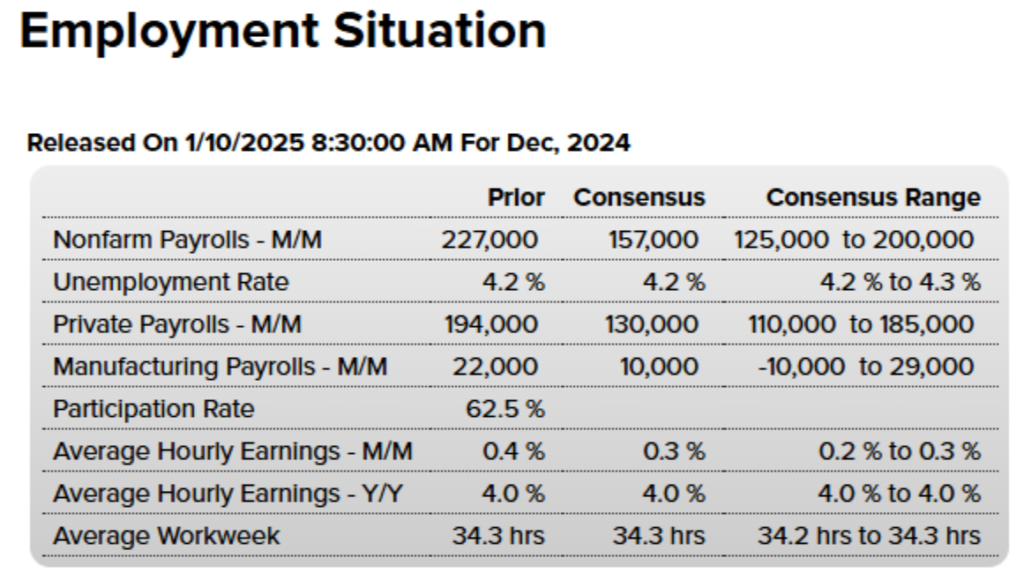

The U.S. Labor Department’s Employment Situation report provides a comprehensive overview of the job market, including job creation, the unemployment rate, and wage growth. In a “good news is bad news” market, a stronger-than-expected report could push the Fed to delay more rate cuts. However, if the numbers fall short of expectations, especially in the face of rising inflationary pressures, market participants may begin to question the underlying health of the economy.

Unemployment is expected to stay at 4.2%, which is still an indication of a healthy economy. Keep an eye for any large surprises outside of the Consensus range.

While the Fed has indicated its commitment to combating inflation through higher interest rates, a weakening job market might prompt a shift in priorities. In such a case, the Fed could delay planned rate hikes or even consider rate cuts if economic growth falters, aiming to stabilize the economy and prevent a potential recession.

Volatility and Market Reactions

The anticipation of these reports has already started to stir volatility. Rising bond yields and stock market corrections are just the beginning; if the Employment Situation report signals economic distress, we could see the U.S. dollar weaken and commodity prices rise, especially in sectors sensitive to interest rates, like housing and financials.

However, the Volatility Index (VIX) is fairly stable, sitting just under 20. Investors may be cautious, but we’re not seeing panic.

This volatility ties directly into the Fed’s decision-making process. The central bank has long used interest rates as a tool to control inflation and stimulate or slow economic activity. If rising volatility is seen as a sign of economic uncertainty, the Fed may decide that cutting rates is necessary to avoid a deeper downturn. Conversely, if job growth remains strong and inflation persists, the Fed may view the volatility as a temporary market reaction, keeping its hawkish stance intact.

