The biggest stock trend of the past year has undoubtedly been the rise of generative artificial intelligence and the wide-ranging implications it has for the companies involved and society as a whole. Some are likening the investor exuberance surrounding AI stocks to the dot-com bubble of the late 1990s. Yet, as a recent Reuters article noted, stock valuations are currently lower than they were during that time and supported by stronger earnings rather than speculative growth projections.

We’ve been riding this trend at Traders Reserve across our services, trading AI darling Nvidia (NVDA), as well as tech leaders like Microsoft (MSFT), Meta Platforms (META) and Super Micro Computer (SMCI), and lesser-known names like GitLab (GTLB) and Vertiv Holdings (VRT).

While tech has been stealing the spotlight – and offering premium for option traders in a volatility-starved environment — it’s not the only game in town. Another trend we’ve been capitalizing on recently is the soaring popularity of obesity drugs.

Ozempic, the injectable drug that has become synonymous with rapid weight loss, is actually approved to treat Type 2 diabetes. However, its off-label use to help people (including some high-profile celebrities) shed unwanted pounds was what put it on the map. Wegovy, a higher-dose version of the drug made by Danish drugmaker Novo Nordisk (NVO), was approved by the FDA to treat obesity in June 2021.

The success of these drugs, which saw a combined $18.4 billion in sales last year, has catapulted NVO to a $634 billion market cap, with shares up roughly 470% over the past five years.

We’ve traded NVO in the past, both in the Income Masters and Options Income Weekly programs, selling cash-secured puts when the stock was trading at the sub-$100 level.

But Novo Nordisk isn’t the only way to play the popularity of obesity drugs. Lately, we’ve been having great success trading pharmaceutical company Eli Lilly (LLY).

Ozempic and Wegovy fall under a drug class called GLP-1 agonists, which mimic GLP-1 receptors in the body, improving production of insulin to help regulate blood sugar levels, making the stomach empty slower and regulating the brain’s hunger signals.

Eli Lilly’s GLP-1 agonists are Mounjaro for type 2 diabetes and Zepbound for weight loss and management. Mounjaro sales hit $5.2 billion in 2023, while Zepbound, which was approved in November, generated more than $175 million in sales during its first quarter on the market. Largely thanks to the soaring popularity of these drugs, Eli Lilly expects 2024 revenue to top $40 billion, up from $34 billion last year.

Like NVO, LLY has seen its share price appreciate substantially over the past five years, with the stock up more than 700% and approaching the $1,000 per-share level.

Eli Lilly’s nearly quadruple-digit share price has analysts wondering if it will be the next big company to announce a stock split. Last month, Nvidia completed a 10-for-1 split, while Chipotle Mexican Grill (CMG) underwent a 50-for-1 split.

Given LLY’s high share price, we’ve been using bull put spreads in the Income Masters program to greatly reduce our capital requirement while trading the stock.

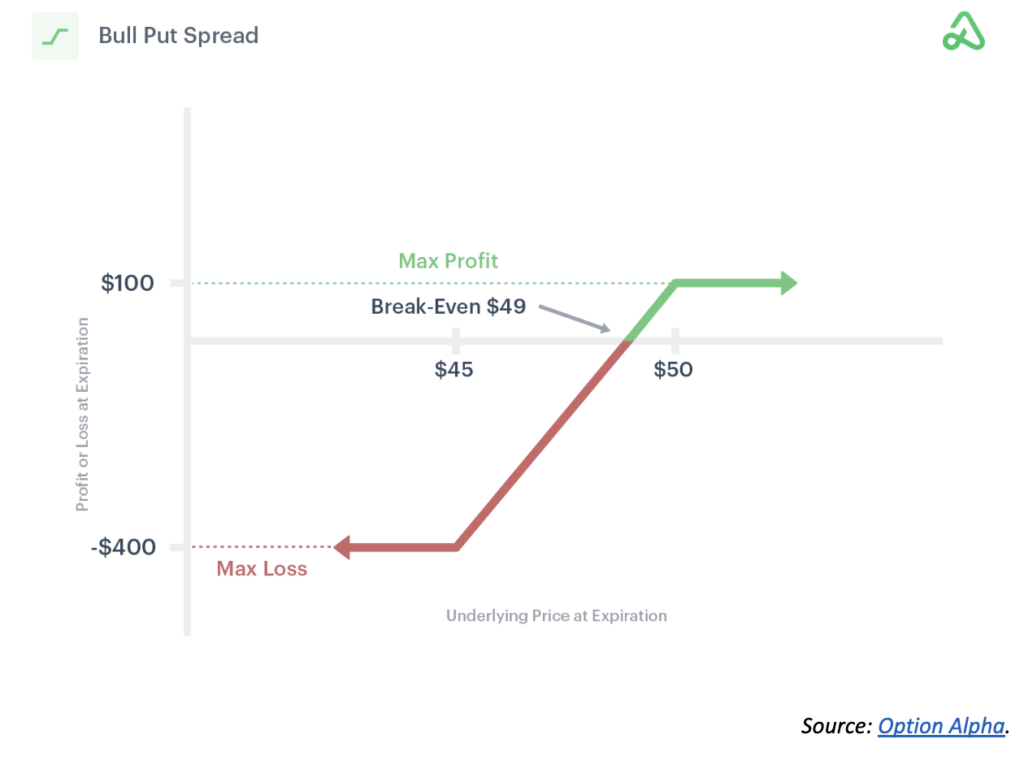

For those who are not familiar with the strategy, a bull put spread, also known as a put credit spread, involves selling a put option and purchasing a put option at a lower strike price with the same expiration date to generate a net credit.

