Despite investors’ hesitation toward the Jackson Hole Symposium, the event finished with the much-anticipated message from the Fed that it is now time for interest rates to come down. The market has already been pricing in rate cuts, so the next thing to watch for is how quickly rate cuts will be implemented. The market is pricing in a 0.25 basis point cut in September. How will this news impact trading for the week ahead?

Retail earnings are taking center stage this week with a dozen or so retailers reporting this week. The earnings season so far has been mostly positive, with some mega caps giving a lower future guidance. Despite the somewhat muted session, we could see some big names move by over 10% this week after they announce earnings.

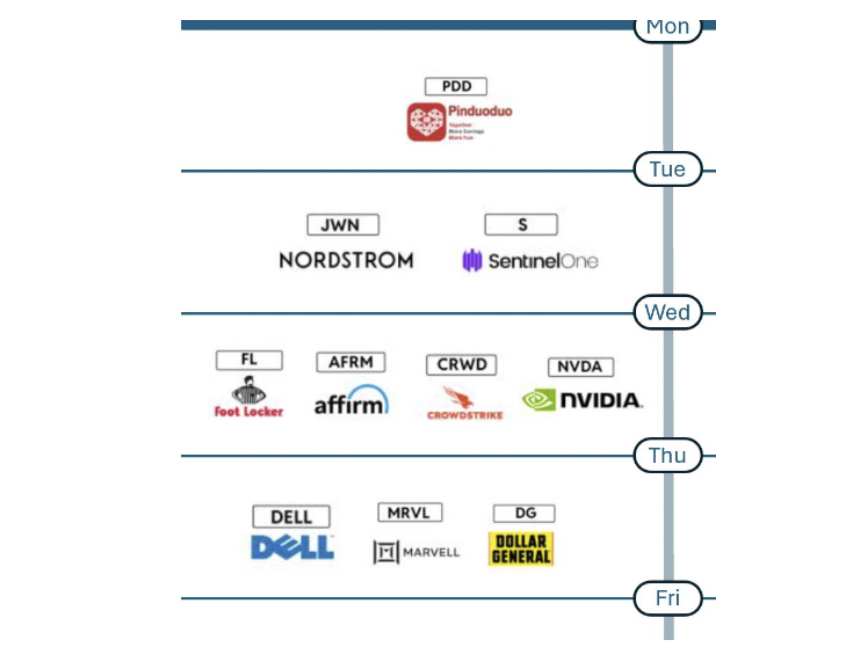

Monday – Pinduoduo (PDD)

Tuesday – Nordstrom (JWN) and Sentinel One (S)

Wednesday – Foot Locker (FL), Affirm (AFRM), Crowdstrike (CRWD) and Nvidia (NVDA)

Thursday – Dell (DELL), Marvell (MRVL) and Dollar General (DG)

It will be interesting to see how many of them mention the impacts of rate cuts on future sales. The consumer has been resilient throughout the last few years. Certainly, the technology and AI stocks could continue the next leg up if Nvidia offers strong forward guidance.

Despite retail earnings announcements this week, it’s also the last unofficial week of summer with the U.S. Holiday, Labor Day, happening a week from Monday. Senior officials will likely be out of the office, and I doubt they will let the office interns allow the market to fluctuate too much. I’d expect to see lighter trading volumes this week and a resumption of the existing trend.

Other economic reports you should be aware of this week include:

Monday – Durable Goods Orders

Tuesday – Consumer Confidence

Wednesday – Fed Member Waller speaks

Thursday – Unemployment Claims

Friday – Core PCE Price Index

In terms of the S&P 500 (using the SPY ETF), look for a key level at $565. That was the previous high before the historically unusual July dip. Looking at historical averages for the next 5 days after the Jackson Hole Symposium, and given the increase we saw over the last five days, history says we should move sideways from here. That would become a problem if the market can’t cross over that $565 level and not complete a new higher-higher.

This makes earnings this week that much more important – the market needs bullish fuel to keep the rally going. Even if the market does drift lower this week, I’d still look for support at the 50-day moving average for now, which is working its way toward the $550 level.

The Technology 100 (QQQ) is showing signs of potential weakness and the index needs a strong showing from Nvidia this week. Here’s what you should watch for this week – the index made a lower high and a lower low and even with the positive news from the Fed, Friday’s price action wasn’t enough to clear Thursday’s high. If the index can’t find more bullish fuel, it could halt the S&P 500’s progress as well.

How will the market continue to react to the Fed’s rate cut plans? Can Nvidia help tech continue the rally this week? August has historically been a neutral month, leading into a historically bearish month of September, but this year is different. This year hasn’t behaved to historical norms in the last two to three months, so we could be setting up for something completely different in September. Let’s see how this week goes and then we can target potential levels, both up and down. Stay tuned this week and next. We’ll keep you posted.