September kicked off with a big down day in the markets. Stocks were led lower by high-flying technology names. That’s nothing new. Nor is the fact that September tends to be a challenging month for investors.

Economic reports on Monday showed weakness in the manufacturing sector. But the big news this week is the monthly U.S. employment data set to be released on Friday morning. Last month’s report came in surprisingly weak, with the jobless rate hitting a post-pandemic high. With the Federal Reserve paying close attention to the jobs market as it eyes future interest-rate cuts, Friday’s report could be a major market-moving event.

If the market responds poorly, it could set the stage for a rocky September. Only time will tell. But traders should be cautious heading into the end of the week, adjusting their position sizes accordingly.

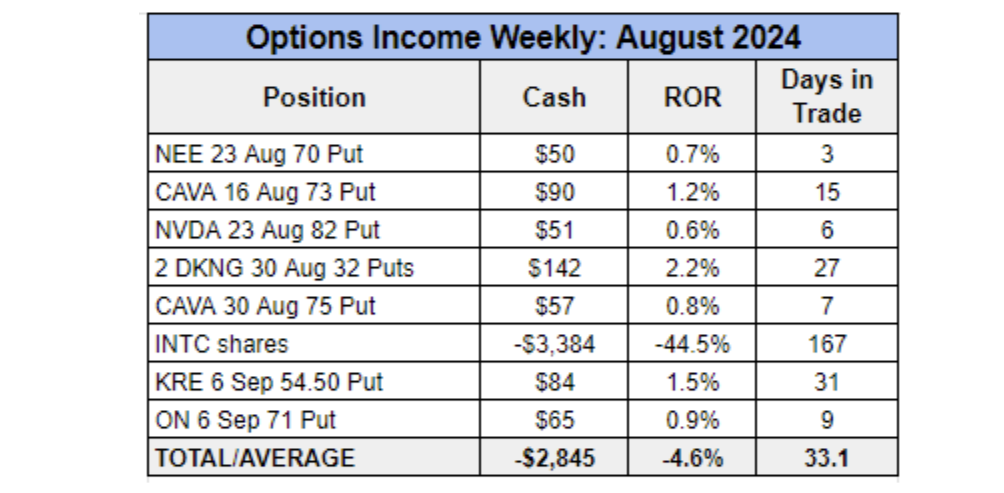

Looking back at August, we closed seven winners in the Options Income Weekly program, pocketing $539 in cash in our live account. Yet, the income we generated did not offset the big loss we took when we decided to move on from our recovery position in Intel (INTC).

This was not a decision we took lightly. However, the chipmaker is dramatically underperforming its peers. The company whiffed on its latest earnings report due in part to excessive capital spending as it looks to build out major U.S.-based chip manufacturing and fab processing plants. Despite generous government grants, questions remain about the credibility of Intel’s growth plan.

While it’s possible the stock may recover, it could have taken years for us to break even if shares continued to stall out. And that is simply too long to tie up capital when there are better income-generating opportunities out there.

Take our recent trade in ON Semiconductor (ON), for instance.

Prior to the post-Labor Day sell-off, the stock was up more than twice as much as the S&P 500 since shares bottomed in April. Even with Tuesday’s pullback, ON has gained more than 16% over the past four and a half months despite selling in the tech sector. Meanwhile, INTC has fallen 40% during that time. This includes a 4% drop since we sold our shares on Aug. 20.

When Nvidia (NVDA) announced its quarterly results last week, beating revenue and earnings estimates and guiding higher for Q3, the stock fell 6% on the day. However, other tech stocks traded higher, including ON. Shares popped 5% on Thursday before ultimately giving back some of those gains.

But not before the put we sold hit its target exit price, allowing us to book more than 75% of the max profit with more than a week to go till expiration. Clearly, trades like this are a better use of our capital than continuing to trade INTC, and we will look to make back the loss as quickly as we can with more lucrative opportunities.

Speaking of better opportunities, technically, we closed eight profitable positions in August, as we had a second NextEra Energy (NEE) put expire worthless on Aug. 23, allowing us to keep the full $142 in credit we generated on a rolled position.

However, we noted when we entered the position earlier in the month that we would be trading the clean energy utility stock Perpetual Income style. In other words, we will be treating it as a longer-term position where we’re more focused on generating income from selling puts and covered calls and less focused on whether or not we’re assigned shares. With Perpetual Income stocks, we’re also attempting to collect dividends where we can.

In the case of NEE, after our put expired worthless, we purchased 100 shares of the stock at $79.98 during our Aug. 27 Options Income Weekly Live Trading Session and immediately sold the NEE 13 Sep 81 Call for $1.04. Factoring in the call premium and the $1.42 we generated from selling puts, our cost basis on shares is $77.52, which is about4 % below the current share price.

The reason we chose to enter a covered call position rather than selling another put was that NEE was set to go ex-dividend on Aug. 30 with a $0.51 per-share quarterly dividend. When that cash hits our account on Sept. 16, it will further reduce our cost basis on shares.

Of course, given that our call expires three days before the payout date, it’s possible we could have our shares called away by then. But if we do, we stand to book a nice profit:

Shares called away at $81

Cost basis = $77.52

$3.48 in profit + $0.51 dividend = $3.99 total profit per contract for a 5.1% return in one month

Then again, we may just keep trading NEE to build up our cash further as we look to navigate what could be a challenging market in the weeks ahead.