GOAL OF THIS TRAINING: To provide options traders with a comprehensive understanding of assignment risk, how to assess it using key option metrics, and practical strategies for managing or leveraging assignments. This training aims to build confidence and control in navigating options.

WHO THIS IS IDEAL FOR:

Options traders with a basic understanding of calls and puts who want to enhance their risk management skills, especially those who:

- Actively sell options (e.g., covered calls, cash-secured puts, credit spreads).

- Seek to understand and manage early assignment risk.

- Desire to incorporate planned assignments into their trading strategy.

In the fast-paced world of options trading, understanding the nuances of how positions can evolve is crucial. While the market might be making headlines with giants like Nvidia hitting $4 trillion (again!), or airlines like Delta and United soaring, the real story for many traders lies in managing their positions effectively. Today, we’re diving deep into a topic that often causes more annoyance than fear for options traders: assignments.

The Basics: Exercise vs. Assignment 🧐

Let’s clear up some fundamental terms. When you trade options on stocks and ETFs (known as American-style options), they can be exercised by the option buyer at any time before expiration. This means:

- Call Option Buyer: Can choose to buy the underlying stock at the strike price.

- Put Option Buyer: Can choose to sell the underlying stock at the strike price.

As an option seller, you’re on the other side of this transaction. You face assignment, which is the obligation to fulfill the buyer’s exercise.

- If you sold a call option and are assigned, you must sell 100 shares of the underlying stock you own (as in a covered call).

- If you sold a put option and are assigned, you must buy 100 shares of the underlying stock.

It’s important to note that only sellers of options can be assigned, and this can happen before expiration, not just at expiration. This early assignment risk is a key differentiator for American-style options compared to European-style options (like index options such as SPX or NDX), which can only be exercised at expiration.

Demystifying Assignment Risk: Intrinsic, Extrinsic, and Time Value

Understanding the factors that influence assignment risk is paramount. Three key option metrics can help you assess this risk:

- Intrinsic Value: This is the amount by which an option is “in the money.”

- For a call option: It’s the stock price minus the strike price.

- For a put option: It’s the strike price minus the stock price. If your sold option has intrinsic value, it means the stock has moved past your strike price, and theoretically, you’re at risk of assignment.

- Extrinsic Value: This is the value of an option above its intrinsic value, primarily driven by time and volatility.

- Calculation: Option Price – Intrinsic Value.

- Why is this important? Because if an in-the-money option still has significant extrinsic value, the buyer is less likely to exercise it early. They would likely benefit more by simply selling the option back into the market rather than exercising and losing that extrinsic value. As extrinsic value (especially time value) diminishes closer to expiration, the risk of early assignment sharply increases.

- Time Value: A subset of extrinsic value, time value represents the remaining time until an option expires. Early in a trade (e.g., 35-45 days to expiration), time value is high, making early assignment rare. However, as expiration nears, time value rapidly decays, especially during the final weeks. This acceleration of decay (often referred to as the “gamma effect” in the last week) is why proactive management is crucial.

