as a “jade lizard” that involves selling an out-of-the money (OTM) cash-secured put while also selling a call spread above where the stock is trading to collect additional premium. The additional premium serves as added downside protection. Furthermore, as long as the total credit received is greater than the width of the call spread, there is no risk if the stock trades higher and the call spread goes in the money.

If you want to learn more about this strategy, we covered the CAVA jade lizard trade in more detail here. But for today’s purposes, suffice to say that we booked another win on the stock.

We went back to the stock again in early September. With the market heading higher in anticipation of an interest-rate cut by the Federal Reserve, we opted not to add a call spread, which turned out to be the right move.

Stocks ripped higher following the Fed’s 50-basis-point reduction and our put hit its target exit price, delivering us our fifth winning trade on CAVA in just three and a half months.

And we’re about to make that six, with our latest CAVA trade just a few cents away from triggering the good ‘til canceled (GTC) order we placed when we entered the trade in late September.

After we exit that trade, the company’s upcoming earnings report could provide us with another chance to go back to the stock. However, depending on how shares trade between now and then, we may wait to take advantage of still-elevated volatility levels with a post-earnings trade and/or opt for a jade lizard to provide us with some downside protection.

But one thing is clear: Fast-casual dining star CAVA has become a go-to income stock in the Options Income Weekly program.