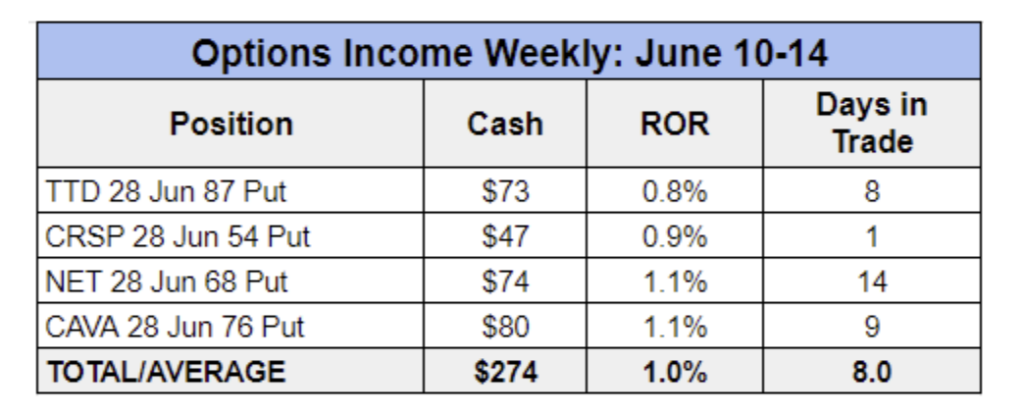

Options Income Weekly members closed four trades last week, pocketing $274 in cash and averaging a 1% return per trade with an average holding time of eight days. This brings our monthly total cash to $508 for the first half of June. Not a bad start!

We closed our first one-day trade of the year last week after we booked profits on CRISPR Therapeutics (CRSP) less than 24 hours after we entered the trade.

This stock was actually brought to our attention by members, who asked that we look into the Switzerland-based biotechnology company as a potential income opportunity.

CRISPR Therapeutics develops gene-based medicines. The company received its first major regulatory approval in late 2023 for gene-editing treatment Casgevy, which is used to treat sickle cell disease.

The stock hit a high around $91 in late February before selling off sharply. By the time shares bottomed out in mid-May, they were down 44% from peak to trough.

This bottom came shortly after the company reported its first-quarter results, which showed a narrower-than-expected loss. And upon further inspection, we saw the stock had managed to develop a nice uptrend over the past month, had enough volume and a decent implied volatility rank (IVR) of around 35%.

We entered a trade on CRISPR Therapeutics during the June 11 Options Income Weekly Live Trading Session. With the stock trading around $59 a share, we sold the CRSP 28 Jun 54 Put for around $0.67, or $67 per contract.

Setting the strike price 8.5% out of the money (OTM) gave us some room to manage the trade should this volatile stock move against us. Although, at 17 days to expiration (DTE), the trade was a bit closer in than we’ve typically been going (find out more about that here).

Aiming to capture 70% of the max profit on this trade, we set our target exit price at $0.20, placing a good ‘til canceled (GTC) order to buy back the put at that level. We expected that target to be hit well before expiration, but what happened next surprised even us.

CRSP continued to run after we wrapped up our trading session in the early afternoon, closing the day at $62.31. Shares continued to rally the following morning, as the market opened strong on the heels of the latest CPI report, which showed inflation slowed more than expected in May. This gave investors hope the Federal Reserve will cut interest rates later this year.

Shares hit a high of $67.87 that afternoon. But our GTC ordered triggered hours earlier, allowing us to exit the trade with a profit of $0.47, or $47 per contract, and a 0.9% return on our $5,400 in allocated capital in just one day.

One-day trades certainly aren’t the norm, but they are possible when you have an outsized move in an underlying stock or the broader market. And they’re certainly exciting, allowing you to turn your capital over quickly in the pursuit of more premium.

We’ll be putting that capital back to work with new Options Income Weekly trades next week. And please don’t hesitate to let us know if you come across a potential income opportunity that you’d like us to investigate further. We’re always on the lookout for new ideas.