We just wrapped up the latest round of Income Madness, and it was a resounding success. We kicked things off on June 24 with the first of six consecutive days of live trading.

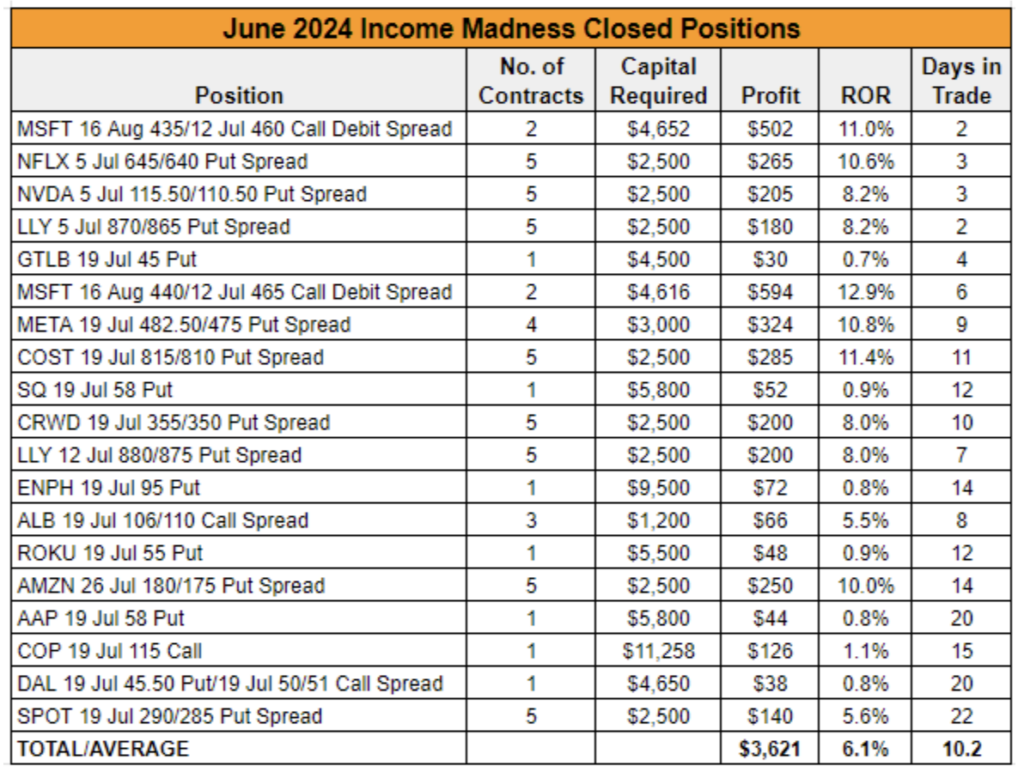

Over the next 25 days, we generated more than $3,600 in cash with 19 profitable trades closed. We averaged a 6.1% return per trade with an average holding time of just over 10 days.

Here’s a look at all the trades we made:

The goal of Income Madness is to generate a large amount of cash in a short amount of time using option strategies. We predominately sell cash-secured puts and bull put spreads, but during this round, we utilized a variety of other tactics as we sought to maximize income and adapt to market conditions. Specifically, we traded a buy-write, a bear call spread, a jade lizard and two diagonal call debit spreads.

Each of these strategies has its own unique benefits and all are useful tools in any income trader’s toolbox.

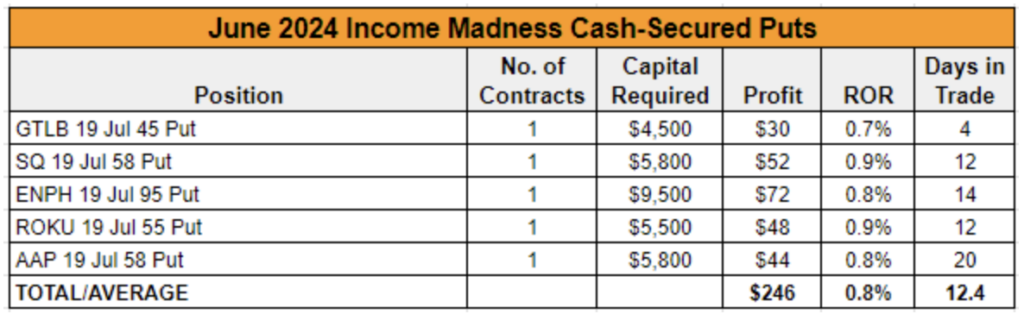

The vast majority of Income Madness trades used to be straightforward cash-secured puts. And we still traded a handful of those in the latest round.

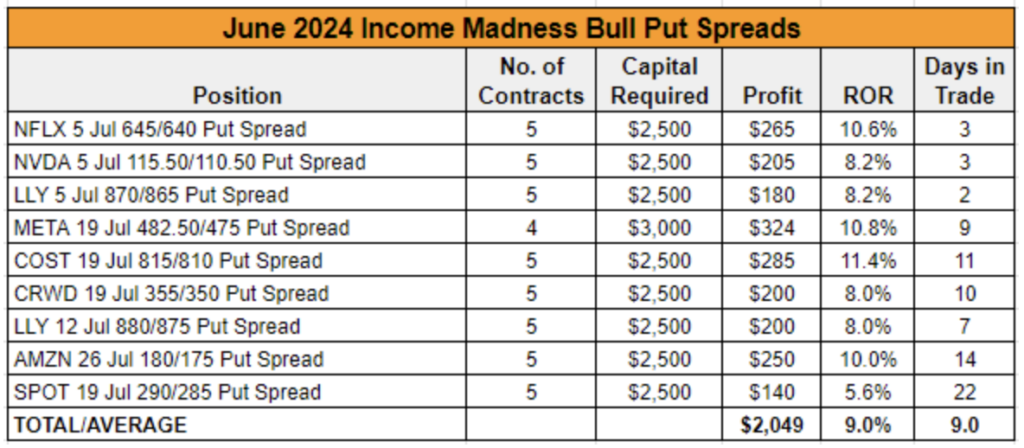

However, lately, we have been favoring bull put spreads. A bull put spread, also known as a put credit spread, involves selling a put option and purchasing a put option at a lower strike price with the same expiration date to generate a net credit.

