Ed. Note: Weekly Income Report will be out on Wednesday.

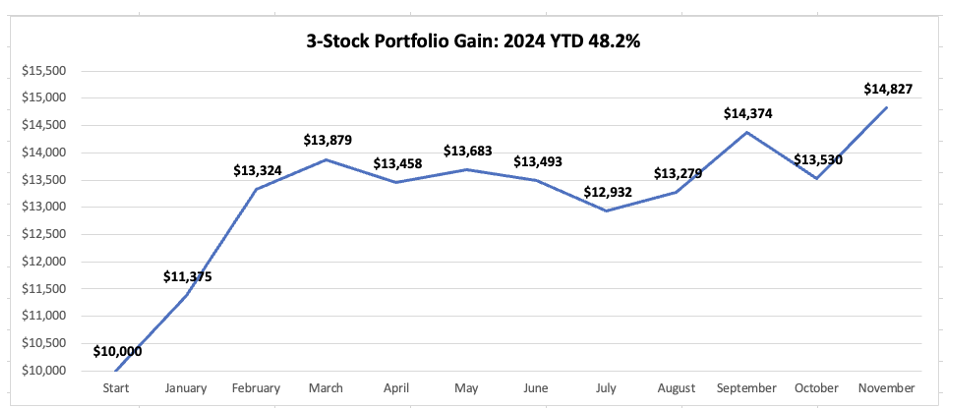

Over the last few weeks, you’ve read our Weekly Income Report and have seen the gains and losses (few) from various services. One of the services we have not yet reported on is the 3-Stock Trading Strategy.

In October, our 3-Stock Strategy had one of its worst performing months (-6%), which followed an uneven period of gains and losses from April through September, and that led to some folks throwing in the towel and giving up.

Today’s Lesson: You can’t give up.

Any trading strategy has a bad day, week or month. It’s what you do in the NEXT period that matters. Our November returns month-to-date for 3-Stock Trading Strategy will prove that.

Read on to see the huge turnaround story:

For members of the 3-Stock Strategy, as we prepare for a likely slowdown heading into the Thanksgiving holiday, I have a question for you: Where are you?

I’ve been monitoring the chat all month on the Traders Reserve Live site as our 3 stocks this month reach 16%, 10% and 9% gains respectively, and…

Crickets. Nothing but crickets.

Seriously – we have one rough month and everyone’s out with the pitchforks, tar and feathers and we come back with a combined monthly gain of 10.6% as of Friday’s close and I can’t even get a smiley face.

Makes me think I’m the turkey.

Palantir (PLTR) (+16.4%) remains our leader for the month, followed by Targa Resources (TRGP) (+9.8%), with Carpenter Technologies (CRS) rising more than 5% on Friday to +9.6%.

That’s much better performance, and 4x ahead of our 2% monthly goal.

Some quick notes on our 3 stocks:

Palantir (PLTR) (+16.4%) has been heavily in the news since it was announced that PLTR would be added to the NASDAQ 100 (and begin trading via the NASADAQ vs NYSE).

The chart shows a rapid breakout since early November (earnings) and a curve sideways creating a range between $60 and $65 per share.

PLTR will need to set a new high in the coming week(s), but I would not be surprised to see the stock consolidate in this range before it does.

I also would not be surprised to see PLTR retest and build a base around the $59-$60 level in the short-term, but remember that we are holding our 3 stocks into December this month due to the post-election entry on November 8.

Targa Resources (TRGP) (+9.8%) continues to benefit from a bullish view of Oil & Gas / Energy markets following the election.

Motley Fool just names it one of 3 “No Brainer” stocks to buy with $1,000. Thanks, guys, but you’re late to the party.

TRGP has also set 4 consecutive new 52-week highs, but it’s due for a pullback and consolidation in the $195-$200 range, as it is overbought on the RSI.

Carpenter Technologies (CRS) (+9.6%) broke out to a new 52-week high and, as I noted in our original 3-Stock alert, this stock tends to rise in ‘waves’ – a move higher, followed by a period of consolidation which leads to the next move higher.

As we head into 2025, Industrials (like CRS) are likely to be beneficiaries of a pro-growth agenda, so for those looking for a stock to add to their portfolio for the next 12 months, CRS is a stock I would give serious thought to adding, even at current highs.

Jeff and I will continue to monitor our 3 stocks post-Thanksgiving and decide when we want to close these three stocks in December.

Right now, my biggest concern in December is the FOMC meeting and how much the rate cut forecast for 2025 changes from the September/November meetings.

Despite challenges in the summer months, especially July, as Wall Street changed directions like a squirrel in a busy road, we’re holding a 49.5% gain year-to-date, with 5 weeks remaining in the calendar year.

If momentum holds and Santa is nice to us, we certainly have the potential to end the year between 50% and 60% for the year.

That’s a big recovery from the middle months where nothing seemed to work with consistency.

Or, it did work but we had the right stock in the wrong month – see Vistra Corp., (VST) which we took a loss on in June, only to watch that stock explode higher in August-October.

I say you can’t give up because look at the turnaround since July:

-9.4% overall from end of March through the end of July

+20.1% from beginning August through today

For those of you who received 3-Stock Strategy with your 10th Anniversary Investor’s Blueprint Live ticket in 2024, you’ll receive choices for renewing in 2025 in mid-December.

And if you’re not following the 3-Stock Strategy yet, now you have a reason to.