Underwhelming earning reports and other economic data are showing that the Fed could get the data it needs to finally consider cutting rates sooner than later. However, as my colleagues have said many times, eventually bad news is going to be just that – bad news. For now, investors seem hopeful that a weakening economy will lead to cut rates that will, in turn, boost the economy back higher while keeping inflation at bay. So, how bad is the data coming in and what can you do about it to keep your portfolio safe?

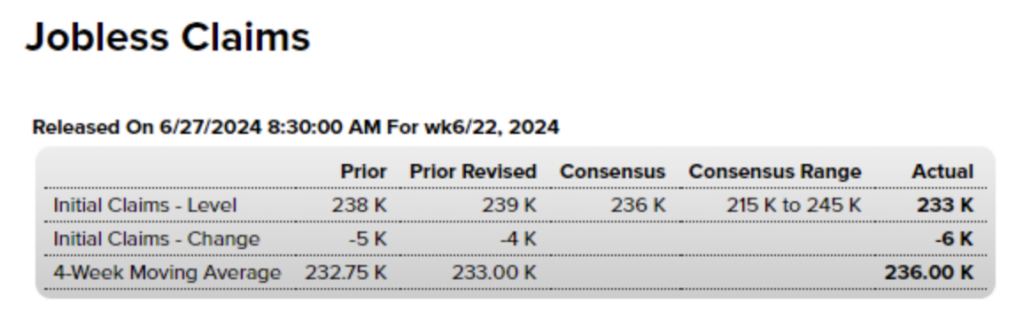

Jobless Claims came out and came in flat compared to the estimates, but the 4-week moving average ticked slightly higher.

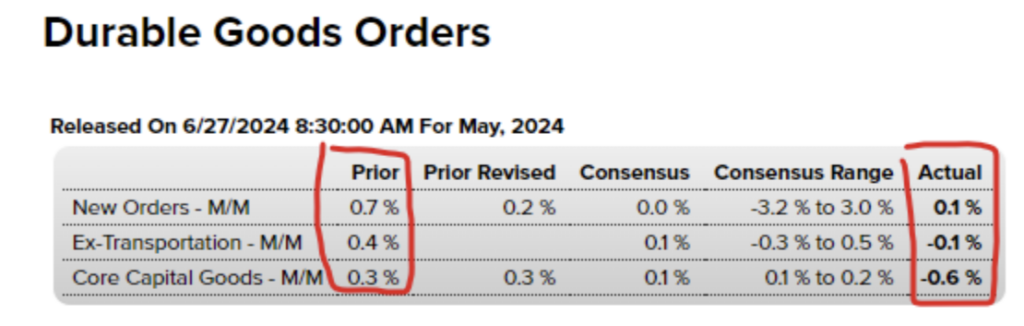

Next up is Durable Goods Orders and while it matched the consensus estimates, the report showed weakness from the prior month.

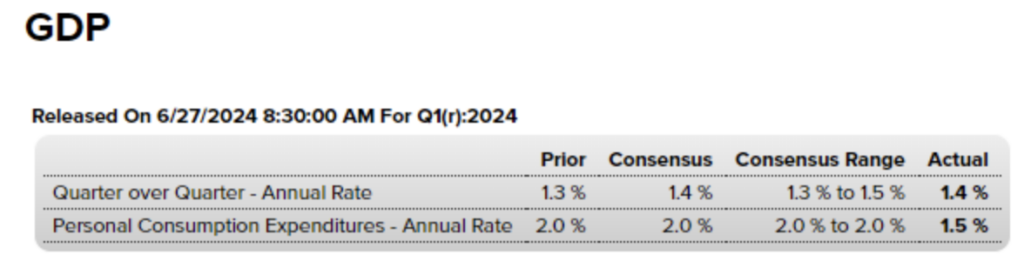

Then the Gross Domestic Product (GDP) report showed a flat line from the previous report. GDP went from 1.3% to 1.4%.