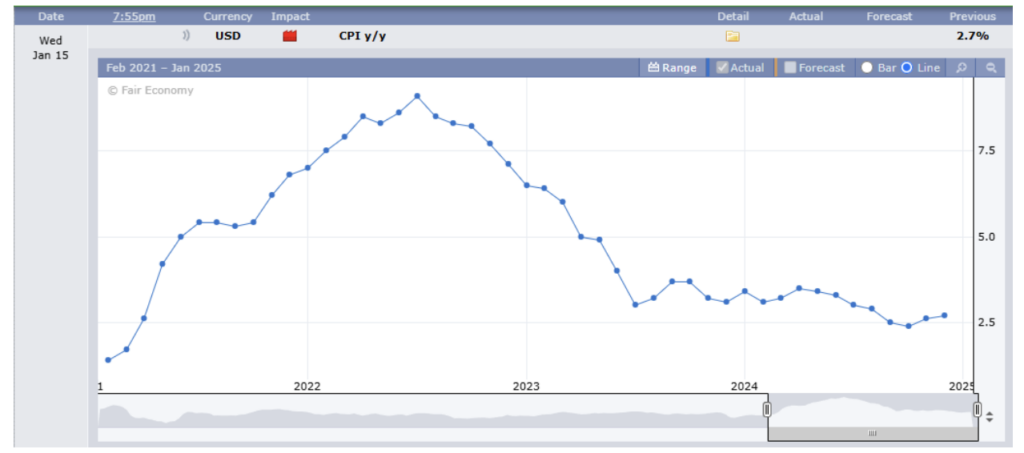

The Role of the Consumer Price Index (CPI)

The CPI report, set for release on January 15, 2025, is the next major data point investors will turn to. The CPI measures the change in the price of a basket of goods and services, providing a clear picture of inflation trends.

If the CPI report shows that inflation is still trending above the Fed’s target of around 2%, the central bank is likely to continue with its strategy of higher interest rates, potentially even bringing back rate hikes. A lower-than-expected CPI would add to the narrative that inflation is under control and that the Fed could ease its tightening stance, a decision that would likely calm markets and reduce volatility.

The interaction between the Employment Situation report and the CPI report creates a delicate balancing act for the Federal Reserve. While a strong jobs report could suggest that the economy is on solid footing, persistent inflation could prompt the Fed to maintain or even increase rates to curb rising prices. On the other hand, a weaker jobs report, combined with a favorable CPI reading, may offer a window of opportunity for the Fed to reduce rates in an attempt to stimulate growth without stoking further inflationary pressures.

Looking Ahead: The Fed’s Dilemma

The central question moving forward is whether the Federal Reserve will prioritize growth or inflation. The employment data offers insights into the health of the economy, while the CPI provides a measure of price stability. Should both reports point to a cooling economy and lower inflation, the Fed may feel the need to act more aggressively, perhaps even cutting rates earlier than expected.

However, if inflation remains sticky, the Fed may be forced to hold its ground and continue tightening, even if the labor market begins to show signs of weakening. This dynamic presents a challenge not only for policymakers but for investors trying to gauge the Fed’s next move.

With earnings around the corner, an incoming president set on tariffs and major economic changes, it’s no wonder the S&P 500 is stuck in a trading range.

The issue is that the S&P 500 (SPY) can’t stay above $600 (it’s tried three times) and it can’t fall below $580 (it’s tried three times).

You don’t often hear investors talk about a triple bottom or triple top – those events don’t follow typical trader psychology of why double tops and bottoms are formed.

That’s another reason why investors should exercise caution until the market makes up its mind. Sure, this sideways market could continue as it has since around November 5th, but that’s not usually the case for the big index.

Summary

The volatility stemming from the Employment Situation report is only the beginning of a critical period for the markets. With the Fed’s decisions on interest rates hanging in the balance, the subsequent CPI report will offer a clearer picture of whether inflation is under control or if the central bank needs to take more drastic action. For traders and analysts, the coming days will be pivotal in determining how the U.S. economy will evolve in the first quarter of 2025, with potential consequences for asset markets, inflation expectations, and growth projections. It’s a time of heightened uncertainty, but also an opportunity for those who can navigate the shifting tides.

Have a good day trading and I hope you have a wonderful weekend.