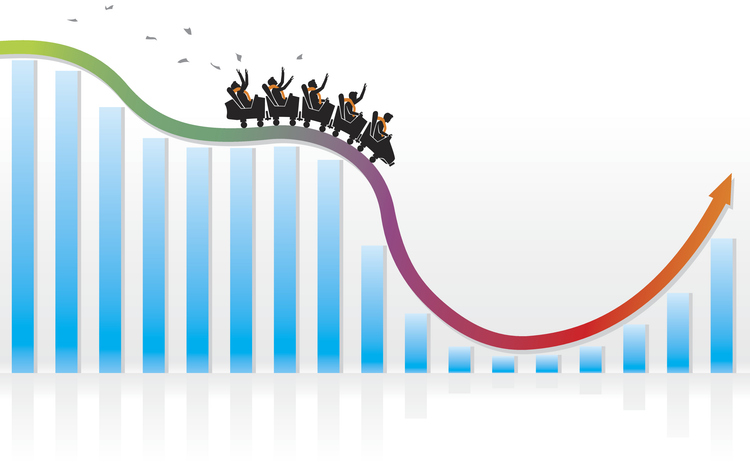

Investors suffered from a serious case of whiplash last week, with stocks delivering their worst single-day performance of the year on Monday and their best single-day performance of the year on Thursday.

All of the sudden, “recession” is back on everyone’s lips after weaker-than-expected jobs data. Fears are mounting that the Federal Reserve may be too late in easing monetary policy and the unwinding of the yen carry trade has led to massive losses in global markets. (For more on why and how the global carry trade is affecting stocks, read this.)

All this uncertainty has caused investors to start seeking cover, selling tech stocks and piling into more defensive plays. This Great Rotation happened swiftly, catching many off guard and forcing traders to adjust on the fly.

The Nasdaq closed last week down slightly despite Thursday’s 2.9% rally and remained in correction territory at Friday’s close. But there have been reports of major investment firms like BlackRock (BLK) and UBS Group (UBS) scooping up shares of mega-cap tech stocks at discounted levels.

To be sure, there are a number of tech stocks that look more reasonable at current levels than they did a few short weeks ago. And we have been looking to capitalize on this and the market’s heightened volatility.

AI leader Nvidia (NVDA), for instance, is down more than 25% from its all-time high made in June.

However, it has rebounded 15% since hitting a low last Monday just above the $90 level. With shares looking like they have put in a short-term bottom, we went back to trading the stock during Tuesday’s Options Income Weekly Live Trading Session.

With the stock trading around $104, we sold a NVDA 23 Aug 82 Put. While NVDA is prone to large swings, our put strike was 21% out of the money (OTM), providing a large cushion to the downside. Additionally, the Aug.23 expiration date keeps us out of the way of the company’s earnings report, which is set to be released on Aug. 28.

We set a target exit price at a little more than 60% of the max profit hoping to get out of the position early rather than getting greedy in a market like this.

Meta Platforms (META) is another big-tech stock we’ve traded recently that has pulled back from recent highs.

META’s low was hit earlier than Nvidia’s, in late July, with the stock falling 18% from peak to trough before rebounding.

We entered a new bull put spread on the stock last week in the Income Masters program after closing out a successful trade just a few days prior.

This exit came after the company reported better-than-expected second-quarter earnings. The stock ran up as much as 11% on the morning after the report despite management warning that they expect to see capital expenditures increase significantly in 2025. This move triggered our good ‘til canceled (GTC) order to exit the position and we booked a 10.7% return on our 10-wide spread in just nine days, pocketing $535 in cash on five contracts in our live account.

In addition to opportunistic neutral-to-bullish trades on potentially oversold tech names, we’ve also been looking for neutral-to-bearish trades that take advantage of waning bullish sentiment in the sector.

Last week, we discussed bear call spreads, which involve simultaneously selling a call option and buying a call option with the same expiration date but a higher strike price. We reviewed the risk profile of this strategy, which mirrors that of the bull put spread, and what we look for when setting up this kind of trade. If you missed that article, you can read it here.

We entered a bear call spread on the VanEck Semiconductor ETF (SMH) on July 30. Trading around $228, the ETF was down roughly 20% from its highs after shares more than doubled over an eight-month span.

We sold the SMH 30 Aug 252.50 Call and bought the SMH 30 Aug 257.50 Call, collecting a net credit of $0.88, or $88 per spread. We sold five contracts, generating $440 in cash. We set our target exit price at $0.40, aiming to book 55% of the max profit well ahead of expiration.

The ETF initially moved higher, hitting $247.69 the next day. This put the share price within 2% of our sold put strike.

However, the next day, SMH turned lower. Our target exit price was hit on Aug. 7, and we exited the trade with $240 in profit, earning a 9.6% return on our 5-wide spread in just over a week.

So, while this whipsaw market may have traders struggling to get their bearings, there are profits to be made. Just be sure to adjust your risk accordingly, as we are likely to see more large intraday swings in the days ahead, especially with the release of the July Consumer Price Index (CPI) on Wednesday and jobless claims on Thursday.

If the roller-coaster market is making you feel a bit queasy, there’s no shame in getting off the ride for a bit. But if you stay on, keep your position sizes small and don’t get greedy.