People are always on the lookout for the next Amazon (AMZN), Tesla (TSLA), Apple (AAPL) or Chipotle Mexican Grill (CMG), which have delivered massive gains to long-term shareholders. The truth is that juggernauts like these don’t come around very often, which is part of their appeal. But one company that’s drawn frequent comparison to the latter is CAVA Group (CAVA).

Cava Group is a Mediterranean-focused fast-casual restaurant chain that uses a build-your-own-entree style like Chipotle. It opened its first location in 2011 and now operates more than 340 restaurants.

Revenue is growing at a fast clip, rising 35% year over year during the most recently reported quarter and expected to be up 28% for the full year. CAVA’s earnings surged 183% in the second quarter and analysts anticipate they will grow more than 90% in 2024.

Also like CMG, the stock has delivered some eye-popping returns, up more than 400% since going public at $22 a share in June 2023.

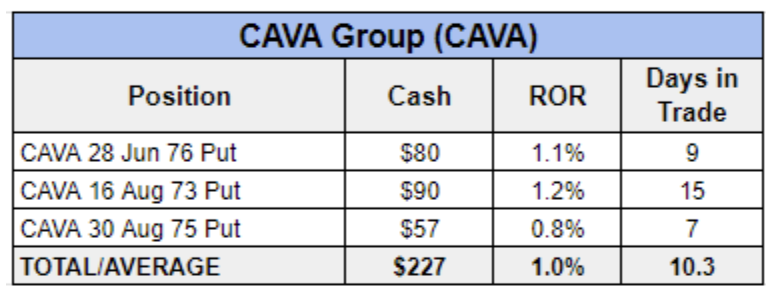

We began trading CAVA in the Options Income Weekly program in early June, following an earnings beat and increase in forward guidance. We’ve racked up some wins with cash-secured puts over the past few months.

For our latest CAVA trade, though, we altered our strategy a bit. Rather than sell a straight cash-secured put, we used an options strategy with an interesting name and an even more interesting risk profile.

It’s called the “jade lizard,” and it works as an enhancement to our go-to strategy of selling short put options to generate income.

To create a jade lizard, you sell a put option with a strike price below the current stock price and sell a call spread above where the stock is trading to collect additional premium.

This is a neutral-to-bullish trade, where the max profit is the credit you collected and the max risk is the sold put strike times 100 less the credit received. In this case, the call spread you sold offers additional downside protection in the form of more credit brought in.

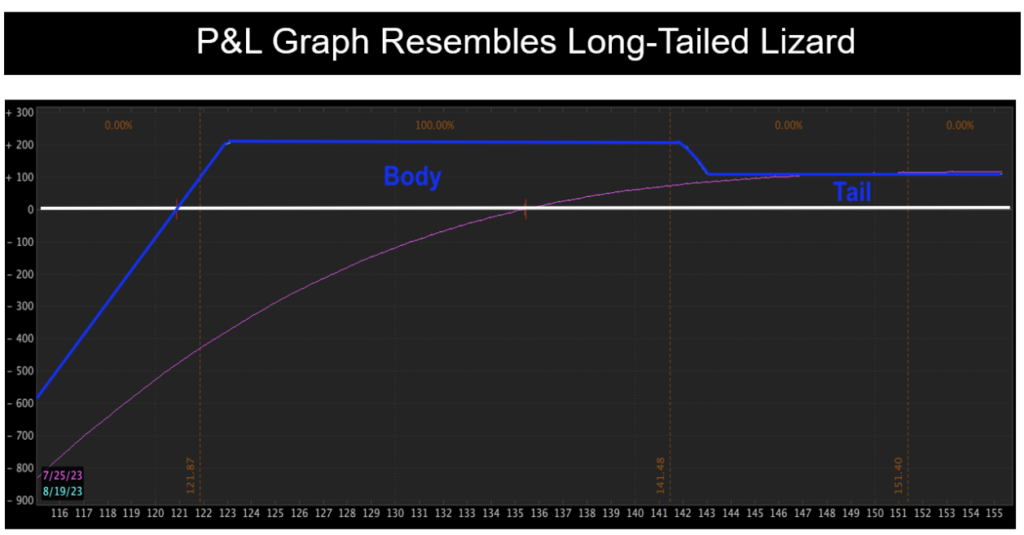

What makes the jade lizard so interesting is that, as long as the total credit received is greater than the width of the call spread, there is no risk if the stock trades higher and the call spread goes in the money.

This is, in fact, where the strategy gets its name, as the profit-and-loss graph resembles a lizard with a long tail.

Now, back to our CAVA trade…

CAVA Group reported better-than-expected second-quarter earnings on Aug. 22, and shares jumped nearly 20% the next day, making a new record high. However, the following week, the stock sold off after several key executives and directors, including CEO Brent Schulman, disclosed sales of CAVA stock. This pullback gave us a nice entry point following the post-earnings run-up.

With the stock trading at $118.49, we sold to open the CAVA 20 Sep 101 Put for $1.12 in the Aug. 27 Options Income Weekly Live Trading Session. That put was nearly 15% out of the money (OTM) and below the 14-point expected move, providing a nice cushion.

Yet, even with CAVA’s recent pullback, the stock was still up significantly over the past few months. Given this and the market’s jitters amid heightened economic concerns, we wanted some added protection in the trade.

So, we sold the CAVA 20 Sep 121 Call and bought the CAVA 20 Sep 122 Call for a net credit of $0.39. This gave us a total credit of $1.51 on the position, which was greater than the $1 width of the call spread, meaning we had no risk to the upside even if CAVA took off running.

If CAVA closed above $101 (short put strike) and below $121 (short call strike) at expiration, we’d keep the max profit. But with theta decay working in our favor as expiration approached, we’d look to exit the trade sooner. However, as long as the stock stayed between $99.49 and $122.51, we’d make money.

That extra protection helped us breathe easier when CAVA continued to sell off after we entered the trade. Shares fell as much as 7% before bouncing off the $110 level.

The stock continued to run up over the next few days, nearing the $120 level. This caused the premium on our sold put to fall to just $0.30. So, we decided to book profits on it and close the call spread at breakeven before it went in the money. This gave us a profit of $0.82, or $82 per contract, on the position for a 0.8% return in 13 days.

While we didn’t generate any extra income from the call spread this time around, that’s not always the case. We boosted our income on positions with this strategy numerous times in the Income Masters program.

Yet, the CAVA jade lizard did accomplish our goal of providing some extra downside protection on the trade had we needed it.

CAVA is an interesting consumer discretionary play, up sharply this year while the sector is underperforming the broader market.

trade. This time, we sold a straight cash-secured put, as the strikes at the expiration we were targeting were 5-wide, which made finding enough credit a challenge.

However, we plan to continue using the jade lizard strategy as we look to navigate upcoming volatility in what could be a late-cycle market.