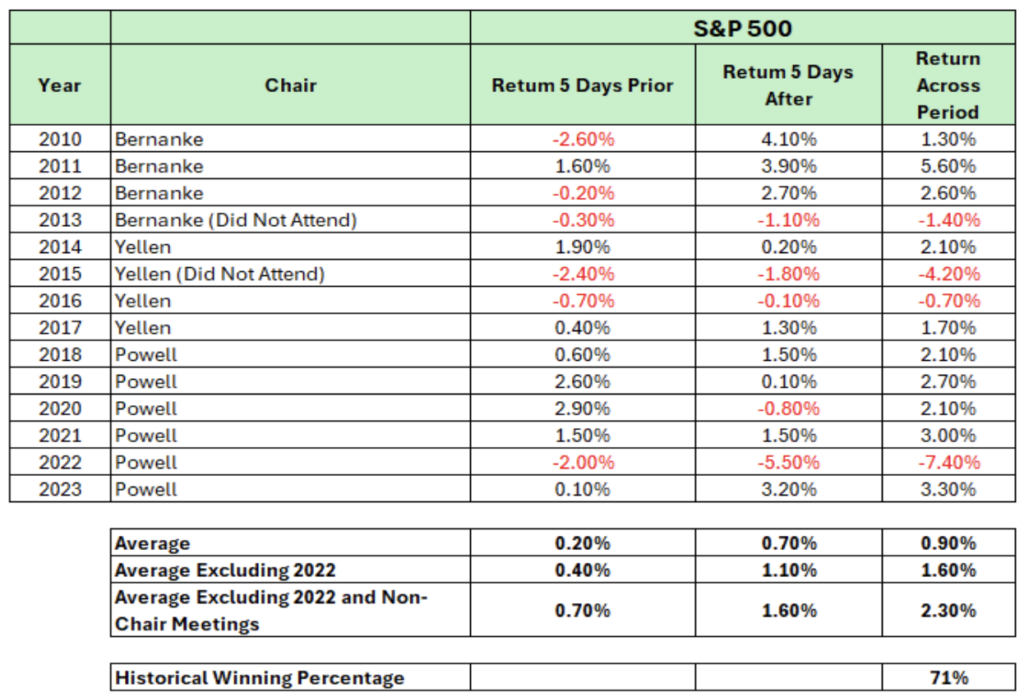

The Jackson Hole Symposium, a key gathering of central bankers and economists in Jackson Hole, Wyoming, runs from August 22-24. Powell is slated to deliver his remarks today at 10 a.m. Eastern time. The major indices fell over -0.05% yesterday, showing just how jittery investors are, waiting for a signal of upcoming Fed moves. You may remember 2022 when Powell spoke at Jackson Hole (a -5.5% move), but what does history have to say about the S&P 500 performance during this event?

U.S. stocks have a history of rising around the Federal Reserve’s annual Jackson Hole Economic Policy Symposium.

The S&P 500 tends to rally over the two weeks around the event, with gains mostly coming after the Fed Chair’s speech. In 10 of the last 14 years, the S&P 500 had a positive return from 5 days before the event to 5 days after. The overall average return is 0.90%, but 2022 was certainly an outlier in the data. If you remove that year, the average return jumps to 1.6%. The numbers look even better if you also remove the years when the Fed Chair didn’t appear at the Symposium. The average return jumps to 2.6%.

Powell’s 2022 Jackson Hole speech caught markets off guard as he emphasized the Fed’s commitment to fighting inflation, even at the cost of economic growth. He warned that higher rates would likely bring “some pain to households and businesses,” as the tightening monetary policy was expected to slow growth and weaken the labor market.

In 2024, investors hope for rate cuts from the Fed as inflation has cooled, and concerns about the economy have grown, especially with recent signs of weakness in the U.S. job market.

Powell knows markets have been volatile lately, so we will need to see if he is careful with his wording about future rate cuts or if he has another 2022 surprise. I think it will be the former.

Earnings continue to show strength. While earlier in the earnings season we heard some mega caps warn against slowing growth, only 6% of the S&P 500 companies have mentioned the word, “recession” during their latest earnings calls.

Where does that put us today? The S&P 500 ETF, the SPY, has been advancing most of the 5 days before the Jackson Hole event, rising over 2%. Historically when the market rose before the event, the 5 days after tend to be more neutral. We could see the market rest along the 8-day simple moving average the week before the American Labor Day Holiday.

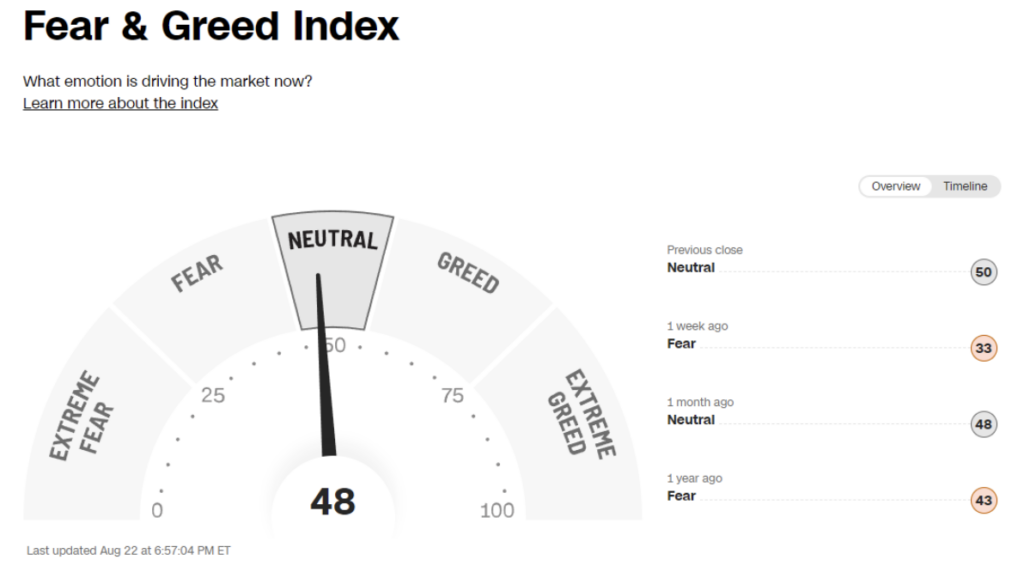

The CNN Fear & Greed Index increased from a week ago but sits at Neutral for now.

Unless Powell has something in store for the markets, I suspect next week should be fairly quiet and made for credit trades that benefit from theta decay.

I’ll be back on Monday with a recap of Jackson Hole and what you can look forward to for the week ahead.

With that, have a great weekend!