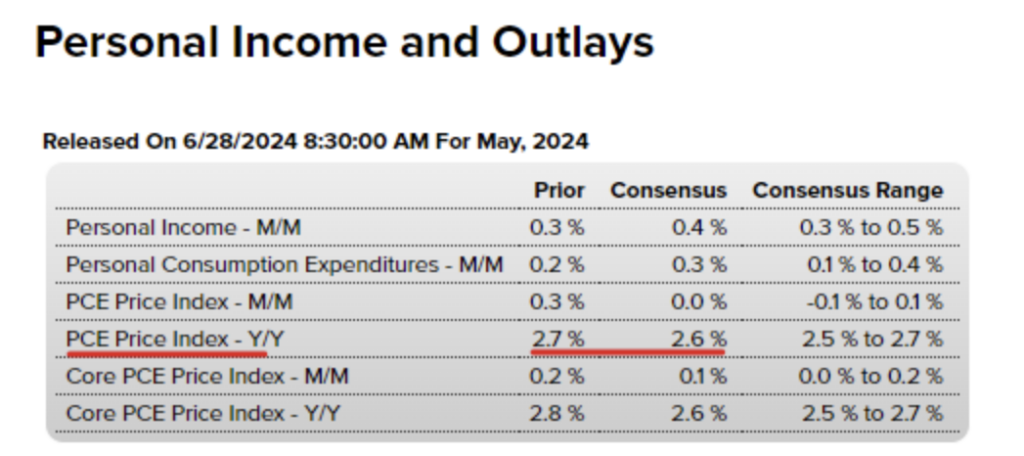

On the earnings front, Micron (MU) and Levi-Strauss (LEVI) missed earnings and didn’t provide much excitement for the future. That may help the next crucial report, the one the Fed looks at most, Personal Consumption and Expenditures (PCE). More specifically, the Fed likes to look at the less-volatile Core PCE, which excludes food and energy (convenient, right?).

The Fed will be looking for the year-over-year price to drop below the previous 2.7% reading.

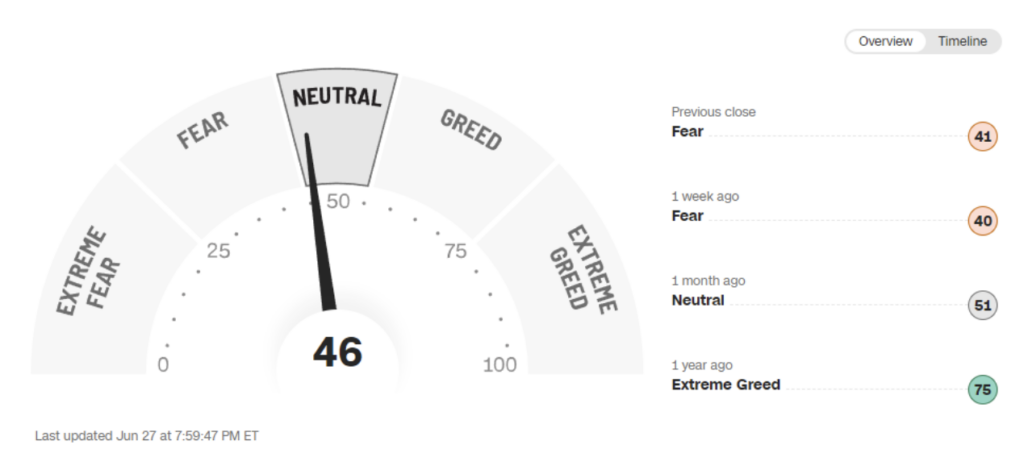

If that happens, we could see the bulls jump back into the market. Retail traders seem to be okay with the handful of poor economic news because they have finally helped push the CNN Fear and Greed Index out of Fear and into Neutral territory.

Investors are likely to stay in mega-cap names they are familiar with and ones that have a history of growth this year.