The maximum profit is the credit received and is achieved if the top leg finishes out of the money (OTM). While the profit is capped, so too is your risk, as the most you can lose on the trade is the width of the spread minus the credit received.

In addition to limiting risk, bull put spreads offer leverage, allowing you to potentially book high rates of return on the limited capital required.

Our most recent LLY trade was put on during Income Madness week, where we focus on generating a large amount of cash over the course of six back-to-back trading sessions. We typically target faster closeouts in the program, occasionally selling options with fewer days to expiration (DTE) to accomplish this goal.

On July 26, with LLY trading at $903.78, we sold the LLY 5 Jul 870 Put and bought the LLY 5 Jul 865 Put for a net credit of $0.51, or $51 per contract. Given the low capital requirement of just $500 per 5-wide spread, we traded five contracts in the live account, bringing in a total of $255 in income.

For comparison, had we sold a single cash-secured put at the 870 strike, we would have needed $87,000 in options buying power. Even trading five contracts of the spread position (which required $2,500 in capital), we reduced our capital outlay by 97%.

With nine days to expiration on the trade, we set a good ‘til canceled (GTC) order to exit the spread at $0.15. That target exit price was hit just two days later, and we booked a profit of $36 per spread, or $180 for five contracts, for a 7.2% return.

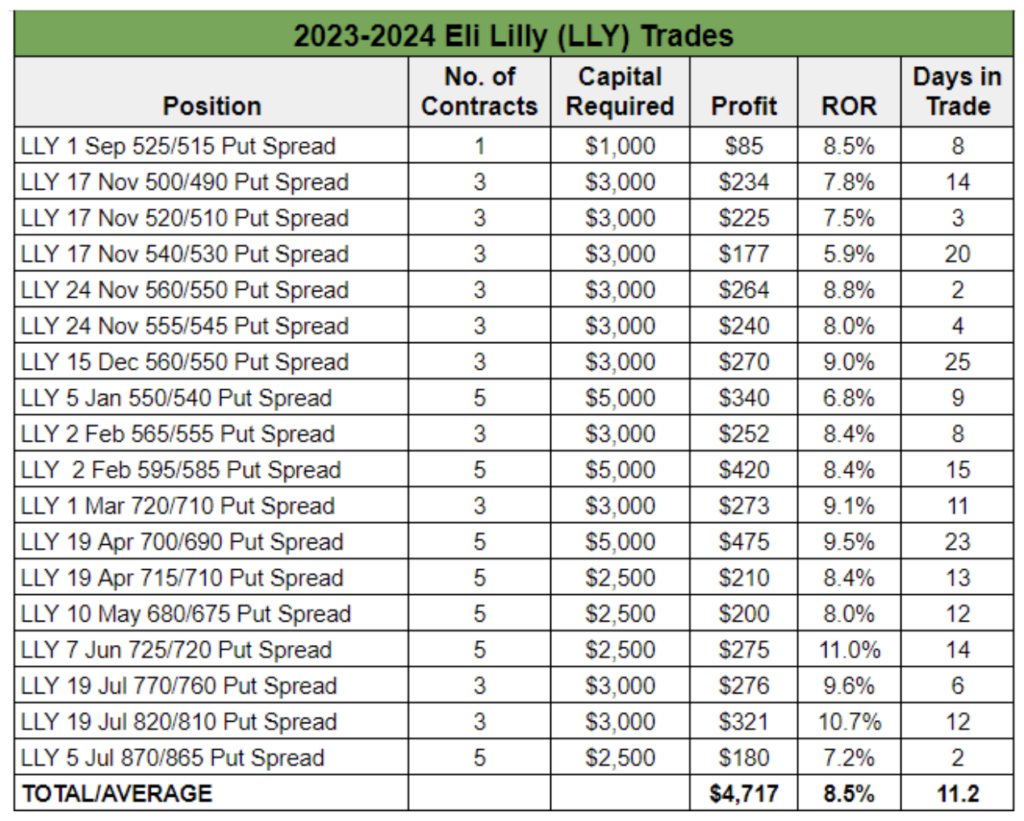

We’ve been using this strategy with LLY for close to a year, and the results are impressive:

We’ve traded LLY successfully 18 times in a row, generating more than $4,700 in cash and averaging an 8.5% return per trade with an average holding time of just over 11 days.

As you can see, bull put spreads are an excellent way for option sellers to generate income with a fraction of the capital outlay while earning high rates of return.

If Eli Lilly does a stock split, we may find ourselves going back to trading cash-secured puts. But, for now, we’re happy to cash in on the weight-loss drug craze with this strategy.