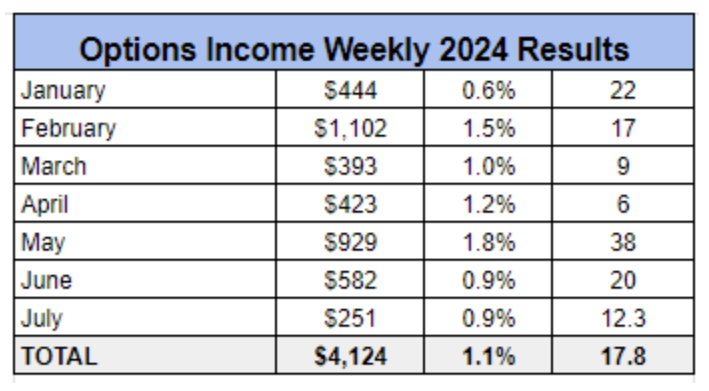

After closing four profitable trades in the first half of the month, we’ve yet to close another Options Income Weekly position in over two weeks. While it’s great to bank consistent profits, that’s just the way it goes sometimes.

Unless we get a nice pop for the final trading day of the month, July will mark our lowest-earning month so far this year.

The market had some of the wind taken out of its sales in the later part of the month, as investors seemed to suddenly grow skeptical of AI leaders’ potential. The Nasdaq 100 is approaching correction territory, down more than 9% since its July 10 peak as of the close on July 30.

The bulk of the selling has been in the high-flying tech stocks, with the Magnificent Seven losing $1 trillion in value in a single day last week, marking their biggest one-day decline ever recorded.

Contributing to the tech rout were Alphabet (GOOGL) and Tesla’s (TSLA) earnings reports, which seemed to disappoint investors despite Alphabet beating on the top and bottom line. Tesla’s revenue also exceeded expectations, but earnings came up short.

We may see more of the same following Microsoft’s (MSFT) earnings, which were released after the close on Tuesday. The stock sold off in after-hours trading after the company reported better-than-expected quarterly earnings and revenue. However, revenue from the company’s Azure public cloud and other cloud services grew 19%, a far cry from the 29% growth analysts were expecting.

Three more of the Magnificent Seven stocks are on deck to report earnings this week with Meta Platforms (META) set to announce after Wednesday’s close, followed by Amazon (AMZN) and Apple (AAPL) on Thursday.

Adding to uncertainty this week is the two-day Federal Reserve meeting, which concludes Wednesday. The market expects the Fed to leave its benchmark rate at 5.25% to 5.5%. However, investors will be dissecting central bankers’ comments for signals of an interest-rate cut in September.

All of this added uncertainty in the market has led to a spike in options volatility. The CBOE Volatility Index (VIX) is back up above 17 for the first time since the April market sell-off.

While the lack of volatility is something we’ve been bemoaning for the past few months, the combination of the swift market downdraft and higher volatility has made it harder to turn over capital quickly.

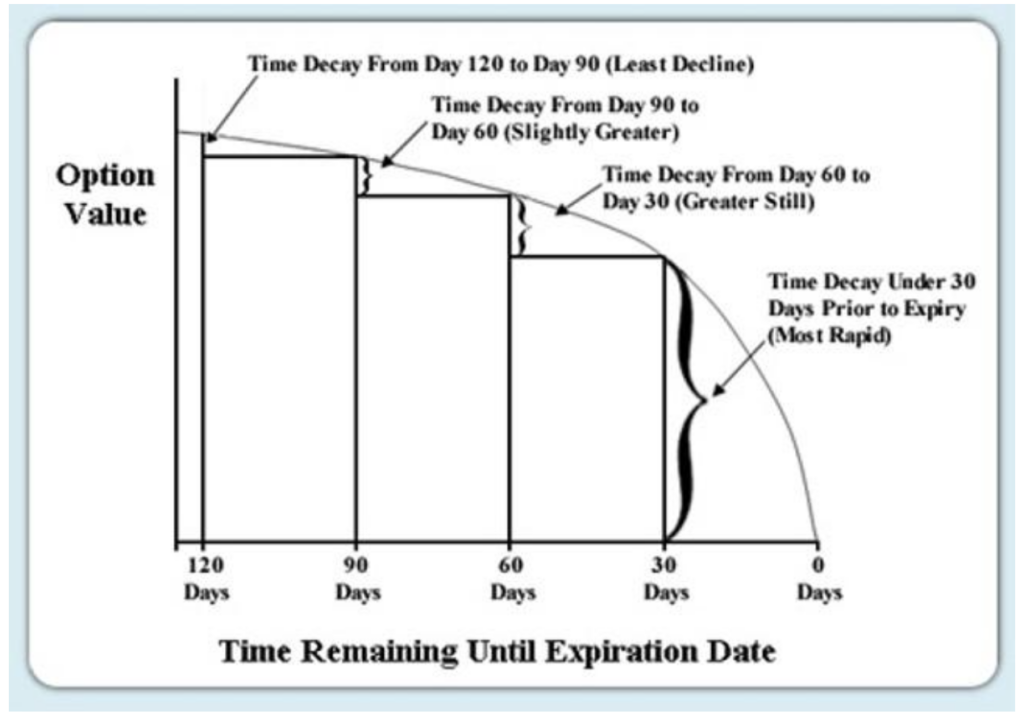

Theta, or time decay, measures the amount an option decreases as time passes. As option sellers, we benefit from theta. As an option approaches its expiration date, all else being equal, it will lose value, thus allowing us to keep more of the premium we collected upfront when we sold the option.

Theta accelerates the closer an option gets to expiration, with the most rapid decay coming in the last 30 days before expiration, as illustrated in the graphic below.

Theta decay is one of the few constants in the market. However, in a market as uncertain as this one, volatility has been overshadowing the erosion of time value, keeping premiums high and keeping us in positions longer than usual.

Yet, despite the market’s gyrations in recent weeks, we remain in a bull market for now, even if it doesn’t quite feel like it.

It will be interesting to see how the market responds to the Federal Reserve’s comments and the remaining big tech earnings. A full-blown correction is not out of the realm of possibility. But it’s important to remember that they happen and not let emotion take over.

We’ve been through slow periods before, and this certainly won’t be the last one. It’s going to require some patience – and more adjustments than usual – but it’s all part of the game.