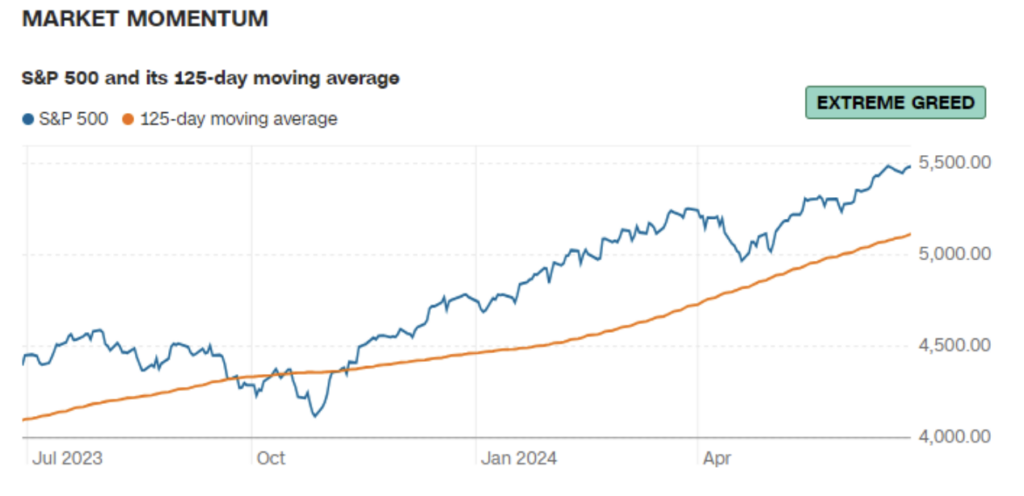

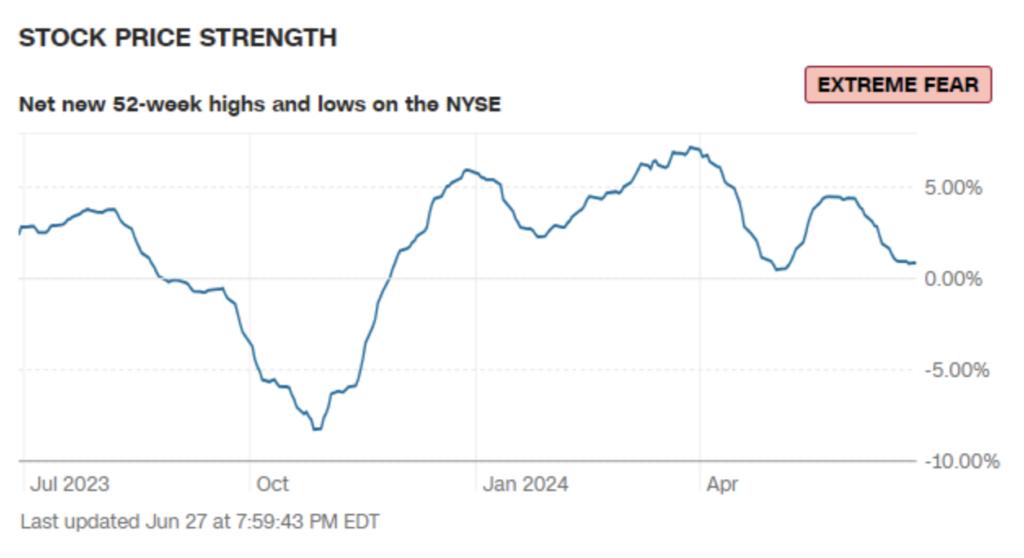

The market momentum is rising high (the S&P 500 is above its 125-day moving average), but the strength seems limited to a handful of stocks because the net number of stocks making new 52-week highs in the NYSE is just above 0% despite the S&P 500 hitting all-time highs not that long ago.

Where are the gains coming from then?

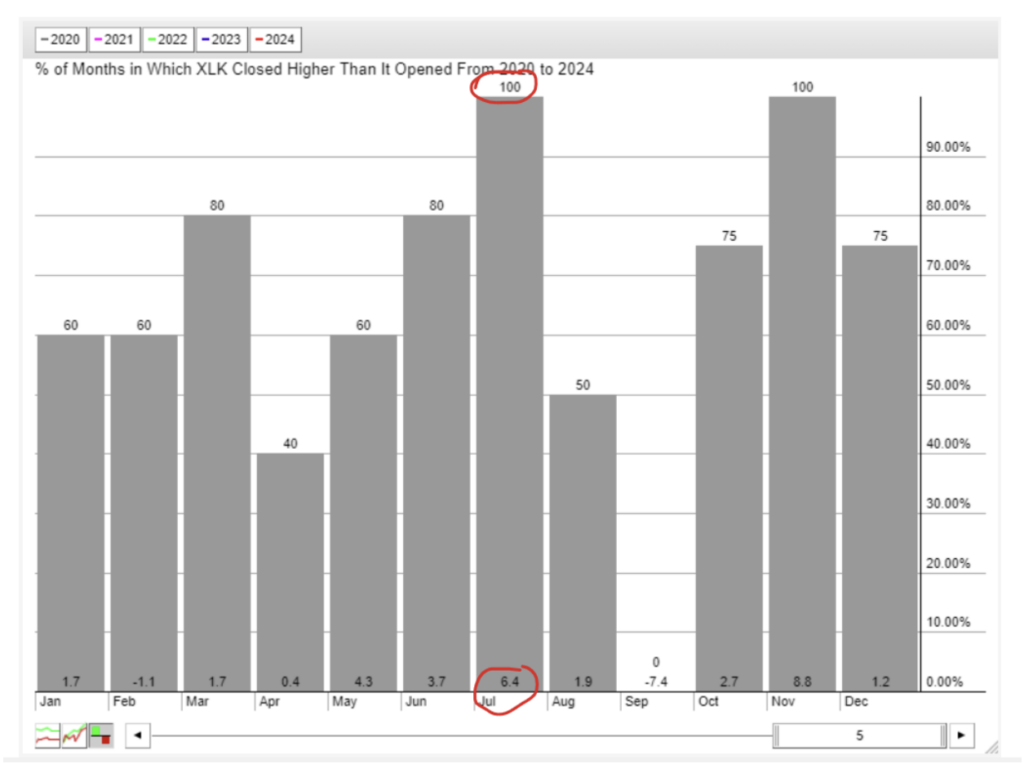

The Technology Sector ETF (XLK) is up over 20% this year and that ETF contains many of the mega-cap names like Microsoft, Nvidia, Meta, and more. I’d look for that trend to continue if the bulls have any steam left.

In the last 5 years, the XLK has increased in July 100% of the time with an average gain of 6.4%.

Over the last 10 years, the ETF has moved up 100% of the time with an average gain of 5.1%.

I would certainly start looking at stocks within the XLK for strength in July.

That’s it for me this week. Remember we have a shortened trading week next week with the 4th of July Holiday in the U.S.

Have a great weekend!