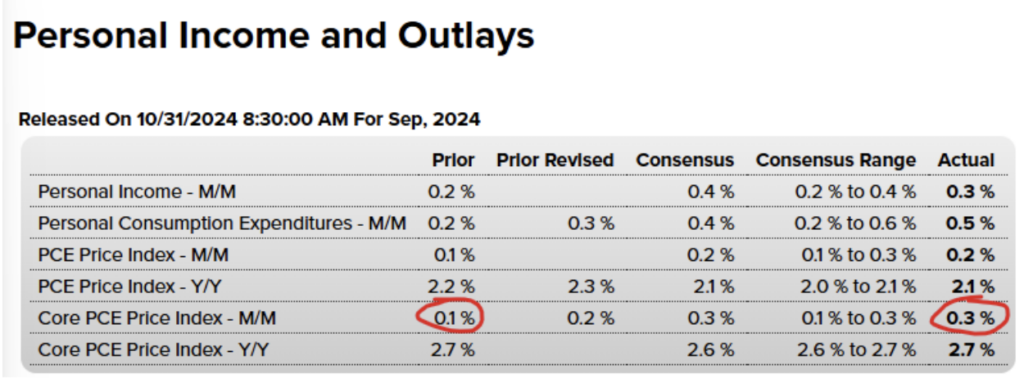

Let’s start by looking at some economic news that is putting pressure on the markets. The Personal Income and Outlays, aka PCE) report showed an increase in the prices of goods month-over-month. The last report showed a 0.1% increase but this month it jumped higher to a 0.3% increase.

That shows that when the Fed cuts rates, there is a reaction to prices. Despite many calling for a jumbo rate cut from the Fed, this report shows exactly what would happen if they did that. Prices would increase and inflation would move back higher.

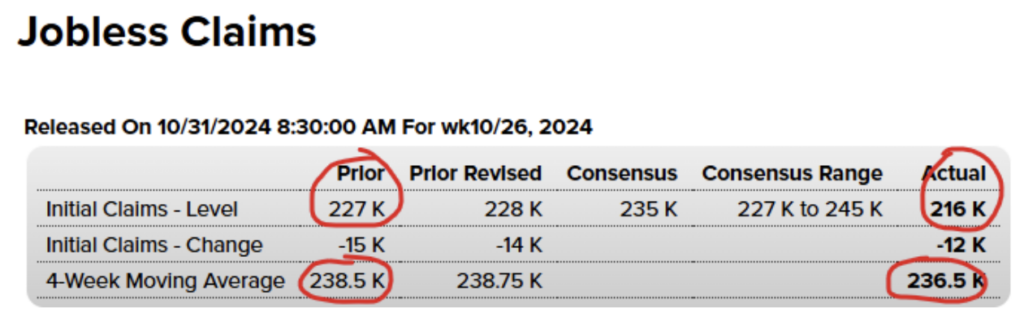

In positive economic news, jobless claims this week came in lower than expected, meaning the hurricanes didn’t cause as many jobs as originally anticipated. That helped lower the 4-week moving average (that’s a good thing).

So, why did the Volatility Index (VIX) skyrocket 13.8% in a single session?

Meta and Microsoft highlighted growing artificial intelligence costs that will hit future earnings, which curbed enthusiasm for megacaps. Both companies dropped over 5% despite BEATING earnings estimates.

Investors want to know if the cost will eventually bring in profits or if AI is the new MetaVerse.

Technically speaking, this week is barely a blip on the S&P 500 Weekly chart (using Heikin Ashi candles to smooth out the trend).

But the chart doesn’t look as nice going down to the smaller time frame, like a Daily chart. We’ve broken through the trend line as well as the recent support level. That means $564 (or $5640 on the SPX) is the next support line unless we see a quick rebound back above $575.

Going back to my original question – did the Halloween sell-off give us a good entry?

With the U.S. election and the next Fed meeting around the corner and with the daily price action technically breaking down, I’m staying on the sidelines until some of the unknowns become known. I’m not usually one to time market bottoms or tops, but there’s no clear bullish move here. Maybe in bonds and gold, but otherwise I’d much rather wait to see if the market can rebound back to $580 or give me some chart pattern to let me know the selling has stopped.

Does that mean it’s time to sell everything? No! The market is still in a strong uptrend and even after July’s 10% pullback, the market moved higher. This is a time to wait-and-see. Please note, I’m not a financial advisor and this is just my opinion. Ultimately you need to do what’s right for your investment objectives.

I hope everyone had a good Halloween and I will see you here next week for one of the biggest news-driven weeks of the year.