A few weeks back, we discussed how record-low volatility was prompting us to add new tactics to our trading arsenal. Specifically, we’ve begun trading diagonal call debit spreads in both the Income Masters and 5K Challenge programs.

To quickly review, a diagonal call debit spread is a neutral-to-bullish options strategy that combines elements of a vertical debit spread and a calendar spread and can yield profits whether the stock stays flat or increases over time.

With a diagonal call debit spread, you buy a long call option with a lower strike price and a later expiration date and sell a short call option with a higher strike price but an earlier expiration date.

If the stock price rises by the expiration of the short call, you can exercise your long call at a lower strike price and immediately sell it at the higher market price, locking in a profit.

You can also profit from time decay on the short call. As the short call nears expiration (assuming the stock price stays below the higher strike price), its time value will erode, benefiting the option seller.

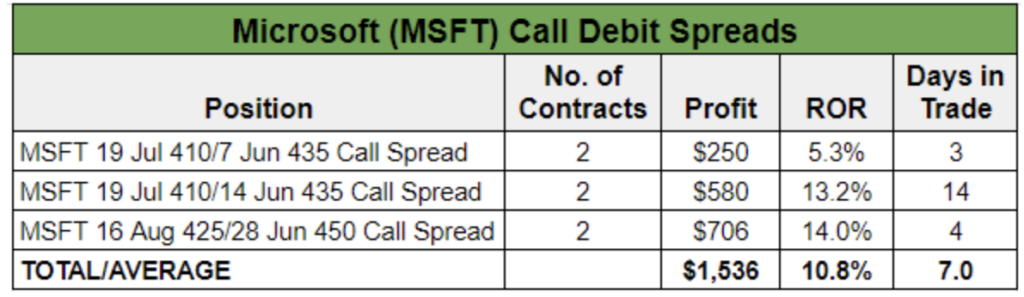

In the previous article, we reviewed a May 21 Income Masters trade on Microsoft (MSFT) in which we bought the MSFT 19 Jul 410 Call and sold the MSFT 7 Jun 435 Call for a net debit of $23.40.

Three days later, we exited the trade for a credit of $24.65, earning $1.25 per spread for a quick 5.3% return. We sold two contracts in the live account, bringing our total cash to $250.

Since we closed that trade on May 24, we successfully traded two more MSFT diagonal call debit spreads, as we continue to look for ways to generate income in a low-volatility environment. Our most recent one yielded a 14% return in just four days.

We entered the trade on Thursday, June 13, for a $25.17 net debit, buying to open MSFT 16 Aug 425 Call and sell to open the MSFT 28 Jun 450 Call. We traded two contracts in the live account. At the time, MSFT was trading for $441.51.

The following Monday afternoon, the stock was up to $448.39, and our debit spread was sitting at a 14% return. Rather than get greedy, we sent an alert telling members to book profits, exiting our two contracts for a net credit of $28.70 each.

With our three back-to-back MSFT winners, we’ve pocketed more than $1,500 in cash in less than a month and averaged a 10.8% return per trade.

During this time, the stock has advanced about 5%, although the run-up this month has been more impressive, with shares rallying 7.5% in June as the tech sector extended its bull run.

As long as MSFT remains in an uptrend and volatility remains low, we’ll continue to use this strategy on the stock to supplement the income we’re generating selling cash-secured puts and bull put spreads in the Income Masters program.

As we mentioned above, we’ve also used diagonal call debit spreads in the newly launched 5K Challenge program.

There we’ve booked back-to-back one-day winners on another tech sector favorite, AI darling Nvidia (NVDA), booking $1,053 in profits on two trades and earning 10%-plus returns.

As you can see from our recent success trading MSFT and NVDA with this strategy, diagonal call debit spreads are a great way to generate profits in a low-volatility environment.