Last week was a very good one for Income Masters members, with nine profitable positions closed and more than $3,100 in cash generated. This included our 20th winning trade in a row on drugmaker Eli Lilly (LLY).

We’ve been cashing in on the weight-loss drug craze, booking more than $5,700 in cash from LLY over the past year using a bull put spread strategy. The latest trade on LLY was last week’s highest-earning trade from a cash and rate-of-return perspective. We earned $815 in our live account trading five contracts for a 16.3% return.

Coming in second was a trade on electric vehicle maker Tesla (TSLA) that was a bit unusual for a few reasons. For starters, it was our first ever options straddle traded in Income Masters, but we’ll get to that in a moment.

The other reason this trade was a bit different is that it was also a recovery trade of sorts.

Back in mid-July, we discussed the wild ride Tesla had taken us on since we traded it during the April round of Income Madness. We entered a bear call spread on the stock a few hours before the company was set to report its first-quarter results on April 23.

A bear call spread is a neutral-to-bearish strategy that involves simultaneously selling a call option and buying a call option with the same expiration date but a higher strike price. The risk profile is similar to that of the neutral-to-bullish put credit spread. And we look for similar criteria when selecting these trades, including an implied volatility rank (IVR) of 30 or more, decent liquidity and a 10%-plus return on risk.

However, this strategy can be a bit trickier to manage than bull put spreads because the market has a long-term bullish bias, rising more than it falls over time. Additionally, much of an individual stock’s move has to do with the overall market direction, and stocks tend to move higher even on bad news.

And that’s exactly what happened with Tesla. The company missed earnings estimates and reported its sharpest year-over-year decline in quarterly sales since 2012, as well as a 55% drop in net income. Yet, the stock rallied 12% the next day.

It just goes to show you that even if you can correctly predict whether a company will miss or beat expectations, there’s no telling how the market will react.

Despite our efforts to mitigate risk by selecting a short call strike that was 15 points beyond the stock’s expected move, our call spread went into the money, forcing us to adjust the position.

We rolled the call spread out and added a put spread, creating an iron condor, to reduce our debit from rolling. We eventually closed that position and opened a new put spread, forgoing the call side due to the stock’s bullish momentum.

As TSLA shares advanced, we continued to trade put spreads, reducing our net debit to just $0.50 per contract ($1.50 on three contracts we traded) on a position that had been deep underwater a few months earlier.

However, as we considered our next move, we decided to change tack again, utilizing an options straddle when we went back to trading Tesla this month.

