It’s time for another Weekly Income Report.

This past week was slow compared with the previous one, when we closed 23 winners in a row. Of course, that was to be expected. We noted that those results were unprecedented, with us netting nearly $6,300 in cash in the live account across all of our services. If only every week could be that good!

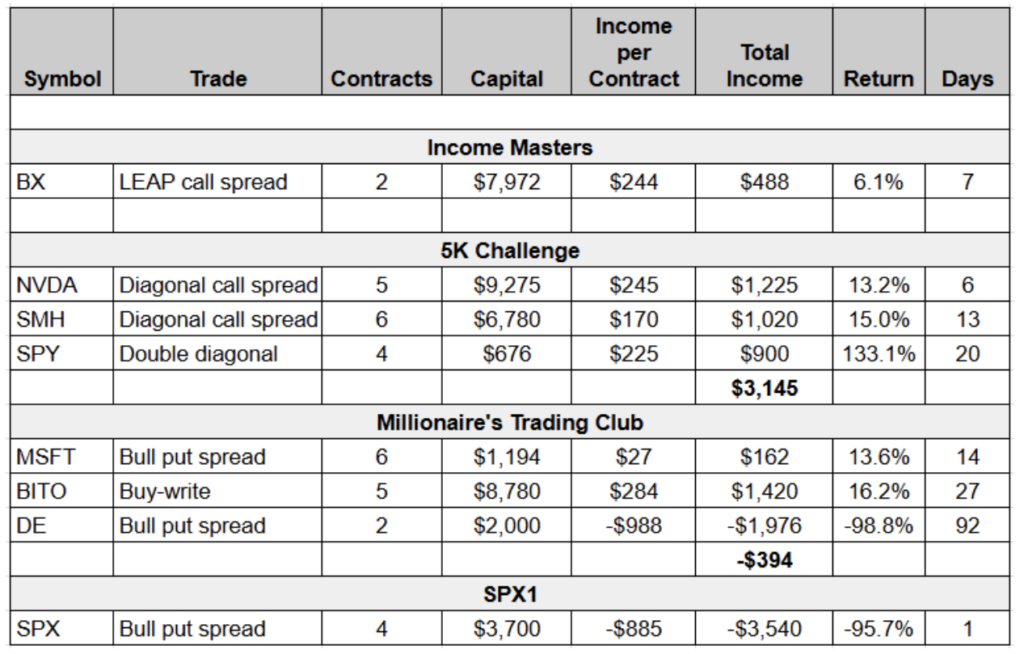

Last week was bumpy by comparison, as you can see in the table below covering our Nov. 11-15 closeouts.

We scored some big wins in the 5K Challenge program with our diagonal call spreads on Nvidia (NVDA) and VanEck Semiconductor ETF (SMH), which both yielded four-figure profits.

And we were able to close the SPDR S&P 500 ETF Trust (SPY) double diagonal we set up to take advantage of potential volatility around the election and the Federal Reserve meeting for twice the amount of our initial debit, delivering a more than 130% return in less than three weeks.

Another standout trade was the ProShares Bitcoin ETF (BITO) buy-write that we put on during the Millionaire’s Trading Club live event in Las Vegas last month.

BITO, the first bitcoin-linked ETF to trade in the US primarily invests in bitcoin futures, as opposed to the cryptocurrency itself. Whatever your thoughts on bitcoin, I doubt you think of it as a dividend play. Yet, BITO pays a monthly dividend to shareholders, totaling $12.19 over the past 12 months for a 49.4% yield.

On Oct. 17, we purchased 500 shares of BITO at $19.04 apiece and sold five BITO 8 Nov 20 Calls for $0.47. This lowered our cost basis to $18.57.

We knew there was a chance we would get called out of those shares before the stock went ex-dividend at the beginning of November. But if we were, we stood to make $1.43 per contract.

That would have been a nice profit, but we wanted to collect the dividend if possible. On Oct. 30, our call was trading right at the money. So, we recommended rolling it out and up to the BITO 22 Nov 20.50 Call.

While we only picked up $0.02 per contract on the roll, we gave ourselves another $0.50 in potential capital appreciation and ultimately secured the Nov. 1 dividend payment of $0.99 per share, effectively reducing our cost basis to $17.56 per share.

