The Fed rate frenzy is almost getting as hyped as seeing Roaring Kitty return to trading GME after years of being silent. All investors watched as the Consumer Price Index (CPI) numbers signaled ongoing disinflation. While stocks shot higher on Wednesday, investors ignored the Fed presentation later in the day. That was a mistake as the Fed laid out a troubling scenario.

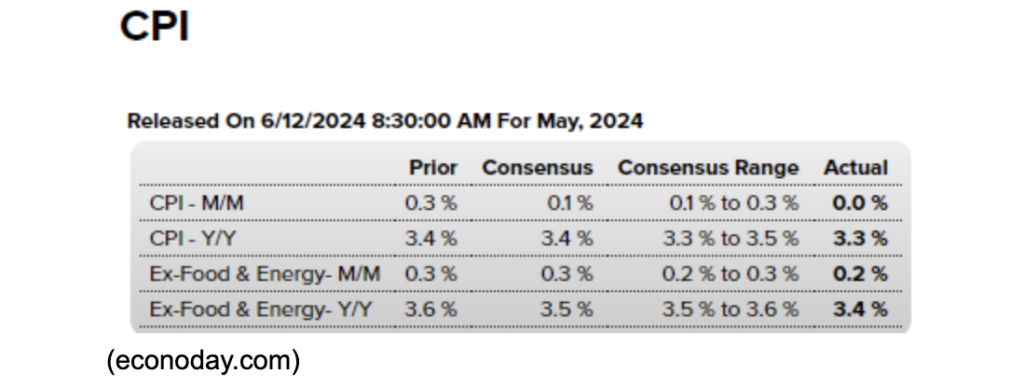

Let’s start with the good news. Consumer Prices are rising less than the consensus range. For example, the year-over-year number was expected to increase by 3.4%, whereas the actual CPI number came in at 3.3%.

While that is positive news, it’s important to realize that prices are still higher than a year ago – 3.3% higher! Investors cheered the news as a sign that the Fed will surely have to cut interest rates sooner, or maybe even add another rate cut before the end of the year, right?!

For those working 9-5 jobs, how many have you received a 3.3% raise? The disinflation story is great, but prices are still out of control while squeezing the middle and lower classes.

Then came the Fed Chair, Powell’s Q&A session in the afternoon. The one that investors tuned out of after seeing the data.

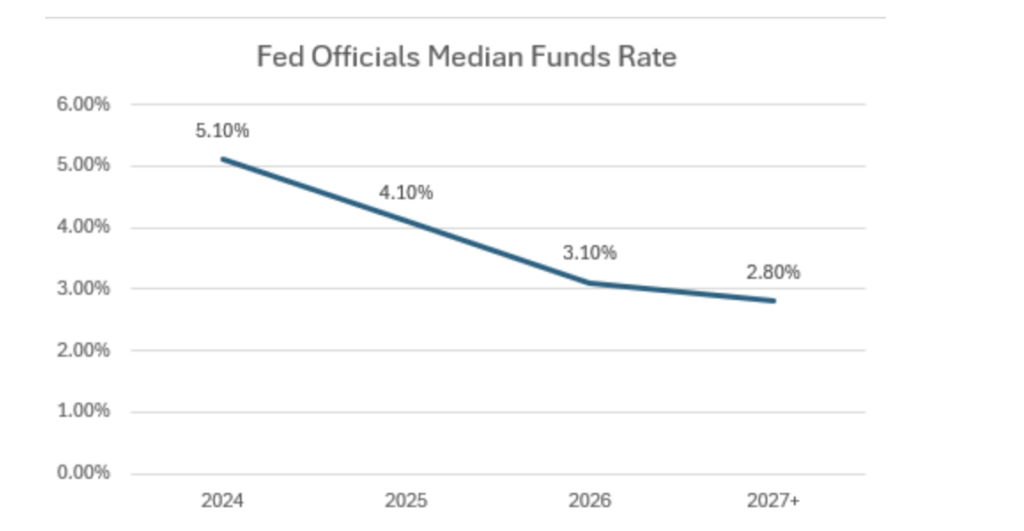

The Fed sees the Funds Rate slowly declining over the next few YEARS!

The median FOMC member now anticipates one rate cut in 2024, compared to the three indicated in March. Additionally, the federal funds rate is expected to be 4.1% in 2025 (up from 3.9%) and 3.1% in 2026 (unchanged). For the longer term, expectations have risen from 2.6% to 2.8%.

Their target goal is still to have inflation as low as 2%, but even they are saying it will take years to accomplish, and that’s if they’re still around after the next presidential cycle.

Powell went on to say, “We don’t have high confidence in forecasts.” And a bit later he said, “Unexpected labor market weakness could prompt a response. We are monitoring for signs of weakness, but none are observed currently.”

While the market was cheering, they seemed to forget the part when the Fed reduced rate cuts in 2024 from three down to possibly one. Or maybe investors are cheering that the Fed has reduced rhetoric around possible rate hikes soon. The reality is the Fed is in a wait-and-see pattern of looking at data and doesn’t know how else to say, “expect rates higher for longer.” And if we think that by the time jobs are lost the Fed can come in and save the economy with a rate cut, we are all missing the bigger picture.

CPI will likely drop from 3.3% to 2.75% by the end of the year as Jobless Claims increase. The labor force will shrink, as will the labor participation rate, and disinflation will continue.

If we don’t get the soft landing everyone wants, a recession will likely come into place next year in 2025, making dividends, commodities like Gold, and fixed-income assets attractive right now.

Anecdotally, when someone comes up and says to me, “I’m making so much money off bank interest,” I know that interest rates are high enough to get people excited about stashing cash into banks rather than the “riskier” stock market. I think that will continue throughout the year, with pockets of gains in stocks. If those are in the largest stocks, we could see the rise of the overall indices as well.

In the meantime, the S&P 500 (SPY) is still in bullish territory. The 14-day RSI stayed above 50 during the latest swing low, showing that the bullish trend is still intact and likely to continue. Watch out for the smaller moving average crossovers to indicate weakness, but right now the 8-day simple moving average (blue line) is well above the 16-day (red line). We may try to fill the gap at $537, but I could see base building at these levels for a few weeks before trying to push higher in July.

I hope everyone had a great week of trading and is looking forward to next week! Have a wonderful weekend.