The maximum profit is the credit received and is achieved if the top leg finishes out of the money (OTM). While the profit is capped, so too is your risk, as the most you can lose on the trade is the width of the spread minus the credit received.

In addition to limiting risk, bull put spreads offer leverage, allowing you to potentially book high rates of return on the limited capital required, which is evident by comparing the table above to the one below.

Our bull put spreads required far less options buying power, allowing us to sell multiple contracts to generate larger amounts of cash and much higher rates of return. We averaged a 9% return on capital with these spreads versus an average 0.8% return for our cash-secured puts.

While a bull put spread is a neutral-to-bullish strategy, we occasionally trade bear call spreads in Income Madness as well. This involves simultaneously selling a call option and buying a call option with the same expiration date but a higher strike price. Like a bear put spread, the use of this strategy greatly reduces the capital required, offering the potential for high rates of return. However, this is a neutral-to-bearish strategy.

We sold a bear call spread on specialty chemicals producer Albemarle (ALB) on July 1. The company is an electric vehicle battery play, and the stock had been losing steam throughout the year.

While we don’t necessarily need the underlying stock to sell off before expiration for a bear call spread to be profitable, it certainly helps!

In the case of Albemarle, shares fell nearly 9% on July 9 to a multiyear low after two banks lowered their price targets on the stock, citing the sharp drop in lithium prices. With this move lower, the spread hit our target exit price, allowing us to close the position with a 5.5% return on our capital in just eight days.

Now, technically, ALB wasn’t the only call spread we sold, but the other position was a bit different. Known as a “jade lizard,” it works as an enhancement to a cash-secured put.

To create a jade lizard, you sell a put option with a strike price below the current stock price and sell a call spread above where the stock is trading to collect additional premium.

This is a neutral-to-bullish trade, where the call spread you sold offers additional downside protection in the form of more credit brought in. What makes the jade lizard interesting is that, as long as the total credit received is greater than the width of the call spread, there is no risk if the stock trades higher and the call spread goes in the money.

We used this strategy on Delta Air Lines (DAL), trading the July 19 options expiration, which was after the company was set to report earnings. We noted at the time that those who were uncomfortable with holding the position through the announcement should pass on the trade.

Things didn’t quite go as planned. The company missed revenue and earnings estimates when it reported on July 11. Management warned that fare discounting among all airlines was impacting sales during the busy summer travel season but reaffirmed its full-year outlook.

The stock opened down 10% on the day. While it recovered some of those losses by the close, our put remained in the money. But the added credit from the call spread gave us a bit more breathing room than we would have had without it. We held tight and DAL recovered a bit further. We ended up closing the put position a few days ahead of expiration for a small profit and kept all the premium we collected from the call spread when it expired worthless that Friday.

It certainly wasn’t our most profitable Income Madness trade, but it was a good example of how a jade lizard can offer traders additional downside protection.

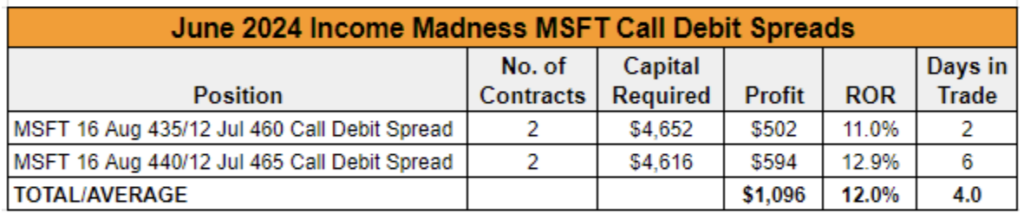

When it comes to our most profitable trades – from both an absolute dollar standpoint and return perspective – the prize goes to our two Microsoft (MSFT) diagonal call debit spreads. These trades yielded over $500 in cash apiece with rates of return between 11% and 13%.

With a diagonal call debit spread, you buy a long call option with a lower strike price and a later expiration date and sell a short call option with a higher strike price but an earlier expiration date. The strategy can yield profits whether the stock stays flat or increases over time, making it ideal for the low-volatility environment we currently find ourselves in.

If the stock price rises by the expiration of the short call, you can exercise your long call at a lower strike price and immediately sell it at the higher market price, locking in a profit.

You can also profit from time decay on the short call. As the short call nears expiration (assuming the stock price stays below the higher strike price), its time value will erode, benefiting the option seller.

But we didn’t hold either of our MSFT positions to expiration. One of our trades returned 11% in just two days thanks to a 2.2% rise in Microsoft’s share price. After closing it, we immediately went back to the stock, putting on another trade just a few hours later. This one was open for just six days and returned nearly 13%.

All in all, it was a very successful few weeks of trading, and we walked away with a few extra thousand dollars in our pockets. There were some minor bumps in the road, but we remained calm and managed our trades adeptly to meet market conditions.

We’ve yet to set the dates for the next round of Income Madness, which will be exclusive to Income Masters members, but we will let you know as soon as we have settled on the dates.