After closing eight winners in a row in June, Options Income Weekly members exited their first trade in July last week, booking profits on Onsemi (ON), which makes power and sensor chips for the automotive and industrial markets.

What’s interesting about this trade is that ON has been a clear underperformer this year. The stock is down 12% so far in 2024 compared with a roughly 17% gain for the S&P 500.

What’s more, much of the broader market’s gains have been driven by AI stocks like chipmaker Nvidia (NVDA), up more than 155% year to date, and social media giant Meta Platforms (META), up 48%.

Onsemi doesn’t directly develop AI technology, but it plays a supporting role by developing power supply solutions for the data centers that process AI applications. The Scottsdale, Ariz.-based company also makes components that improve efficiency by allowing the processing of data directly on small devices such as industrial sensors instead of relying on cloud analytics, which can be slow and require a lot of power.

While ON has been a laggard this year, its five-year performance tells a different story. The stock is up 270% compared to a roughly 85% return for the S&P 500. This is in spite of the fact that shares are well off their highs made last fall.

The company reported its most-recent quarterly results on April 29. Adjusted first-quarter earnings of $1.08 a share were down 9% year over year but came in $0.04 ahead of estimates. Revenue of $1.86 billion slightly exceeded Wall Street’s target of $1.85 billion, although sales were also down on a year-over-year basis, falling 5%.

The company’s second-quarter forecast was a bit soft, with management calling for adjusted EPS of $0.92 on sales of $1.73 billion versus the $1 a share on $1.82 billion analysts were expecting.

Yet, the stock rose more than 4% on the day, perhaps helped by bullish analyst coverage. Goldman Sachs reiterated its “buy” rating and upped its price target for shares to $89 from $81 previously.

We capitalized on the still-elevated post-earnings volatility to place our first trade on the stock in the Options Income Weekly program the next day.

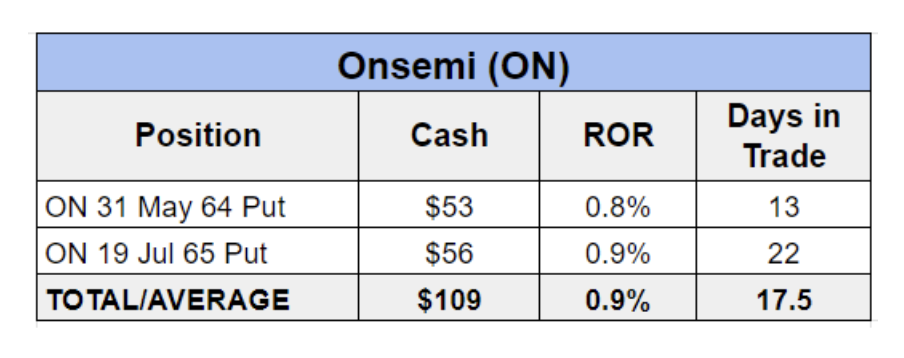

With ON trading at $71.78, we sold the ON 31 May 64 Put, collecting $0.73 in premium, or $73 per contract. We set a target exit price of $0.20, placing a good ‘til canceled (GTC) order to buy back the put at that level.

After we entered the trade, the stock gave back some of its post-earnings gains, but our put remained comfortably out of the money as shares bounced around in a range between $68 and $72.

On May 13, our trade hit its target, allowing us to exit the position with more than 70% of the max profit nearly three weeks ahead of expiration.

Later that month, Onsemi benefitted from Nvidia’s better-than-expected earnings report and upbeat guidance, rallying nearly 5% on the day the company reported. It finished the month of May up 4%.

Yet, ON has struggled to gain any real bullish momentum since then, as you can see in the three-month chart below.

But we managed to take advantage of short-term volatility in the stock with another trade, selling the ON 19 Jul 65 Put on June 11 for $0.81, or $81 per contract.

The stock was trading at $72.67 when we entered the position. The next day, ON hit an intraday high of $77.22. But shares quickly reversed, selling off as much as 13% in just over a week and falling to the $67 level. Our put remained 2 points out of the money (OTM), but it was closer than we might have liked.

Luckily, ON put in a short-term bottom and began trading higher in late June. Shares picked up some bullish momentum in early July and our target exit price of $0.25 was hit on July 3, allowing us to book a profit of $56 per contract for a 0.9% return in 22 days.

These trades go to show you that you don’t need to trade the well-known, high-priced AI names to play the trend. There are smaller names, and even some contrarian plays like Onsemi, that offer decent implied volatility and the opportunity for option sellers to generate attractive premium.

Onsemi has not yet confirmed the date of its Q2 earnings announcement, but the company is expected to report earnings in late July or early August.

We may look to once again capitalize on earnings-related volatility in the stock either before, or more likely just after, the company reports.