Recent turmoil in global markets has analysts scrambling to assess the extent of the global carry trade, where investors borrow from low-interest economies like Japan or Switzerland to invest in higher-yield assets elsewhere.

This strategy, which has fueled global risk assets for years, was jolted when the Bank of Japan raised interest rates last week. This move forced some investors to withdraw from the trade, causing the yen to surge. The resulting unwind triggered massive losses in global stock markets, with Japan’s Nikkei experiencing its worst day since 1987.

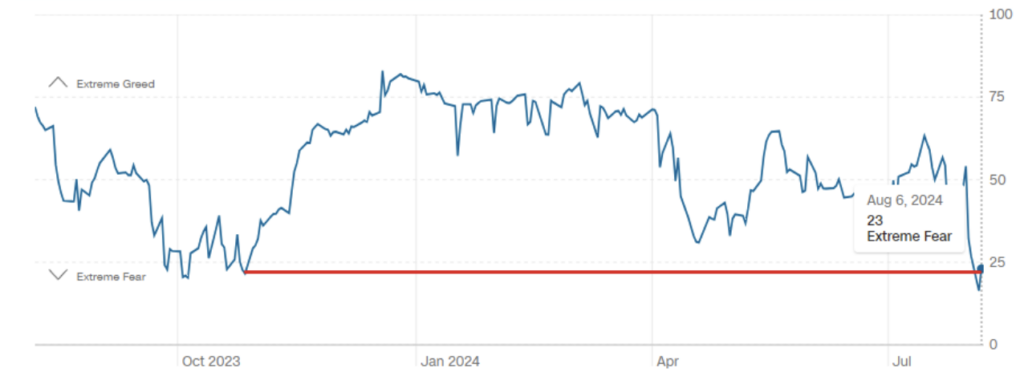

The CNN Fear and Greed Index plunged to its lowest levels since October 2023.

Some analysts believe the Yen Carry Trade is only 50% unwound, which means more pain could still be on the way before we return to normal. Of course, that could also change if the Fed holds an emergency meeting to cut rates, as many are demanding.

While the market rebounded somewhat, the long wick on the S&P 500 (SPY) chart indicates that as much as the bulls pushed the market higher throughout the day, the bears came in at the end and drove the market lower into the close. The market sits at a previous resistance level.

With such large amounts of selling in a short period, I wouldn’t be surprised to see a profit-taking day before consolidating or even moving lower.

The SPY (S&P 500 ETF) is sitting just below a volume resistance block between $530 and $533 on the hourly chart. A short-term trend change could turn bullish if the SPY can cross above $538. Otherwise, keep your eye on another leg lower.

If the market continues to sell off after a profit-taking day, here are a series of potential reversal levels. The first is back down around $511 to retest swing lows, then $505, $500, $492, and $481.

Getting back to the Yen Carry Trade, if you believe there is more hardship for the markets and that the Japanese Yen won’t stay weak forever, you can always invest in something like the Invesco CurrencyShares Japanese Yen Trust (FXY). It broke out from a multi-year downtrend and could be on its way to retesting its 200-day moving average should this continue.

I’ll be back later in the week to see what levels are being respected and where we might go from there.