If you recall, I wrote that while there was more downside risk in the market, there were two things that had the greatest chance of bringing the market out of its trading range: jobs reports and Apple mentioning anything related to bringing AI to their offerings. Both happened last week, so let’s see what the potential impact is for the week ahead.

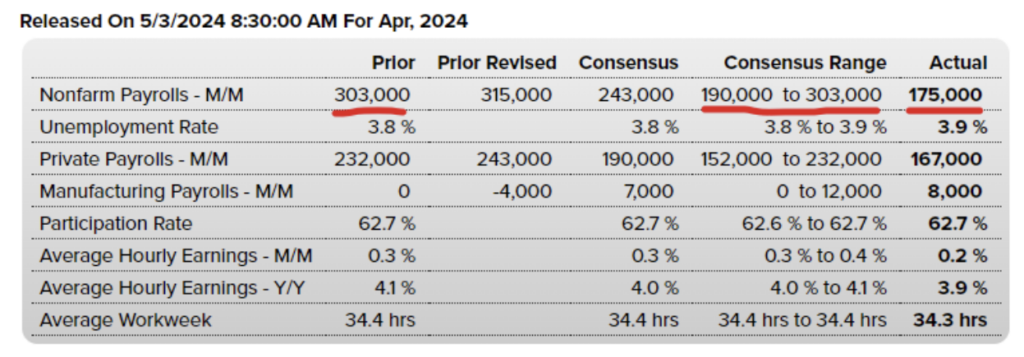

Employers cooled off hiring efforts in April with payrolls falling much more than expected and almost half from the prior month. This is what the Fed is looking for and while one jobs report isn’t enough data for a sudden change of heart, it was enough for the bulls to come out and take over from the bears, at least for a day.

“The demand for labor is slowing, which will eventually ease inflation pressures, giving the Fed some leeway to cut rates later this year,” said Jeffrey Roach, chief economist for LPL Financial. “Slower payroll growth and fewer hours worked imply the economy is slowing at a measured pace. This jobs report is consistent with the soft landing narrative.”

Markets were also strong late last week due to Apple (AAPL) gapping 6% higher after they announced a mammoth $110 billion stock buyback. The second crucial data point coming from Apple’s earnings was CEO, Tim Cook, mentioning AI.

“I think AI — generative AI and AI — both are big opportunities for us across our products, and we’ll talk more about it in the coming weeks. I think there are numerous ways there that are great for us, and we think that we’re well-positioned,” Cook said.

It’s important mostly because analysts have seen the once-perceived technology leader falling behind others in the AI race. Just the mention of more AI in their products was enough to give analysts hope that Apple won’t fall far behind.

The buyback announcement is at least an actionable item rather than talk about AI, but it’s also important to note that they are raising their stock price using buybacks to help during a time when sales of iPhones are near pandemic lows from four years ago.

The optimism from the jobs data and Apple was enough to bring the S&P 500 (as represented below by the ETF, SPY) to break higher than its previous swing high. We now have a series of higher highs and higher lows. Is the correction over? Are we bound to move higher? Was I wrong when I wrote that there is more downside risk?

You need to trade what price action gives you. I won’t argue with that. Let’s see if we can get a confirmation day or two and if so, we could see the SPY go to $515 and then challenge all-time highs.

That said, there is still a downside rise. From a fundamental perspective, the market is overpriced and investors could be too greedy with this jobs report and Apple news. One report isn’t a trend.

Remember it was only earlier last week that the jobs data also showed Q1 Unit Labor Costs rose 4.7% vs. the estimated 3.3% annual rate. Wage inflation will continue to pressure stocks unless the reduction of new jobs can outweigh the increase in wage costs.

I’m also looking at what this earnings season is telling us. Companies like Expedia Group didn’t fare as well as the rest of the market last week, despite its latest quarterly results beating Wall Street targets. Its shares slumped 15.3%, the biggest decline among S&P 500 stocks after it lowered its full-year bookings guidance.

Yet another company warned about forward guidance while the market rose by over 1% in a single session.

I’m standing by the roller coaster theory for now. I think we’ll likely see these big up days, followed by big down days. I don’t think this market will be as easy to navigate as at the beginning of the year, but that also means there should be bullish and bearish opportunities to choose from, giving investors more flexibility throughout the weeks ahead. We might even see the neutral iron condor strategy become more effective in the next few months.