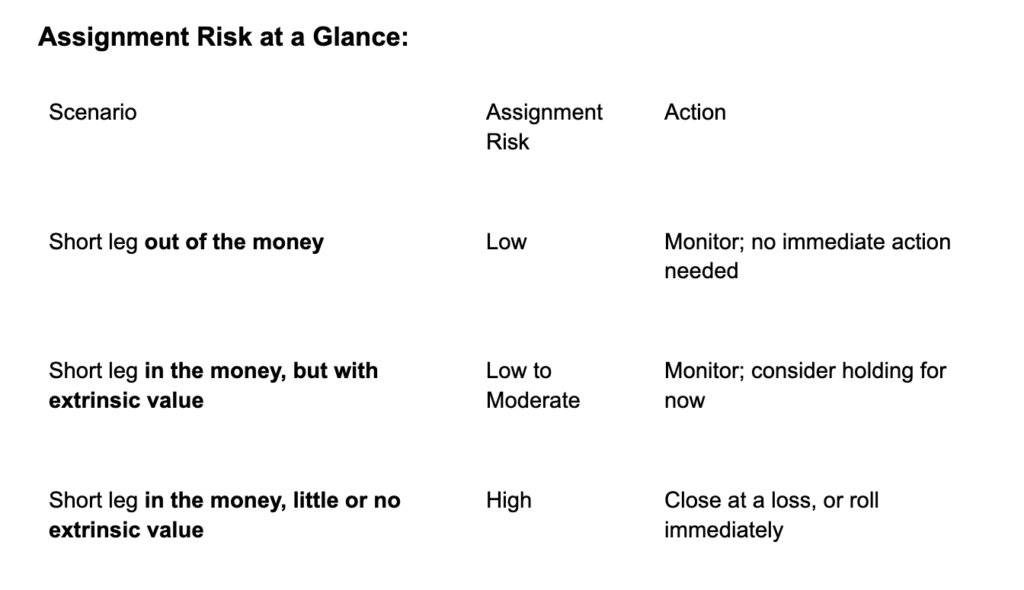

This general guideline helps determine when to consider taking action. For instance, if your short put is in the money but still has a month until expiration and significant extrinsic value, you likely have more leeway than if it’s deeply in the money with only a few days left.

Avoiding Assignment: Proactive Management is Key

The best defense against unwanted assignments starts with a solid trade setup:

- Liquid Underlyings: Choose stocks or ETFs with active options markets for easier adjustments.

- Directional Bias: Understand your outlook for the stock (neutral, bullish, bearish) and choose strategies accordingly.

- Implied Volatility Rank (IVR): Aim for an IVR of 30% or higher to potentially collect more premium.

- Days to Expiration (DTE): Consider initiating trades with 35-45 days to expiration. This provides ample time for the trade to work out and for time decay to benefit you.

- Delta: Target a delta around 15, which generally corresponds to a higher probability of the option finishing out of the money.

- Credit Received: In a perfect world, aiming for 1/3 of the spread width is ideal, but in lower volatility environments, target a net return of 8-10%.

- Target Price: Set clear profit targets (e.g., 50-60% of max profit) and use “Good ‘Til Canceled” orders to capture profits efficiently.

Even with the best setup, stocks can (and will) move against your position. Consistent monitoring is vital. If your short option gets within 3% of the money, or if you’re within the last 2-2.5 weeks to expiration and your strike is still at risk, it’s time to prepare for action. Unexpected news or market shifts can dramatically impact positions in those final days.

Common Management Tactics:

- Roll the Position: This is the most common adjustment. You can roll your options:

- Out in time: To a later expiration date.

- Out in strike: To a different strike price further away from the current stock price.

- Often, you’ll roll both out in time and out in strike to collect additional credit and give the trade more time to recover.

- Add Another Side to the Trade: For spread trades, you might add an opposing spread (e.g., a call spread to a put spread to create an iron condor) to collect more premium and manage the overall risk.

- Trade Reset: If the stock moves significantly against you, it might be best to close the current trade (even at a loss) and re-establish a new position with a fresh thesis, especially if you still believe in the original directional bias.

- Convert to Another Option Strategy: Depending on the situation, you could adjust your position into a more complex strategy like a butterfly or iron fly.

Embracing Planned Assignments: When Being Assigned is Good

While avoiding unwanted assignments is a primary goal, there are scenarios where taking assignment is part of your trading plan:

- Acquiring Stock at a Discount: You might intentionally sell a cash-secured put at a strike price where you’d be happy to own the stock if assigned. For example, if a stock trades at $100 and you sell the $98 put for $2. If assigned, you effectively buy the stock at $96 ($98 strike – $2 premium).

- Managing Perpetual Income Trades: In strategies focused on generating regular income, you might strategically allow assignment on a covered call to realize capital appreciation and then move back to selling puts to re-acquire shares and continue the cycle.

In these cases, assignment isn’t an annoyance but a planned step in your trading journey, allowing you to achieve specific investment goals.

The Bottom Line: Stay Engaged, Stay Prepared 🛡️

The market is constantly evolving, and while bull runs can feel exhilarating, complacency can be costly. Proper setup helps, but it doesn’t guarantee smooth sailing. Consistent monitoring and understanding the nuances of intrinsic and extrinsic value, alongside time decay, are your best tools to navigate potential assignment risks.

Remember, the goal isn’t necessarily to fear assignment, but to understand it, anticipate it, and have a plan to manage it. Whether it’s adjusting a challenged position or embracing a planned assignment, being proactive keeps you in control.

YOUR NEXT RECOMMENDED TRAINING:

Secrets To Options ➡️ ➡️ ➡️