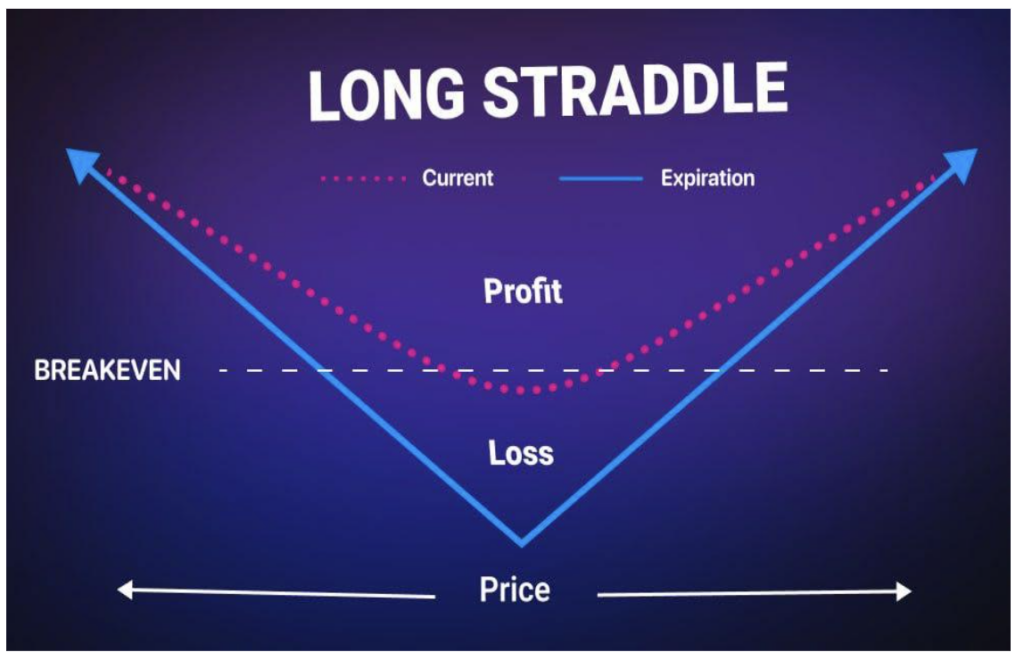

A straddle is an options strategy in which you buy or sell a call and a put option at the same strike price and same expiration date. When you buy the call and put, you have what is known as a “long straddle” versus selling them and creating a “short straddle.” While we are typically option sellers, we only trade long straddles.

A long straddle is an ideal trade when you’re looking to profit from increasing volatility but are unsure of which direction the underlying might go next. The goal is to profit from a big move in the underlying up or down. Since you pay a debit to enter the trade, you’re looking to close it by selling the position for a credit that is more than the debit you paid.

Long straddles are a defined-risk trade, as the maximum loss is limited to the total debit paid to enter the trade. However, unlike when selling options, time decay is working against us rather than for us, as the value of the options we bought will decline as expiration approaches. So, if the underlying does not move enough to reach profitability before expiration, the position may require an adjustment.

Yet, as you can see in the chart below, a lack of movement isn’t generally a problem for TSLA.

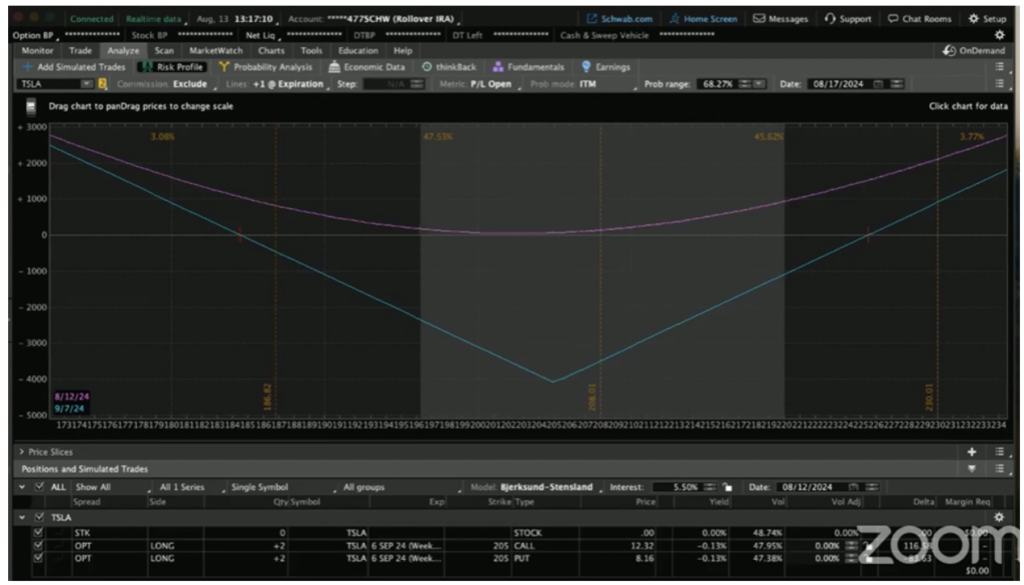

On Aug. 13, with the stock trading at $207.33 and sporting an implied volatility rank of 21, we bought the TSLA 6 Sep 205 Put and the TSLA 6 Sep 205 Call for a net debit of $20.48 each. We traded two contracts of the straddle in our live account, costing us $4,096 in options buying power.

We essentially gave ourselves 24 days for the stock to make its move.

While we didn’t set a target exit price at the time we entered the trade, we added one two days later at $23.50, placing a good ‘til canceled (GTC) order at that level. The GTC was triggered the next morning as TSLA ran up toward the $220 level.

We exited the trade with a profit of $302 per contract ($23.50 credit – $20.48 debit to enter), or $604 for two contracts. This more than offset the loss from the previous Income Madness trade and earned us a 14.7% return on our capital in just three days.

Be on the lookout for more long straddles in the Income Masters program as we look to take advantage of volatility… without necessarily having to guess which way a stock is headed next.