Treasury Secretary Janet Yellen says the U.S. is still on the path to a soft landing, but investors aren’t acting that way, selling off shares to make last week one of the worst weeks in a year. So what is it that she sees that investors don’t? How will the recent string of data affect the Fed’s decision to cut interest rates later this month? The previous two monthly jobs reports may show turbulence on the way to a soft landing.

The last two months’ worth of Non-Farm Employment data has shown that the number of new jobs created has declined steeply. You can see from the chart below that it was the report released on August 2nd that fell well under the Forecast and was the precursor to the Fed announcing they would be open to cutting rates during their upcoming September meeting.

Last week investors were once again unpleasantly surprised by the jobs report coming in less than the forecasted amount. While investors wanted to see the job market stabilize so that the Fed would cut rates, the fear is the labor market has fallen apart too quickly and the Fed has been too late in responding. With a fear of a recession, institutions and retail traders alike had to adjust their portfolios.

That’s when Yellen stepped in to try to persuade investors that the U.S. economy is healthy despite the cooler jobs data. Yellen pointed to the lack of meaningful layoffs, even though job creation is on the decline. She said that’s a signal of a soft landing rather than a recession. The latest unemployment figures back her up, showing a recent decline in the unemployment rate.

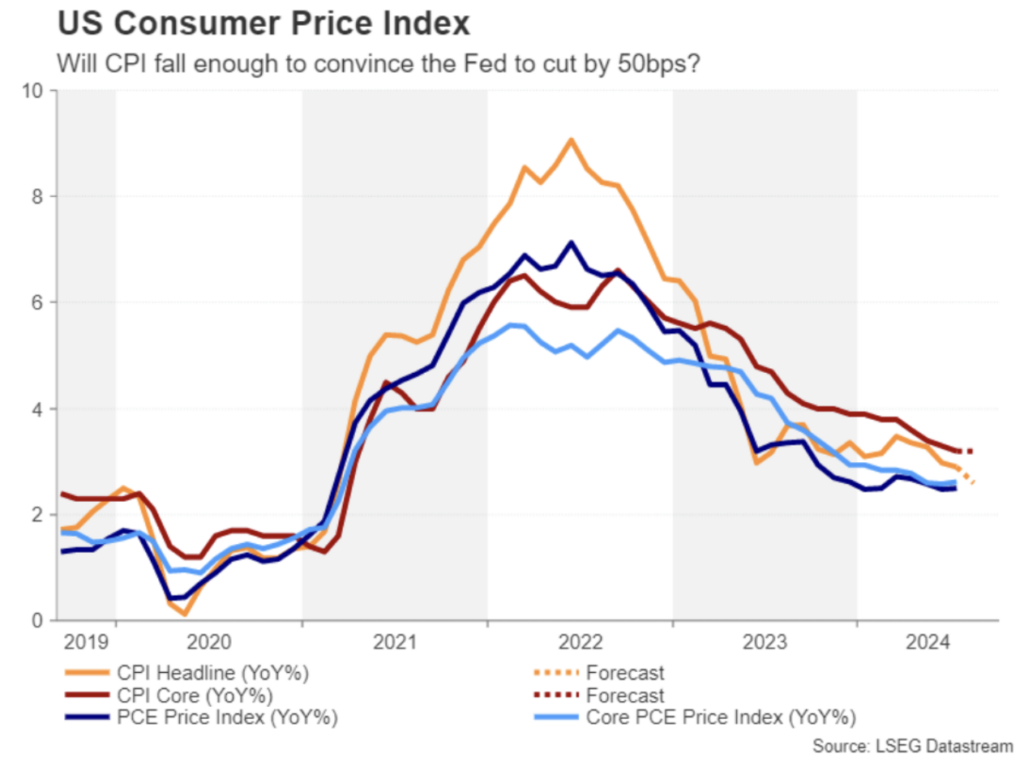

What is the Fed likely to do now? Well, it may depend on the upcoming Consumer Price Index report (CPI) coming out later this week.

The headline CPI number is set to show a 2.9% increase year-over-year, which is a drop from the last reading of 3.0%. The core CPI rate is forecast to stay unchanged at 3.2% though.

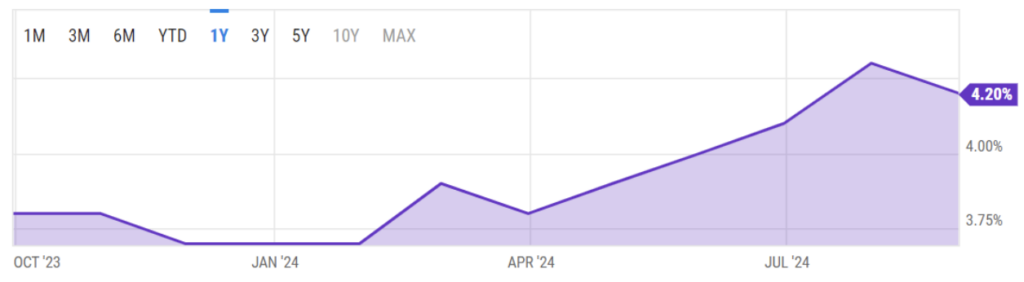

That brings us to the question of whether or not the Fed will cut rates by 50 basis points.