This extended our trade out two weeks, but as you can see bitcoin ripped higher after the election, with the market anticipating a more crypto-friendly stance from the government.

We exited the position on Nov. 13, a week and a half before expiration. At the time, our calls were comfortably in the money and we were on track to have our shares called away. However, bitcoin is notoriously volatile and could have easily sold off before expiration.

Plus, by closing early, we booked a $1.85 per contract profit, which was only $0.10 below the max profit we would have earned had we held to expiration and bitcoin didn’t reverse lower.

Plus, we picked up the $0.99 per-share dividend, bringing our per-contract profit to $2.84. And since we purchased 500 shares and sold five calls, we netted $1,420 on this trade for a 16% return in less than a month, adding another winner to our already impressive Millionaire’s Trading Club results.

In the Weekly Income Report, we generally pick one trade to review more closely. And in a typical week, that would have been this BITO buy-write.

But we also booked two big losses last week that need some context.

The first was a Deere & Company (DE) trade from the August Millionaire’s Trading Club pre-conference special live trading event.

We held three of these sessions in the run-up to the main event in Las Vegas – in July, August and September.

During the August session, we entered an iron condor on DE as an earnings play. The idea was that the stock would trade flat to slightly up or down.

To the contrary, DE sold off after earnings and then rebounded, pushing higher despite a number of issues that included underwhelming guidance, recalls on compact tractors, job cuts, an FTC probe and the threat of tariffs from President-elect Donald Trump if Deere moves some production to Mexico.

Rather than continue with the trade, which would have required going out past this week’s earnings date, we decided to book the loss. Because some trades don’t work out and aren’t worth rescuing.

Prior to closing the DE trade, we had booked $1,032 from the August session from an Applied Materials (AMAT) calendar spread and a Nvidia (NVDA) straddle. But the DE loss was large enough that it wiped out those profits and then some.

No one likes taking losses. But taking a bigger picture look is key. For instance, while the August pre-conference trading event was a bust, when you look at the cumulative results from the three pre-conference sessions and the live event, we are up nearly $11,000.

Three trades remain open from the October session, and it’s possible we may need to take a loss or two before we close the books. But the profits we’ve generated thus far should leave us well in the black.

The other big loss was on our SPX1 trade. For those who are unfamiliar with this strategy, it is a 1-DTE (days to expiration) options trade that we enter most Thursdays at 3 p.m. Eastern and close the following day.

We sell vertical credit spreads — typically a neutral-to-bullish put credit spread but occasionally a neutral-to-bearish call credit spread. We collect premium for selling the spread and close the next day by buying it back for a (hopefully smaller) debit.

We typically target an initial credit of $0.80 to $1.20 and set a good ‘til canceled (GTC) order to buy back the spread, generally for $0.05 to $0.20, depending on our initial credit and market conditions. But this isn’t a “set-it-and-forget-it” trade. On the contrary, this trade requires active monitoring, especially when it goes against us.

And against us it went on Friday.

The market sold off hard at the open, with the short leg of our spread going in the money around 10 a.m. The index appeared to put in a bottom around 11:30 a.m. Eastern, but then continued to slide. We watched the position closely into the early afternoon, holding out for a slight reversal that could reduce our loss. But it never came.

We shut down the trade around 2 p.m. Eastern, booking a loss of $8.70, or $870 per contract, and $3,480 total on the four contracts we traded in the live account. Ouch.

But let’s broaden our lens to put this trade in perspective.

We launched the SPX1 service in mid-February. Since then, we’ve made 34 trades and skipped six weeks, due to market holidays or conditions. Of those 34 trades, we’ve had 30 winners and four losers, including last week’s trade.

Friday’s loss ate up three months’ worth of gains. There’s no getting around that. But when looking at the strategy overall, we are still up $3,779 since the service began on a trade that typically requires putting up about $3,600 in capital for less than 24 hours.

It’s important to remember that index trading (and options trading in general) entails risk to your capital. And you should never risk more than you can afford to lose.

Because there will be times when we have losing trades. But the idea is for the winners to outweigh those losers over time, and that has been the case. This is a short-term strategy with a long-term focus, which is true of options selling in general.

So, we’ll lick our wounds, learn from our mistakes and live to trade another day.