We ended 2023 on a high note, wrapping up the latest round of Income Madness by closing our final winning position on the last trading day of the year.

From Dec. 14 through Dec. 21, we opened 17 Income Madness trades during six back-to-back live trading sessions. And we closed all of those trades at a profit before it was time to pop the champagne and ring in the new year.

It’s true we had the market in our favor almost every day except for the sudden sell-off on Dec. 20, spurred in part by disappointing earnings from delivery giant FedEx (FDX). But that was far from the only reason for our success.

We focused on trading higher implied volatility (IV) stocks, such as cloud-based artificial intelligence lending platform Upstart (UPST), cosmetic and skin care products maker e.l.f. Beauty (ELF) and pharmaceutical company Eli Lilly (LLY), a stock that is on many traders’ radars due to the hype surrounding obesity drugs. High IV translates into higher option premiums for option sellers like us.

We also selected options with strike prices that had an 80% or better probability of finishing out of the money (OTM), thus significantly improving our odds of closing winning trades.

Finally, we set target exit prices at 60% to 70% of max profit. This allowed us to essentially automate our profits while capitalizing on intraday volatility. Rather than holding to expiration to try to capture the last few cents in premium, we were able to turn over our capital quickly, redeploying it on new lucrative opportunities.

When all was said and done, we ended Income Madness with over $3,400 of profit in our live account, providing traders with a nice cash infusion ahead of the holidays.

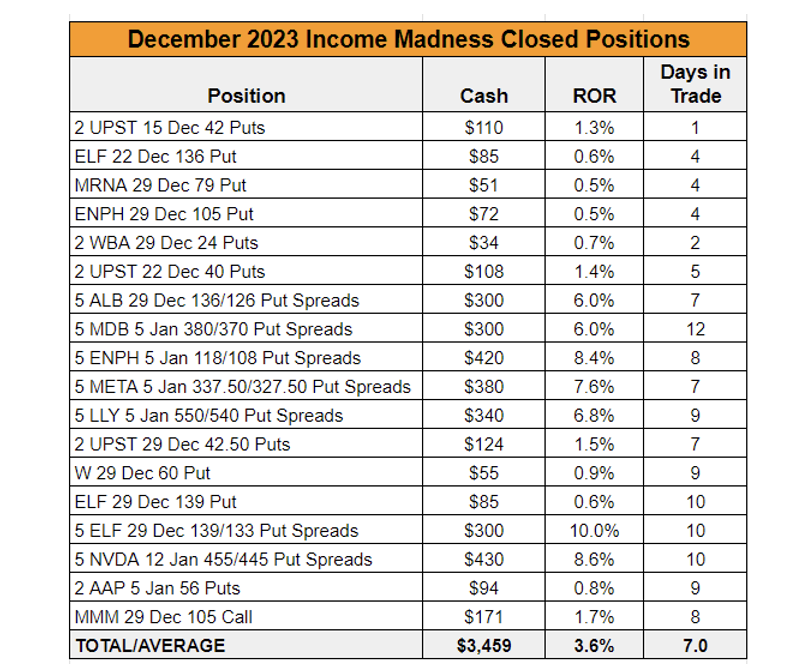

Here’s a look at every trade we made during Income Madness:

As you can see above, the length of time we spent in a trade ranged from one day to 12 days. Our average time in a position was just one week, underscoring the short-term nature of this trading program.

We used a handful of different option-selling strategies, predominately selling cash-secured puts and bull put spreads, and trading one buy/write position.

We averaged a 1% return on our cash-secured puts and buy/write position, while our average spread returned 7.5%.

The higher return potential of spreads was abundantly apparent the second time we traded e.l.f. Beauty.

During live trading, we recommended both a short put and a put spread, telling traders to select the strategy that best suited their trading goals and risk profile.

Both trades were profitable, and the short put yielded a higher dollar amount per contract of $85. However, we collected more total income on the put spread by selling five contracts, booking $300 in profit. And we earned a higher rate of return of 10% on the $5,000 in capital required for the spread position versus 0.6% on the $13,900 required for a single sold put contract.

We’ll be looking to employ similar tactics during our next round of Income Madness in February, while continuing to target high IV stocks and stick to our trade parameters and goals. We hope you can join us!