The Fed is likely to deliver a dovish cut of 25 basis points unless there is a significant downside surprise in the core CPI number. We know Powell likes to take the slow-and-steady approach and anything more than a 0.25% cut would signal either inflation is well under control (low CPI) or the economy is weakening too quickly and needs a sudden injection of growth hormone from the Fed.

Fed officials have indicated that the labor market is now of greater significance given their confidence that inflation is heading back to its 2% target. If that’s the case, investors are pricing in a 25-30% chance the Fed ramps up to a 50 basis point cut.

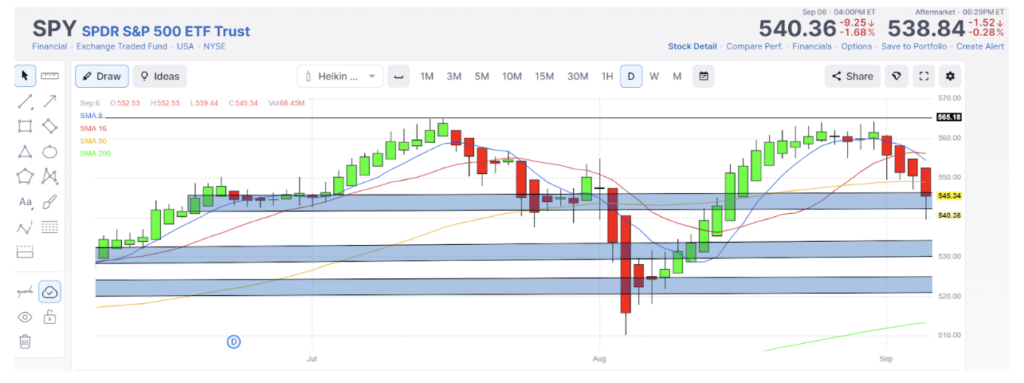

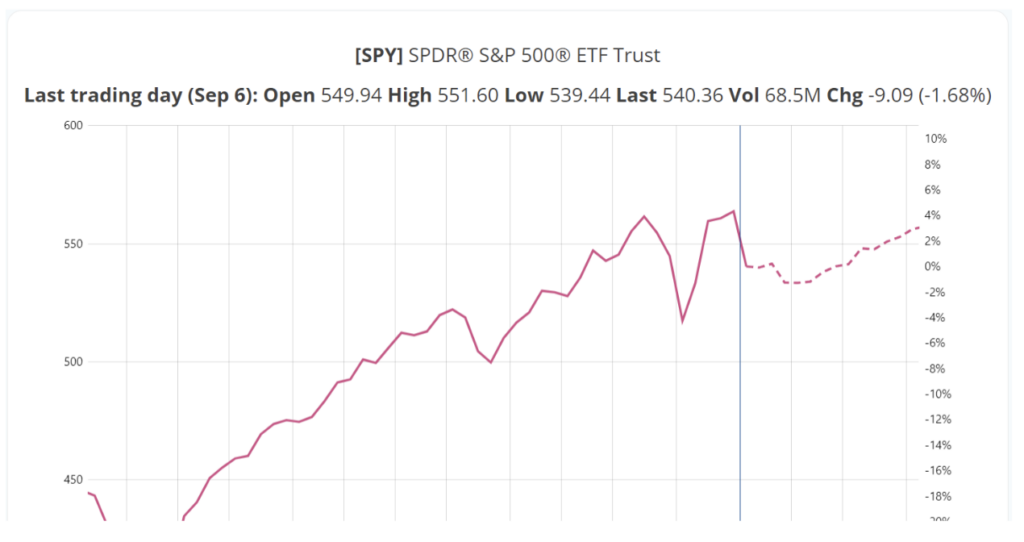

That leaves the S&P 500 sitting at precarious levels without much of a bullish catalyst until earnings season kicks in. The index is sitting at a previous level of interest, but it can certainly go lower as we saw in August.

If we look at historic norms, the market is projected to drop another 1.5% over the next three weeks but could rise an average of 3% before the end of the year. Here we see the seasonal data of the S&P 500, with the dashed lines showing the seasonal moves over the next 13 weeks. The market doesn’t always move in line with seasonal patterns – the market turned around at the end of October 2023 rather than the end of September, but that launched a major bullish impulse move that ran for the first four months of 2024.

While I won’t be sitting on the sidelines for the rest of the month, I will continue to adjust money management per trade to be ready to go for the next bullish impulse move higher.

Have a great trading week!