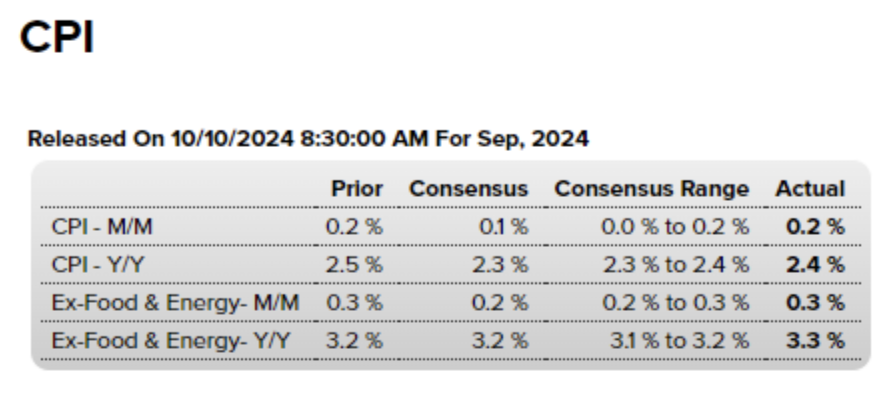

We have to talk about the Consumer Price Index numbers first. While the year-over-year numbers dropped to 2.4%, the month-over-month number ticked higher to 0.2%. But the number that caught most of the attention was the CPI excluding Food & Energy, which jumped to 3.3%. Food and energy can be volatile, so seeing the number move higher that excludes those areas is something to take note of, especially as the Fed tries to figure out if the market can handle a 25 or 50-bay-point cut. This would certainly point to a future 25 basis point cut.

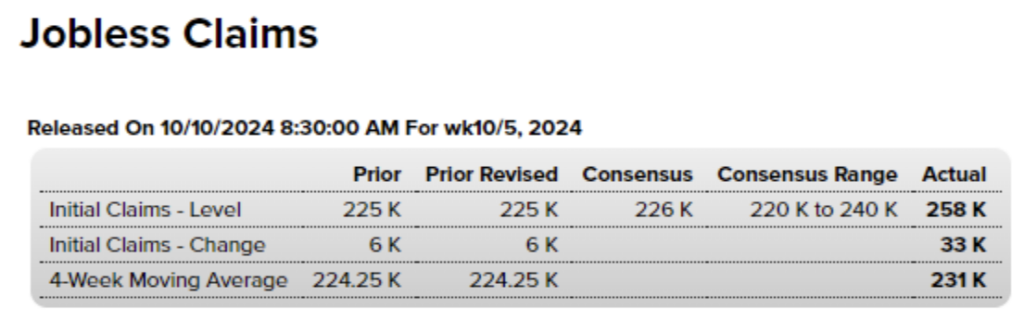

Then came the higher-than-expected jobless claims. This week’s 258k number trounced last week’s 225k number, but there’s likely a good reason. Hurricane Helene did extensive damage in Florida and North Carolina. Don’t be surprised to see this number jump even higher next week after we get a better feel of the damage caused by Hurricane Milton.

That brings us to the start of Q3 earnings season. Bloomberg is reporting that companies in the S&P 500 are expected to report an average +4.7% increase in quarterly earnings in Q3 from a year ago, although that is down from the +7.9% growth that was previously projected in July.

Bank of New York Mellon Corp/The (BK), Blackrock Inc (BLK), Fastenal Co (FAST), JPMorgan Chase & Co (JPM), and Wells Fargo & Co (WFC) kick off the earnings fun today.

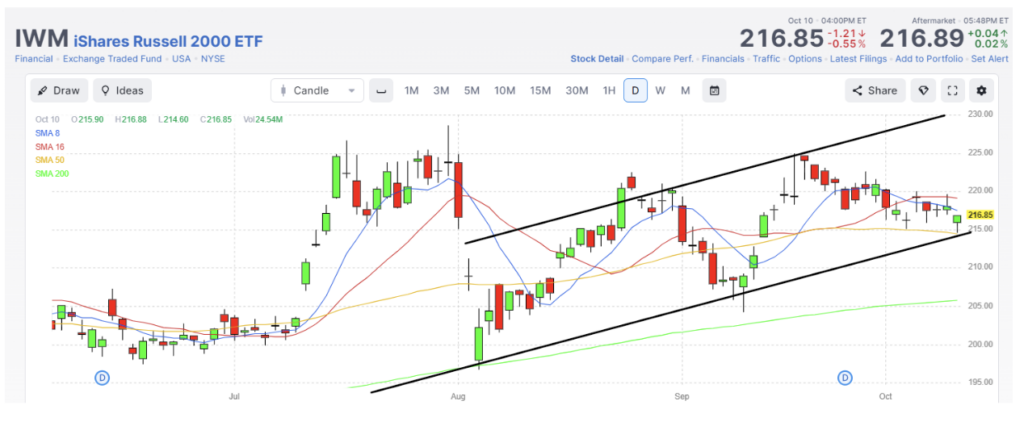

We will see how the market responds to the banks, but one thing that could give us an indication of where the market may be headed is looking at the Russell 2000 ETF, IWM. The Russell 2000 is often considered a barometer for investors’ tolerance of risk. The good news is that IWM is currently trading at the lower part of the existing trend channel, so we could see a broader move higher if the IWM starts to tick higher from here.

However, lately, it seems like the Semiconductor sector is leading the rest of the market either higher or lower. If that’s the case, we need to see ETFs like SMH break out of current resistance.

For that to happen, the sector needs stocks like Nvidia, NVDA, to keep moving higher. Given that the stock is sitting at resistance, we should get a feel in the next day or two for where the market is going to go.

That’s it for me this week. I hope to see you at our conference in Vegas next week!

Have a good weekend!